Crypto Payment System Architecture: From Blockchain to Real Payments

A deep architectural breakdown of crypto payment systems, covering payment expectations, blockchain interpretation, payment states, events, and settlement logic.

Crypto payments are not just about sending a transaction on a blockchain.

For a business, crypto payment is a multi-layered system that must work correctly before the blockchain, on the blockchain, and after the blockchain.

A real payment system must be able to answer these questions:

- What is being paid for?

- How should the payment be received?

- How should it be interpreted?

- When is it acceptable?

- And how should it turn into a real business action?

The blockchain alone understands none of these concepts.

The blockchain only records value transfer, not commercial payment.

OxaPay recognized this reality from the beginning and designed its system not as a simple wallet or tool, but as a complete payment infrastructure.

On this page, we explain this architecture step by step.

This architecture is derived from real-world experience in building and operating crypto payment systems across multiple blockchain networks. Challenging conditions such as network congestion, chain reorganizations, partial payments, and delayed confirmations have directly shaped our approach to payment state management and business logic.

Why the Definition of “Payment” Goes Beyond a Transaction

If payment is viewed only as sending a transaction, its connection to business logic disappears.

A business needs to know what the transaction was for, within which time window it was valid, and whether it met the acceptance conditions or not.

Without this information, there is no difference between a random transfer and a valid payment.

This distinction is the most fundamental requirement of any operational payment system.

Why Are Crypto Payments Inherently Complex?

Unlike banking systems, blockchains were not designed for commercial payments.

At the blockchain protocol layer:

- There is no invoice

- There is no order

- There is no expiration time

- Underpayment or overpayment has no meaning

- There is no concept of “payment acceptance”

The blockchain records only one thing: value transfer.

All the concepts required for a real payment, such as the expected amount, time validity, payment status, order association, and wrong-network detection, must be built at the application layer, not within the blockchain protocol itself.

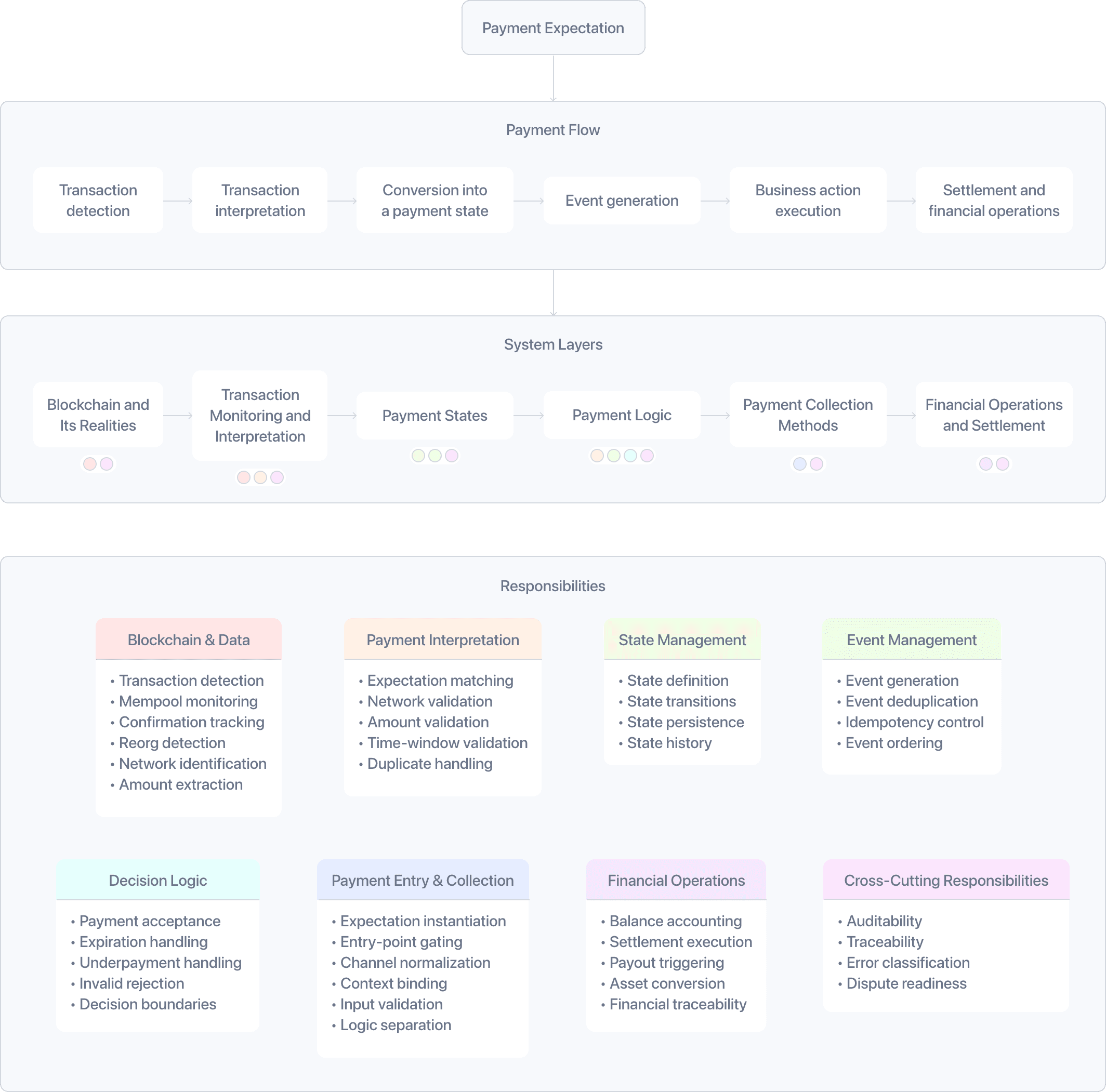

The Mental Model of a Crypto Payment System as a Process

A healthy crypto payment system must be understood as a process, not a single event.

In practice, this process is structured around two distinct parts.

Conceptual prerequisite (before the flow):

- Payment expectation definition

Payment flow (processing stages):

- Transaction detection

- Transaction interpretation

- Conversion into a payment state

- Event generation

- Business action execution

- Settlement and financial operations

The blockchain is only one component within this flow, not the entire system.

Because each processing stage depends on validated outcomes from the previous one, payment decisions cannot be made at a single moment in time. A process-oriented model is required to handle delays, partial payments, and network instability without relying on raw blockchain activity as final payment truth.

What Happens Before the Blockchain?

Before a transaction is ever created on the blockchain, the payment system must already know:

- What is being paid for

- What is the exact amount

- Which order or service the payment belongs to

- Which cryptocurrencies and networks are allowed

- Until when the payment is valid

At this stage, the payment expectation is created.

A payment expectation is not an abstract concept. It must have a concrete identity that allows future blockchain transactions to be matched and interpreted correctly.

Depending on the payment method and use case, this identity may take different forms, such as:

- A unique blockchain address generated for a specific invoice

- A static address combined with a reference or internal mapping logic

- A payment link session identifier anchored to a predefined expectation

Regardless of the form, the purpose is the same: to give the system a deterministic way to match incoming transactions to an expected payment.

Without a clearly defined expectation, transactions arrive without context and cannot be reliably interpreted, even if funds are successfully received on the blockchain.

The Invoice as the Payment Decision Reference

An invoice in a crypto payment system is not a receipt. It is a payment contract created before any blockchain transaction occurs.

When an invoice is generated, the system defines data that the blockchain itself does not understand, including:

- Reference payment amount

- Reference currency (such as USD or EUR)

- Allowed cryptocurrencies and networks

- Payment expiration time

- Order or service identifier

- Payment acceptance rules

This information gives meaning to incoming transactions and determines which payments are valid, rejected, or actionable from a business perspective. Because all subsequent decisions, from confirmation to settlement, rely on the invoice definition, it becomes the primary decision reference for the entire payment lifecycle. Without a clearly defined invoice, blockchain transactions remain isolated value transfers with no reliable connection to business logic.

Payment Address Generation and the Risk of Context Loss

Generating a payment address in a crypto payment system is different from simply using a blockchain address. In a proper payment architecture, an address is not just a destination but a point of interpretation.

When the system generates a payment address, it links that address to a specific payment expectation and its acceptance rules. This connection allows incoming transactions to be correctly associated with an order or service and evaluated for validity.

An address without this contextual link is dangerous. Even if funds are received, the system cannot determine how to react, often leading to errors, misclassification, and financial disputes.

Layer One: Blockchain and Its Realities

At the lowest layer lies the blockchain.

At this layer:

- Transactions are irreversible

- Confirmation takes time

- Network congestion causes delays

- Finality differs between networks

For the average user, this layer appears to be the entire payment.

But for a payment system, the blockchain is only a source of raw data.

The blockchain is not a payment system. The blockchain is only the value transfer layer.

The Inherent Limitations of Blockchain in Payments

The blockchain provides no guarantee about exact finalization time or state stability.

For this reason, making decisions directly based on blockchain data is risky.

A payment system must treat blockchain data as raw input, not as a final outcome.

What Enters the System From the Blockchain?

What enters the system from the blockchain is:

not a “payment”,

not a “success”,

but only raw transaction events.

These data do not yet know:

which payment expectation they belong to,

whether they are trustworthy,

or whether decisions can be made based on them.

At this stage, no payment has happened yet.

The Nature of Blockchain Data

Blockchain data consists of technical information such as transaction hashes, addresses, amounts, and confirmation status.

This data contains no knowledge of payment intent or commercial acceptance.

If a payment system directly treats this data as a “payment”, the risk of serious errors becomes very high.

Layer Two: Transaction Monitoring and Interpretation

At this layer, the system monitors the blockchain in a targeted way.

Not to observe all transactions, but only to find transactions that the system was already expecting.

At this stage, the system checks:

- Whether the transaction is in the mempool or confirmed

- How many confirmations it has

- Whether there is a risk of reorg

- Whether the full amount was sent or a lower amount

- Whether the transaction was made on an allowed network

Simple monitoring is not sufficient, because network behavior is not always stable.

Why Transaction Interpretation Is a Sensitive Problem

A transaction may be confirmed but later disappear due to a reorg.

If the system does not consider this risk, it may treat a payment as valid that later vanishes.

This layer is responsible for converting unstable blockchain data into reliable information.

Why Seeing a Transaction Is Not Enough

Seeing a transaction means “something happened on the blockchain.”

A payment means “I can take action based on it.”

This difference is the boundary between a blockchain tool and a real payment system.

The Decision Boundary in a Payment System

The decision boundary is the point where a payment system is allowed to trigger irreversible business actions.

Before this boundary, blockchain data is provisional and unstable. Transactions can be delayed, reorganized, underpaid, or duplicated.

Crossing this boundary too early is a common cause of payment failures. Once fulfillment or settlement is triggered, reversing the outcome becomes costly or impossible.

A correct payment system separates transaction visibility from payment acceptance. Only validated amounts, verified networks, and confirmed states are allowed to cross this boundary.

Layer Three: Payment States

At this layer, the interpreted transaction is converted into a payment state.

Examples of common payment states include:

- Created

- Pending

- Detected

- Paid

- Confirmed

- Completed

- Expired

- Underpaid

- Invalid Network

These states are the shared language between the payment system and business logic.

Businesses make decisions based on states, not on transaction hashes.

Why Payment Control Is Impossible Without States

States make the payment lifecycle explicit.

Without them, the system is forced to make decisions based on fragmented data.

States form the foundation of automation, reporting, and error management.

Payment State Is Not Only for Internal Use

Every state change represents a significant event.

Each change must:

- Be recorded

- Be traceable

- Be communicated to external systems

This is where the concept of a payment event is formed.

The Importance of Recording State Changes

If state changes are not recorded, reconstructing the payment path during disputes or financial reviews becomes impossible.

Accurate state recording is essential for support and auditing.

From State to Event: The Core of the Payment System

Every time a payment state changes, the system generates an event.

This event defines what changed, when it changed, and why.

Webhooks are only a transport mechanism for these events, not the core of the system.

If a webhook is delivered multiple times, the system must repeat the same decision without side effects.

Why Events Are Critical for System Stability

Networks are unreliable, and delays or duplication are unavoidable.

An event-based and idempotent design ensures that the system behaves correctly even under unstable conditions.

Layer Four: Payment Logic

At this layer, the system decides:

- Whether the payment was made on time

- Whether the amount is acceptable

- Whether the payment has expired

- How conversion rates should be calculated

- Which service the payment should be linked to

But a decision alone is not enough.

A decision must lead to an action.

Why Payment Logic Must Be Independent

Payment logic consists of business rules that change frequently.

If this logic is tied directly to the blockchain, the system becomes fragile.

Separating this layer allows business rules to change without impacting the entire system.

Layer Five: Payment Collection Methods and Their Role

Different payment methods are not separate systems.

They are simply different entry points into a shared core.

- Payment Link

- Invoice

- Static Address

- POS

- Plugin

- Custom Flow

All of these methods create a payment expectation, connect to the same logic, and use the same states and events.

Why a Shared Core Matters

If each payment method had its own independent logic, the system would quickly become inconsistent.

A shared core ensures that payment rules and behavior remain consistent across all scenarios.

Layer Six: Financial Operations and Settlement

After a payment is finalized, the system enters the operational phase:

- Balance management

- Currency conversion when needed

- Withdrawals and settlement

- Reporting

- Accounting

This stage is a natural continuation of the payment process, not something separate from it.

Every financial operation must be linked to a payment state, traceable, and auditable.

Why Settlement Must Be State-Dependent

If settlement is performed without reference to payment state, the risk of incorrect withdrawals or duplicate actions increases.

Linking settlement directly to payment state enables accurate account reconciliation.

How This Architecture Works in Practice

To make this architecture concrete, consider a minimal but realistic payment flow:

- An invoice is created, defining the expected amount, currency, networks, and expiration time.

- A payment address is generated and linked to this invoice.

- A transaction appears in the mempool and is detected by the monitoring layer.

- The transaction is marked as Detected, but no business action is triggered.

- After sufficient confirmations and stability checks, the payment transitions to Paid and then Confirmed.

- Once all acceptance conditions are met, the payment reaches Completed, and business actions are executed.

At each state transition, a payment event is generated.

Webhooks are triggered on these events, not on raw blockchain activity.

Because events are idempotent, webhook retries or duplicate deliveries never result in duplicate business actions.

This flow illustrates why payment correctness depends on state transitions and decision boundaries, not on transaction visibility alone.

Mapping the Payment Architecture to Operational Services

The architecture described here is not a theoretical model. It becomes meaningful only when it is mapped to real operational services. In this view, services are not separate products, but different ways of interacting with a shared payment core that manages payment expectation, transaction interpretation, payment states, events, and settlement in a unified manner.

OxaPay is designed to operate precisely at this connective layer. It is not a blockchain, a wallet, or a shallow payment gateway. It bridges blockchain infrastructure with real business payment logic by connecting payment expectations to blockchain transactions and linking payment states to business actions. By implementing the layers that blockchains inherently lack, OxaPay turns crypto payments from isolated value transfers into a reliable, traceable, and controllable operational process.

Merchant Inflow Services

Invoice

The Invoice service is the formal and contractual implementation of payment expectation. It defines in advance all the information that blockchains do not understand: amount, reference currency, allowed networks, validity period, and acceptance rules. As a result, every incoming transaction can be precisely interpreted and correctly entered into the payment state lifecycle.

Payment Link

Payment Links use the same logic as invoices, but with minimal friction for the user. This method is suitable for scenarios that do not require a formal process, while still correctly creating payment expectation, states, and events.

Static Wallets / Static Addresses

Static addresses are designed for recurring payments. In this model, a single address acts as an anchor that connects multiple transactions to a unified payment logic. This approach enables subscriptions or balance top-ups without removing state management or interpretation.

White-Label Payment Pages

White-labeling only changes the presentation layer. The payment core, expectations, states, and events remain unchanged. This demonstrates that a correct payment architecture must be independent of branding and visual appearance.

Plugins & Integrations

Plugins and merchant APIs serve as connectors between external systems and the payment core. Whether a payment originates from a store, a control panel, or a custom application, all flows enter the same pipeline and follow the same rules.

POS and Custom Payment Flows

In-person payments through Merchant POS and custom scenarios use the same underlying architecture. The only difference is the entry point, not the core system. This shows that the payment architecture is not limited to web or online commerce.

Payout and Financial Operations

Payout and Mass Payment

Outbound payments only make sense once incoming payments have reached a final state. The Payout service is a direct continuation of the payment state lifecycle into financial execution. Without a direct link to payment states, payouts cannot be trusted.

Auto-Withdrawal and Scheduled Withdrawals

Automated or scheduled withdrawals connect payout decisions to payment states and financial policies. This prevents manual, error-prone, or untraceable withdrawals.

Auto-Conversion

Automatic asset conversion is part of settlement logic. It allows conversion to stable assets to manage price volatility at the financial operations layer without affecting the user payment experience.

Built-in Swap

Built-in swap enables asset conversion within the same payment system. This keeps financial operations unified, traceable, and independent of external services.

Shared and Advanced Capabilities as Architectural Features

Mixed Payments

Mixed payments are possible only when multiple transactions can be linked to a single payment expectation. This requires a precise state machine. Without it, payments are either finalized prematurely or misclassified.

Underpaid Handling

Underpayment is one of the most common failure points in crypto payments. The system must treat underpayment as a manageable state, not an absolute failure. This is only stable in an event-driven, state-based architecture.

Webhooks and Real-Time Notifications

Webhooks are transport mechanisms, not decision-makers. Proper webhook design means accepting retries, delays, and network failures, while ensuring that each event triggers a single logical reaction.

Multi-Coin and Multi-Network Support

When architecture is not tied to a specific network, adding a new blockchain requires extending monitoring, not rewriting payment logic. This separation enables scalability and long-term stability.

Dashboard and Management Tools

A real dashboard displays payment states, events, and financial operations, not just transaction lists. Its value depends on having structured and traceable data from the beginning.

Wallet as an Interaction Channel

A wallet, like any other channel, is only an interaction layer. Payment logic, states, and financial operations remain independent of the channel. This separation ensures that the payment system is not bound to a specific platform and can operate consistently across multiple environments.

Why This Architecture Matters in OxaPay

The importance of this architecture becomes clear only when it is executed, not when it exists on paper.

In OxaPay, each architectural layer maps directly to real operational behavior: payment expectations are created, transactions enter decision-making only after interpretation, and no financial action occurs without passing through defined states.

This tight connection between architecture and execution makes payments traceable, repeatable, and auditable.

The result is a system that remains stable even at scale and under adverse network conditions.

Crypto Payments as a System, Not a Transaction

This architecture shows that crypto payments are inherently a process, not a blockchain event. A transaction is only one input to the system.

What makes a payment real is the chain of decisions, states, and operations that occur before and after the blockchain.

In this view, complexity is not removed, but managed. The result is a system that can interpret payments, make decisions, and be reliably used in business, rather than simply observing transactions.