Introduction to Online Payments for Small Businesses

In today’s digital age, online payments have become an integral part of conducting business. Small businesses, in particular, have recognized the importance of accepting payments online to cater to a wider customer base and streamline their operations. However, there are various challenges that small businesses face when it comes to accepting payments. This article will explore the significance of Simplifying Online Payments for Small Businesses and how OxaPay can serve as an ideal payment solution to overcome these challenges.

Importance of Online Payments for Small Businesses

Online payments are crucial for small businesses, offering convenience and accessibility to customers. They increase sales and expand market reach by reaching a broader customer base. Online payments improve cash flow and transaction speed, while also providing enhanced security and fraud protection. They are cost-effective and streamline record-keeping and accounting processes. Accepting online payments gives small businesses a competitive advantage and helps them stay ahead in the market. Overall, online payments are essential for small businesses’ growth and success in the digital age.

The Benefits of Online Payments for Small Businesses

Online payment solutions play a vital role in addressing the challenges faced by small businesses. Online payments have revolutionized small businesses by offering increased customer convenience, expanded sales opportunities, improved operational efficiency, cost savings, enhanced security, competitive advantage, and access to alternative payment methods. These benefits include:

- Increased customer convenience: Online payments provide a hassle-free and convenient way for customers to make purchases from anywhere and at any time.

- Expanded sales opportunities: Small businesses can tap into a broader customer base globally, breaking through geographical barriers and opening up new markets.

- Improved operational efficiency: Implementing online payment solutions automates the payment process, reducing administrative tasks and freeing up valuable time for core activities.

- Cost savings: Online payments generally come with lower transaction fees compared to traditional payment methods, eliminating the need for physical payment processing equipment or maintenance costs.

- Enhanced security: Implementing secure online payment systems instills trust in customers, protecting their financial information and establishing a reliable reputation.

- Competitive advantage: Offering online payment options gives small businesses a competitive edge, attracting and retaining more customers who embrace the convenience of online transactions.

- Access to alternative payment methods: Online payment solutions enable small businesses to accept various payment methods beyond traditional cards, catering to a broader range of customer preferences.

By embracing online payments, small businesses can thrive in the digital marketplace and leverage the benefits to fuel their growth and success.

Challenges in Accepting online Payments for Small Businesses

While online payments offer numerous benefits, small businesses may encounter certain challenges in the process. Let’s take a closer look at these challenges and explore how they can be addressed to maximize the benefits of accepting online payments.

- Setup and Integration

Implementing online payment systems can be complex and require technical expertise. Small businesses may face challenges during the setup and integration process, which can involve additional costs. However, with the right guidance and support, these obstacles can be overcome, allowing small businesses to harness the power of online payments. - Security Concerns

Security is a top concern when it comes to online payments. Small businesses must ensure the protection of customer data and comply with security standards to prevent fraud and breaches. By partnering with trusted payment gateway providers and implementing robust security measures, businesses can establish a secure.

By partnering with trusted payment gateway providers and implementing robust security measures, businesses can establish a secure environment for online transactions. It is essential to prioritize data encryption, secure server connections, and regular security audits to mitigate potential risks. - Technical Support and Maintenance

Small businesses may require ongoing technical support and maintenance for their online payment systems. Issues such as software updates, integration troubleshooting, and transaction monitoring may arise. Choosing a reliable payment gateway that offers dedicated customer support can help small businesses overcome these challenges and ensure smooth payment operations. - Customer Trust and Experience

Building customer trust and delivering a seamless payment experience is crucial for small businesses. It is essential to provide clear and transparent payment processes, prominently display security seals, and offer user-friendly interfaces. By prioritizing customer trust and experience, businesses can enhance customer satisfaction and loyalty.

Introducing OxaPay as an Ideal Payment Solution

Now, let’s dive into the key features and advantages of OxaPay as an ideal payment solution for small businesses. OxaPay is a crypto payment gateway that offers businesses and individuals an easy and secure way to accept cryptocurrency payments. It presents a cost-effective alternative to traditional payment methods, with a fixed transaction fee starting from 0.4%. Let’s explore the unique features and benefits that make OxaPay stand out from the competition.

Easy Integration

OxaPay offers a user-friendly and straightforward integration process. Small businesses can quickly integrate OxaPay’s payment gateway into their existing e-commerce platforms or websites. With easy-to-follow documentation and developer-friendly tools, the integration process becomes hassle-free, allowing businesses to start accepting online payments promptly.

Global Reach

With OxaPay, small businesses can expand their reach to a global customer base. By accepting cryptocurrencies as a form of payment, businesses can attract customers from different countries . This accessibility opens up new market opportunities and increases sales potential.

Cost-Effective Transactions

OxaPay offers cost-effective transactions with competitive fees from 0.4%. By leveraging the efficiency of blockchain technology, OxaPay reduces transaction costs, benefiting small businesses. Lower fees mean higher profit margins and more resources to invest in business growth and development.

Enhanced Security

OxaPay prioritizes security and transparency in every transaction. Built on the blockchain, OxaPay ensures immutability and decentralization, making it resistant to fraud and unauthorized access. The transparent nature of blockchain technology also provides businesses and customers with a verifiable record of transactions, enhancing trust and accountability.

Payment Flexibility

OxaPay supports multiple cryptocurrencies, giving customers the flexibility to choose their preferred payment method. This versatility caters to a diverse customer base and increases the chances of completing successful transactions. Small businesses can accommodate various cryptocurrencies, including Bitcoin, Ethereum, and others, ensuring a seamless payment experience for their customers.

Streamlined Settlements

OxaPay simplifies the settlement process for small businesses. With traditional payment methods, settlements can take several days to complete. However, with OxaPay, transactions settle faster, allowing businesses to access funds more quickly. This accelerated settlement time improves cash flow and enables businesses to manage their finances more efficiently.

Dedicated Support

OxaPay provides dedicated customer support to assist businesses at every stage. Whether it’s integration, technical assistance, or general inquiries, the OxaPay support team is available to help. Having reliable support ensures that small businesses can resolve issues promptly and continue to offer a smooth payment experience to their customers.

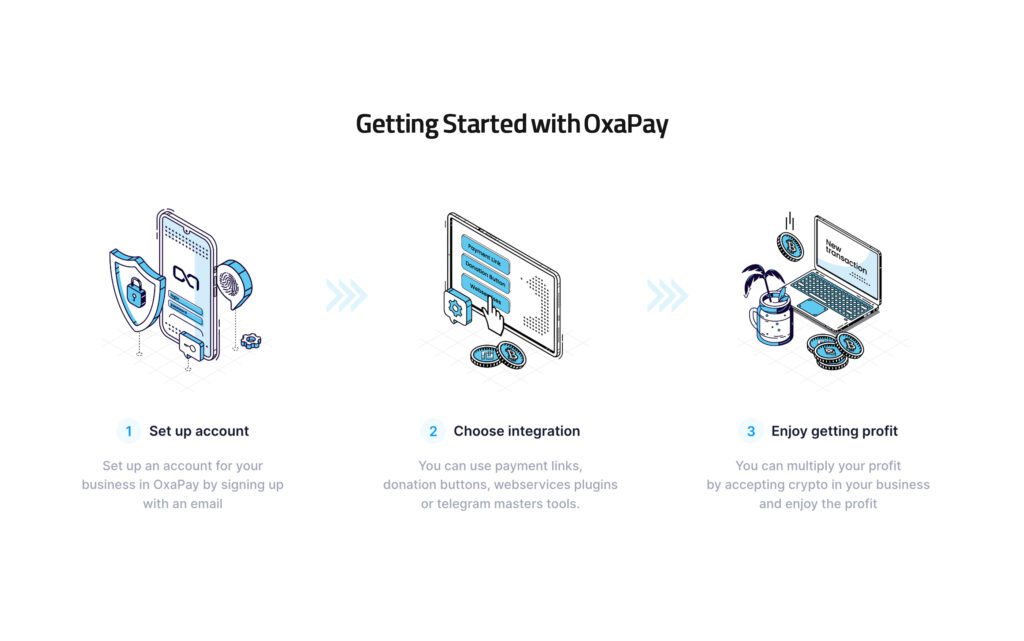

Getting Started with OxaPay

To get started with OxaPay, follow these steps:

- Sign up for an OxaPay account on our website.

- Verify your email address.

- Choose the integration method that best suits your needs, such as payment links, donation buttons, web services, plugins, or Telegram tools.

- Obtain your API key from the OxaPay dashboard.

- Follow the instructions provided by OxaPay to integrate the API into your website or Telegram channel.This may involve adding code snippets to your website or installing a plugin.

- Customize the payment gateway settings according to your preferences, such as the amount and cryptocurrency you wish to use for payments.

- Test the payment gateway to ensure that it is working properly.

- Once you have integrated OxaPay into your website or Telegram channel, you can start accepting cryptocurrency payments.

Conclusion

By choosing Oxapay as your online payment solution, small businesses can simplify their payment processes and unlock the advantages of accepting crypto payments. From seamless integration and compatibility with popular e-commerce platforms to secure fund storage and dedicated customer support, Oxapay offers a comprehensive package tailored to the needs of small businesses. Embrace the digital revolution, streamline your online payments, and elevate your small business to new heights with Oxapay.

With Oxapay, you can tap into the growing popularity of cryptocurrencies and provide your customers with a modern and convenient payment option. By accepting cryptocurrencies, you

FAQs

What challenges do small businesses face in their business?

Small businesses face challenges such as setting up cost-effective and user-friendly payment systems, dealing with high transaction fees and complex integrations, ensuring security and compliance, requiring ongoing technical support, and building customer trust.

What makes OxaPay an ideal payment solution for small businesses?

OxaPay is ideal for small businesses due to its easy integration, global reach through cryptocurrency acceptance, cost-effective transactions with low fees, enhanced security through blockchain technology, payment flexibility, streamlined settlements, and dedicated support.

How does OxaPay simplify the integration process for small businesses?

OxaPay simplifies integration through user-friendly documentation, developer-friendly tools, multiple integration methods, clear instructions, and dedicated customer support.

What are the benefits of using OxaPay crypto payment gateway for small businesses?

Using OxaPay’s crypto payment gateway provides access to a global customer base, cost-effective transactions, enhanced security, payment flexibility, streamlined settlements, and dedicated customer support.

What security features does OxaPay provide to ensure safe online transactions for small businesses?

OxaPay ensures safe online transactions for small businesses through blockchain technology, verifiable transactions, data encryption, secure infrastructure, compliance with security standards, fraud detection and prevention systems, and a dedicated security team.