Traditional and modern payment methods are essential for economic transactions. While traditional methods have long been the standard in finance, the rise of cryptocurrencies and blockchain technology has marked a significant shift. This article explores how conventional payment systems and crypto payment solution compare, discussing their advantages, challenges, and overall impact on the global economy.

Traditional Payment Systems

Traditional payment systems include methods like cash, checks, and electronic transfers. These rely on banks and other financial institutions to handle and complete transactions. Recent data shows that cash is still popular, with $7.6 trillion spent by consumers in 2022 (Global Payments Report 2023).

Fintech Payment Systems

Fintech innovations have transformed how we make payments by introducing online payment gateways, mobile wallets, and peer-to-peer transfers. These technologies speed up transactions and make them more convenient and accessible. The Digital Payments market is expected to reach $9.46 trillion in 2023 and grow to $14.78 trillion by 2027, with an annual growth rate of 11.80% (Statista).

Traditional Payment Gateways

Companies like PayPal, Visa, and Stripe handle secure payment processing. They provide features such as fraud protection, buyer and seller protection, and easy integration with online platforms. In 2022, Visa handled $3.38 trillion in total volume, including payments and cash flows. PayPal processed $1.36 trillion in payments, up 9% from $1.25 trillion in 2021. Stripe’s transactions reached $817 billion, showing a 26% increase from $640 billion in 2021.

| Adoption and Usage | |

| Unbanked Individuals | ~1.7 billion globally |

| Number of Bank Account Holders | Over 4.2 billion |

| Crypto Payment Adoption (Unbanked) | ~5-10% |

| Traditional Payments (Business Acceptance) | Over 90% of businesses |

| Crypto Payments (Business Acceptance) | Under 10% of businesses |

| Major Cards (Visa, Mastercard) | Over 90% of merchants globally accept |

| Cryptocurrency Acceptance | Under 5% -50% planning to accept within 2 years |

| Total Payment Cards in Circulation | Over 2 billion |

| Total Value of Global Remittances | Over $700 billion in 2022 |

| Online Payments | |

| Card Payments | Over 60% of e-commerce payments |

| Digital Wallets | 20-30% of payments |

| Cryptocurrency Payments | Less than 1% of e-commerce payments, |

| ATM Usage | |

| Total ATMs Globally | Over 3.2 million |

| Total Transactions per Year | Over 3 billion |

| Total Value of Transactions ATMs | Over $14 trillion |

| Bitcoin ATMs | Over 39,000, |

| Mobile Payment Adoption | |

| Mobile Payment Users Making Crypto Payments | About 16% |

| Users Making Traditional Mobile Payments | Over 2 billion |

Pros and Cons of Traditional Payment Systems

Pros:

- They are trusted and widely accepted.

- They are familiar, stable, and have a strong foundation.

- They offer fraud protection through measures like chargebacks. A Federal Reserve survey found that 92% of U.S. consumers prefer traditional payment methods for their security (Federal Reserve, 2021).

Cons:

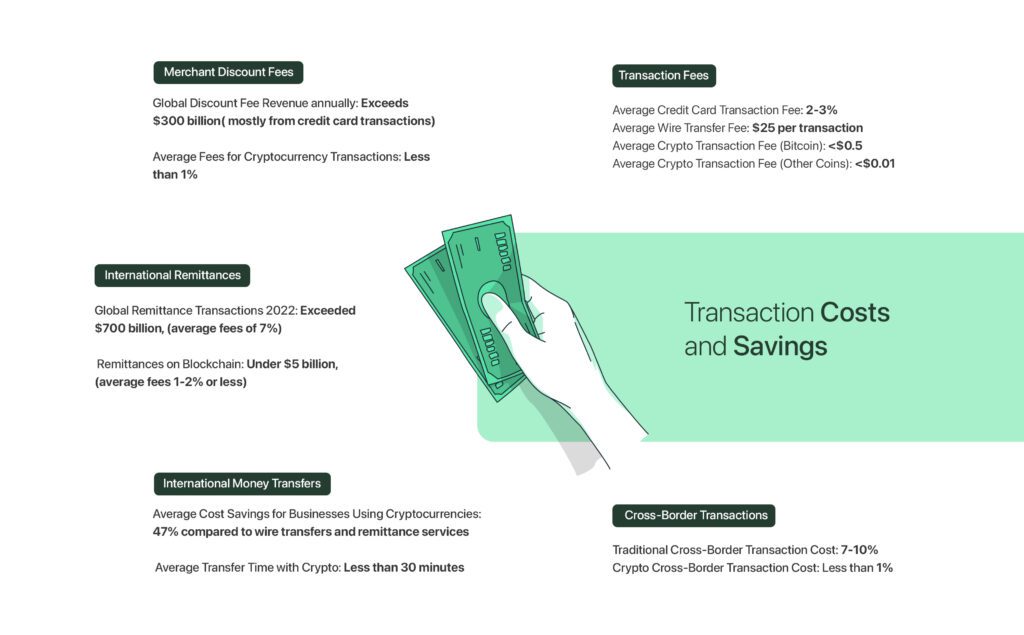

- They have high transaction fees.

- They often have slow settlement times.

- They are not always accessible in areas with few banks.

- They have some security weaknesses.

- The costs for sending money and other fees are rising. For instance, the cost of sending money from G8 countries rose from 5.61% in late 2021 to 5.80% early in 2022. Interchange fees range from 1.15% to 3.15%, and credit card transaction fees are typically 2-3%. Wire transfers cost an average of $25 each (World Bank)

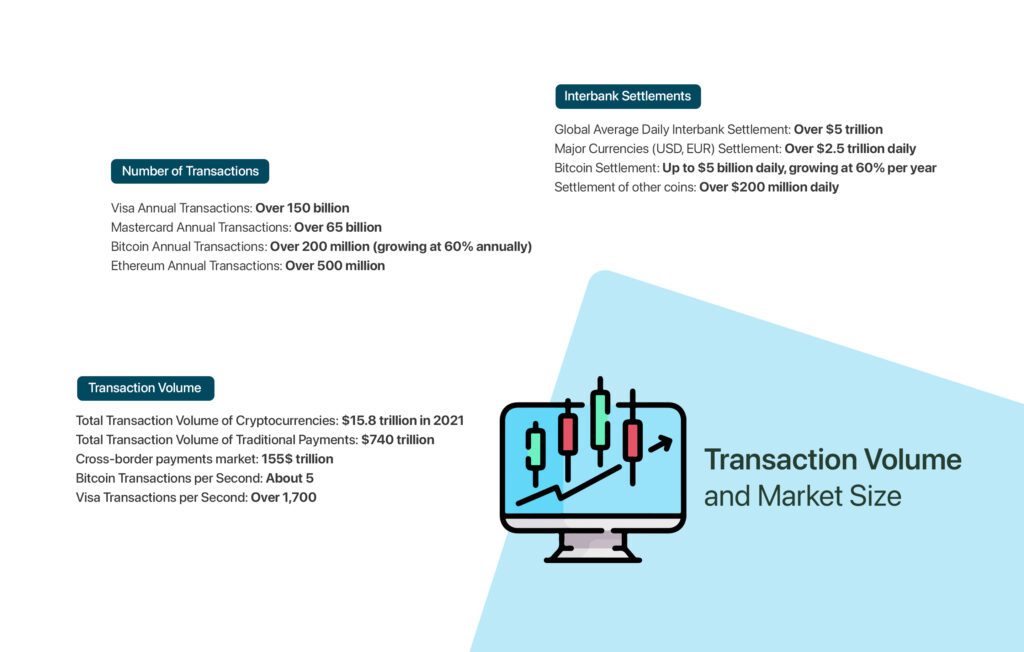

Crypto Payment Solution

As we move deeper into the digital age, crypto payment solution are becoming increasingly popular as innovative financial tools. These solutions use the power of digital currencies and blockchain technology to provide an alternative to traditional payment systems. The main advantages of using crypto payment methods are much faster transaction speeds, much lower processing fees, and access on a global scale.

What is the Payment Solution for Crypto?

Crypto payment solution use digital currencies, like Bitcoin and Ethereum, and process transactions using blockchain technology. Unlike traditional payments, this system is decentralized, meaning transactions are recorded on a public ledger which increases transparency and security. The main parts of a crypto payment system include:

- Crypto Wallets: These are digital wallets that store and manage cryptocurrencies.

- Crypto Payment Gateways: These services help process payments in cryptocurrencies, changing them to regular money if needed.

For example, imagine an online bookstore where a customer decides to pay with Bitcoin. At checkout, the customer sends their payment from their crypto wallet to the store’s digital wallet via a crypto payment gateway. The transaction is checked and logged on the blockchain, making it secure and unchangeable. This method not only speeds up the transaction but also cuts down on fees compared to traditional credit card processing.

Blockchain-Powered Crypto Transactions

Blockchain technology supports crypto payment solution by providing a secure and decentralized ledger to record transactions. Each payment is checked and secured, which enhances safety and cuts costs. This system not only speeds up international transactions but also ensures that they are transparent and permanent, building trust in digital financial exchanges. It’s estimated that blockchain-based transactions could save businesses between $8-12 billion annually in operational costs by 2025 (Accenture, 2021).

Advantages of Crypto Payment Solutions

Diversification of Payment Options:

By accepting cryptocurrencies, businesses can offer more payment choices, meeting the increasing demand for alternative payment methods.

Lower Transaction Fees:

Crypto payments cut out the middlemen, greatly reducing transaction costs. Blockchain technology can lower these costs by up to 90% and speed up transactions (World Economic Forum, 2020).

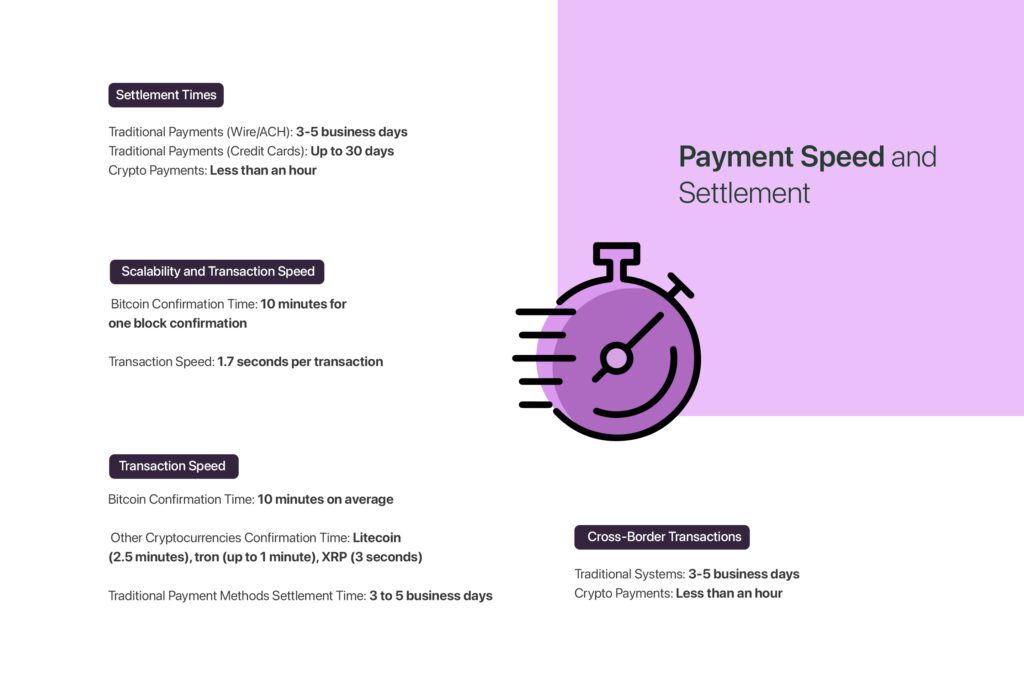

Faster Transactions:

Crypto transactions are processed almost immediately, which helps businesses manage their money better and improves the customer experience.

Enhanced Security:

The decentralized and unchangeable nature of blockchain makes transactions both transparent and secure.

Global Accessibility:

Crypto payments allow businesses to accept payments from around the world without needing to convert currencies or navigate complex bank networks.

Financial Inclusion:

Crypto payment solution help include people without bank accounts or those in underserved areas in the economy. All they need is a smartphone and internet access.

| Save money by accepting crypto | |

| Merchant Savings per Transaction | 2-4% or up to($2,500 per $100,000 in sales) |

| Cross-Border Transaction Cost Savings | Average 5-7% |

| Top Benefits of Crypto for Businesses | Lower fees faster transactions , global reach |

| More access with crypto acceptance | Over 150 countries, 2+ billion people instantly |

| Fraud and Chargebacks | |

| Traditional Payments (Fraud Rate) | 0.5-1%($200B annual losses) |

| Traditional Payments (Chargeback Rate) | 0.5-2% |

| Crypto Payments (Fraud Rate) | Near 0% |

| Crypto Payments (Chargeback Rate) | Near 0% |

Challenges of Crypto Payment Solutions

1. Regulatory Uncertainties:

The rules for cryptocurrencies are still being developed, which can create confusion for both businesses and consumers. This includes issues like taxes, preventing money laundering, protecting investors, and ensuring consumer rights.

2. Price Volatility:

The value of cryptocurrencies can change dramatically, which can make it hard to keep prices stable and manage budgets. Stablecoins have been introduced to help stabilize these fluctuations.

3. Limited Merchant Acceptance:

Even though more businesses are starting to accept cryptocurrencies, their acceptance is still not as widespread as traditional payment methods.

4. User Education and Adoption:

There is a learning curve associated with using cryptocurrencies. Both businesses and consumers need to understand how to secure their wallets and how crypto payments work.

Impact of Cryptocurrency Adoption on Traditional Banking

The rise of digital currencies is significantly affecting traditional banking. This section explores how digital currencies are changing the way banks operate, offer services, and plan their strategies:

1. Increased Competition and Innovation:

Banks are facing more competition from decentralized finance (DeFi) platforms and cryptocurrency services, pushing them to adopt blockchain technology for faster and cheaper services.

2. Development of Bank-issued Digital Currencies:

In response to cryptocurrencies, some central banks are exploring or launching their own digital currencies to combine the benefits of crypto with the reliability of traditional money.

3. Adapting to Changing Consumer Preferences:

Banks are adjusting to the growing use of digital currencies by offering crypto-related services such as custody, trading, and blockchain-based payments.

The Future of Crypto Payment Solutions

Looking forward, the future of crypto payment solution looks bright, with significant potential for growth and integration into mainstream finance. Here’s what might happen next:

Rise of CBDCs:

The development and implementation of Central Bank Digital Currencies will be a significant trend to watch, as it could majorly change the global payment landscape.

Increased Mainstream Adoption:

As cryptocurrencies become easier to use and regulations become clearer, it’s expected that more businesses and consumers will start using crypto payments.

Integration with Traditional Finance:

There could be smoother integration of cryptocurrency payment systems with traditional banking, making it easier for users to switch between traditional money and digital currencies.

Technological Advancements:

Continuous improvements in blockchain technology will further enhance the speed, efficiency, and security of crypto payments.

Focus on Privacy and Security:

With increasing concerns about data privacy and security, future crypto payment solution will likely focus more on enhancing privacy measures.

| Global Crypto Adoption | |

| Number of Crypto Users Worldwide | Over 420 million |

| Bitcoin Wallets | Over 74 million |

| Ethereum Wallets | Over 240 million |

| Global cryptocurrency adoption rate. | About 6% of people |

| Number of Cryptocurrency Wallet Users | Over 85 million |

| businesses using cryptographic micropayments. | Roughly 2% |

| Businesses Conducting Cross-Border Transactions with Crypto | 25-30% |

| Annual Volume of Business Cross-Border Transactions | Exceeds $1 billion |

| Global Remittances Processed Using Crypto | Less than 1% |

| Merchants Accepting Cryptocurrencies | About 4% globally |

| Adoption by Small Businesses | 6% |

| Adoption by Medium Businesses | 3% |

| Adoption by Large Enterprises | 1% |

| Merchants Accepting Cryptocurrencies | About 4% globally |

Best Cryptocurrencies for Payments

When choosing cryptocurrencies for transactions, it’s important to consider their unique features:

Bitcoin (BTC):

Known for its strong security and wide acceptance, Bitcoin is great for large transactions because of its strong presence in the market.

Ethereum (ETH):

Best for transactions that need smart contracts, Ethereum supports complex operations and apps that go beyond simple money transfers.

Litecoin (LTC):

Offers quicker transaction times and lower fees than Bitcoin, making it good for smaller, more frequent payments.

Ripple (XRP):

Known for its almost instant transaction speed and low cost, Ripple is perfect for international money transfers and big business deals.

Stablecoins (e.g., USDT, USDC):

These coins are tied to stable assets like the US dollar, which helps keep their value steady, making them ideal for everyday use.

Bitcoin Cash (BCH):

With quicker processing times and lower fees than Bitcoin, Bitcoin Cash is suitable for daily shopping.

Solana (SOL):

Famous for its extremely fast and cost-effective transactions, Solana is great for applications that need quick processing.

What is a Crypto Payment Gateway?

A crypto payment gateway helps businesses accept cryptocurrencies as payment, acting as a digital middleman. It ensures secure, smooth transactions by converting cryptocurrencies into regular currency or vice versa. This allows businesses to connect with a global market.

Should I Use a Crypto Payment Gateway?

Businesses should think about using a crypto payment gateway to easily and securely accept cryptocurrency payments. These gateways offer crucial infrastructure, reduce the risk of price changes with options to instantly convert to regular money or stablecoins, and provide lower fees, quicker settlement times, and access to a worldwide customer base. This is essential for businesses looking to remain competitive in a digital world.

The Best Payment Gateway for Cryptocurrency

Choosing the right cryptocurrency payment gateway is crucial for businesses that want to smoothly incorporate crypto transactions. Here are some top options:

BitPay:

Known for its easy-to-use interface, BitPay supports several cryptocurrencies and offers solutions for both mobile and web payments.

CoinGate:

Perfect for businesses seeking flexibility, CoinGate allows for cryptocurrency transactions and offers options to instantly convert crypto payments into fiat currencies.

OxaPay:

Notable for its strong security features and low transaction fees, OxaPay helps businesses handle cryptocurrency payments easily. It supports a broad range of cryptocurrencies and is known for its smooth integration capabilities, making it a leading choice in the crypto payment gateway space.

Building a Crypto Payment Infrastructure

To set up a strong crypto payment system that doesn’t just rely on existing solutions, follow these steps:

1. Select a Blockchain Platform:

Pick a blockchain that meets your needs for transaction volume and speed, like Ethereum, which is well-supported and actively developed.

2. Develop Smart Contracts:

Work on creating smart contracts that handle the logic of your crypto payments. This means programming the rules for how payments are made, ensuring they happen automatically and securely.

3. Ensure Regulatory Compliance:

Make sure you understand and follow the legal rules in the areas where you operate to stay compliant.

4. Implement Security Protocols:

Put strong security measures in place to protect transaction data and user privacy, such as using encryption and safe storage methods.

5. Test Extensively:

Test your system thoroughly before it goes live to make sure it works as expected under different scenarios. This is important to catch and fix any issues.

While building your own crypto payment system allows for customization and control, it can be complex, expensive, and time-consuming. For many businesses, using a crypto payment gateway like OxaPay might be more efficient and effective. These gateways offer ready-to-use infrastructure that makes integration easy, ensures security, and meets regulatory standards, making them ideal for businesses that want to quickly and safely start accepting crypto payments.

How to Set Up Crypto Payments for Your Business

Setting up crypto payments involves several key steps to ensure everything works smoothly and securely:

1. Choose a Reliable Crypto Payment Gateway:

Pick a gateway like OxaPay, BitPay, or CoinGate that supports the cryptocurrencies you wish to accept and offers the features you need, such as instant conversion to regular currency to manage price changes.

2. Integrate with Your POS and Online Platforms:

Link the payment gateway to your point-of-sale system and online platforms. Most gateways have plugins and APIs that simplify this integration with your existing e-commerce systems.

3. Set Up a Crypto Wallet:

You’ll need a secure digital wallet to receive cryptocurrency payments. Make sure this wallet is compatible with the payment gateway you are using.

4. Educate Your Team:

Teach your staff the basics of cryptocurrency, how to process transactions, and what to do if problems arise. Proper training is crucial for smooth operations and customer service.

5. Announce Your New Payment Option:

Let your customers know about the new payment option. Highlight benefits like enhanced security and potential savings on transaction fees to encourage them to use it.

6. Monitor and Adjust:

Keep an eye on the transactions and feedback from users. Be prepared to tweak your setup and offer promotions or incentives to get more customers to use the new payment method.

By following these steps, you can effectively introduce and manage crypto payments, broadening your business’s payment options and possibly reaching a wider global market.

Recommendations for Businesses and Consumers

As the use of cryptocurrencies grows worldwide, both business managers and customers can take steps to make the most of this evolving landscape. Here are straightforward tips for adapting to the acceptance of cryptocurrencies:

For Business Managers:

- Embrace Innovation: Consider using crypto payment solution to grow your business.

- Diversify Payment Options: Offer various payment methods to attract more customers.

- Engage with Crypto Communities: Connect with these groups to learn and find new opportunities.

- Educate Your Customers: Teach them about cryptocurrencies to improve their experience.

- Implement Strong Security: Use effective security measures to protect your business and customers.

- Stay Informed: Keep up with changes in crypto regulations to ensure compliance.

For Customers:

- Learn About Cryptocurrencies: Understand the benefits and how they work.

- Choose Secure Businesses: Only deal with businesses known for their security.

- Secure Your Digital Wallet: Use strong passwords and authentication methods.

- Be Aware of Price Changes: Keep in mind that cryptocurrency values can fluctuate significantly.

- Follow Security Best Practices: Stay updated on how to protect your assets.

- Explore New Opportunities: Look into new ways to use cryptocurrencies and consider their long-term benefits.

By following these recommendations, both businesses and consumers can navigate the cryptocurrency landscape more safely and effectively.

Conclusion

Crypto payment solution offer a promising avenue for modernizing transactions with lower fees, enhanced security, and global reach. While facing challenges like regulatory uncertainty and market volatility, their integration into traditional systems and continuous technological advancements suggest a bright future. Businesses should stay informed and adaptable to harness these emerging opportunities effectively.