In recent years, the rapid rise of cryptocurrencies has led to many new crypto payment gateways. These gateways link businesses and consumers, making it easy to use cryptocurrencies for transactions. With so many options, choosing the right crypto payment gateway can be tough. This article will help you pick the best one, ensuring safe and effective transactions. By guiding you on how to choose a crypto payment gateway, we make it easier to start using cryptocurrencies.

Understanding Crypto Payment Gateways

Before delving into the selection process, it’s crucial to understand what a crypto payment gateway is. In essence, A crypto payment gateway is a crucial intermediary that enables businesses to accept and process cryptocurrency payments easily. Besides converting digital currencies into fiat or other cryptocurrencies, these gateways offer robust security to protect sensitive data. They simplify adopting crypto payments, manage transaction flows, and enhance customer satisfaction by varying in features like security, fees, and user experience. Understanding these aspects is vital for choosing the right gateway for your business.

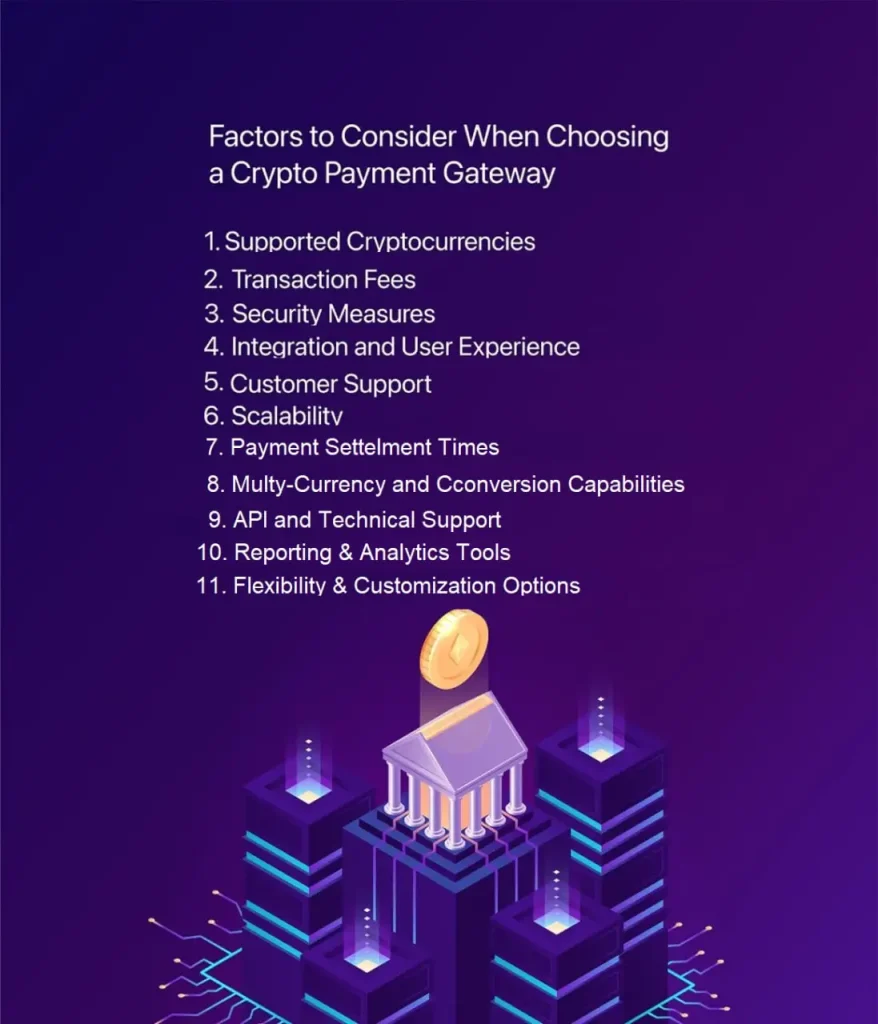

Factors to Consider When Choosing a right Crypto Payment Gateway

1. Supported Cryptocurrencies:

Ensure the gateway supports a wide range of cryptocurrencies, including major ones like Bitcoin (BTC), Ethereum (ETH), and other altcoins, which allows you to cater to diverse customer preferences.

2. Transaction Fees:

Opt for a gateway that offers competitive and transparent transaction fees, and be wary of hidden charges that can inflate costs.

3. Security Measures:

Select a gateway with robust security practices such as encryption and two-factor authentication (2FA) to protect both your funds and customer data.

4. Integration and User Experience:

Choose a gateway that offers straightforward integration with your existing systems and a user-friendly interface for both you and your customers.

5. Customer Support:

Good customer support is essential for dealing with any potential issues swiftly. Ensure the gateway provides responsive and effective support.

6. Scalability:

The gateway should be able to handle increasing transaction volumes as your business grows without performance hitches.

7. Payment Settlement Times:

Consider how quickly the gateway processes transactions and settles payments, as faster settlement can improve your cash flow.

8. Multi-Currency and Conversion Capabilities:

Look for a gateway that handles multiple fiat and cryptocurrencies and offers seamless conversion between them. This is vital for serving international customers.

9. API and Technical Support:

A robust API and reliable technical support can facilitate smoother integration and maintenance, reducing potential downtime and technical issues.

10. Reporting and Analytics Tools:

Access to comprehensive analytics and reporting tools can help you understand transaction patterns, customer behavior, and business performance.

11. Flexibility and Customization Options:

A gateway that offers customization options for payment processing and transaction handling can provide a more tailored solution to fit specific business needs.

Steps to Evaluate a Right Crypto Payment Gateway

1. Research and Compile a List:

Begin by gathering information on various crypto payment gateways. Focus on those that are frequently recommended by industry experts or have received positive feedback in financial technology forums.

2. In-depth Feature Comparison:

Compare the gateways based on their features, such as support for multiple cryptocurrencies, security protocols, user interface, mobile compatibility, and additional tools like fraud detection.

3. Demo or Trial Period:

Check if the gateways offer a demo or a trial period. Utilize this opportunity to test the gateway’s functionality and integration capabilities with your existing systems without making a long-term commitment.

4. Evaluate Integration Process:

Assess how easily the gateway integrates with your current systems. Review the technical documentation for clarity and comprehensiveness. Test the integration process in a controlled environment to identify any potential issues.

5. Consultation with Experts:

Engage with financial technology experts or consultants who specialize in blockchain and cryptocurrencies. Their insights can be crucial in assessing the technical adequacy and security robustness of the gateways.

6. User Interface and Accessibility Evaluation:

Evaluate the ease of use and accessibility of each payment gateway’s user interface. A straightforward and intuitive interface can enhance the transaction experience for both you and your customers.

7. Mobile Support and Compatibility:

Ensure the gateway performs well on mobile platforms and is compatible with various devices, catering to customers who prefer mobile transactions.

8. Legal and Compliance Checks:

Verify the gateway’s compliance with local and international regulatory requirements. Consulting with legal professionals can help ensure that your chosen gateway meets all legal obligations.

9. Read Reviews and Testimonials:

Look for detailed reviews and testimonials from other businesses. Consider both positive and negative feedback to gauge the reliability and customer service quality of the gateway.

10. Cost-Benefit Analysis:

Conduct a cost-benefit analysis to understand whether the fees and features offered by the gateway align with your business needs and financial strategies.

11. Check for Security Certifications and Compliance:

Ensure that the gateway has necessary security certifications and adheres to industry standards such as PCI DSS compliance, which can significantly secure your transactions.

12. Long-term Viability Assessment:

Investigate the gateway provider’s stability and reputation in the market. Look into their financial health, market presence, and development plans to ensure they are a reliable long-term partner.

13. Simulate Transactions:

If possible, perform test transactions to see how the gateway handles payments in real-time. This step can help you assess the transaction speed, conversion process, and overall efficiency.

Key Considerations for Integration Process Evaluation

Evaluating the integration process of a crypto payment gateway is a crucial step for businesses that need to ensure the gateway works seamlessly with their existing infrastructure. Here’s how to effectively assess this process:

1. Technical Documentation Review:

Start by examining the gateway’s technical documentation. Good documentation should be clear, thorough, and provide all the necessary details about the API and other integration tools. It should guide you step-by-step through the process and be accessible even to those with limited technical expertise.

2. API Functionality and Flexibility:

Assess the functionality and flexibility of the API. A robust API should offer comprehensive features that allow for customization and scalability. Check if the API supports various programming languages and frameworks that you currently use or plan to use.

3. Compatibility Checks:

Verify compatibility with your existing software systems, including your e-commerce platform, CRM, and other critical business tools. The gateway should integrate smoothly without requiring extensive changes to your current setup.

4. Ease of Integration:

Consider the complexity of the integration process. A good payment gateway should offer simple integration options that do not demand extensive developer resources. Look for plug-and-play solutions and pre-built modules for popular e-commerce platforms.

5. Support for Mobile and Alternative Payments:

Ensure that the gateway supports mobile integrations and alternative payment methods that you might want to offer, such as QR codes or mobile wallets. This is particularly important if a significant portion of your customer base uses mobile devices for transactions.

6. Developer Support and Resources:

Evaluate the level of support provided during the integration process. A reliable payment gateway provider should offer excellent developer support, including timely assistance from technical support teams, forums, and community support for troubleshooting.

7. Security Implementation:

Review how security measures are integrated during the payment processing. Ensure that the gateway follows best practices for security, such as using secure coding techniques, regular updates, and patches to protect against vulnerabilities.

8. Testing Environment:

Check if the gateway offers a sandbox testing environment for you to safely test the integration without affecting live data. This feature allows you to simulate transactions and troubleshoot any issues before going live.

9. Time and Resource Requirements:

Assess the time and resources needed to complete the integration. This includes understanding the manpower required and any potential disruptions to business operations. A less resource-intensive integration can reduce costs and minimize business impact.

10. Feedback Loop:

Establish a feedback loop with the gateway provider during the trial period. This can help you communicate any issues and receive updates or improvements necessary for better integration.

Oxapay: Right Crypto Payment Gateway for Your Business

Oxapay is a dynamic crypto payment gateway designed to meet the evolving needs of modern businesses that wish to incorporate cryptocurrency transactions into their operations. As the financial landscape becomes increasingly digital, Oxapay offers a robust, secure, and flexible solution that simplifies the integration of crypto payments. Catering to a diverse range of industries, Oxapay ensures that businesses can safely and efficiently handle digital transactions, enhancing their accessibility to global customers.

Key Features of Oxapay

1. Wide Range of Supported Cryptocurrencies:

Oxapay supports numerous cryptocurrencies, including major ones like Bitcoin (BTC), Ethereum (ETH), and various altcoins, making it adaptable to various customer preferences and increasing market reach.

2. Competitive and Transparent Fees:

The platform offers competitive transaction fees with no hidden charges, ensuring that businesses can maintain cost-effectiveness while providing transparent pricing to their customers.

3. Advanced Security Measures:

Oxapay employs state-of-the-art security protocols including end-to-end encryption and two-factor authentication (2FA) to ensure the integrity and safety of every transaction.

4. Seamless Integration Process:

Oxapay provides easy integration tools that are compatible with various e-commerce platforms and require minimal technical effort, complete with extensive documentation and developer support.

5. Mobile Compatibility:

Understanding the necessity of mobile transactions, Oxapay ensures full mobile compatibility, allowing users to conduct and manage transactions via smartphones and tablets effortlessly.

6. Robust Customer Support:

Oxapay’s dedicated customer support team is available 24/7 to assist with any queries or issues, ensuring that businesses receive timely help whenever needed.

7. Enhanced Scalability:

The platform is designed to scale with your business, capable of handling an increase in transaction volume without degradation of service or speed.

8. Comprehensive Reporting Tools:

Businesses can benefit from detailed analytics and reporting tools provided by Oxapay, which offer insights into transaction patterns and help with strategic decision-making.

9. Customization and Flexibility:

Oxapay allows businesses to customize their payment processing needs, offering flexibility in how transactions are handled and funds are managed.

10. Long-term Stability:

With a solid market reputation and backed by robust financial health, Oxapay promises reliability and continuous enhancement in its services and features.

Conclusion

Choosing the best crypto payment gateway is crucial for your business’s success in the digital economy.. While OxaPay stands out for its strong features, it’s important to compare different gateways using the criteria we’ve outlined. Explore several providers, try their services, and choose the one that fits your business needs best. Making the right choice will boost your efficiency, keep customers happy, and help you reach more markets, keeping you ahead in the digital payment space.