Have you ever hesitated to complete an online purchase because you weren’t sure if your payment details were secure? How can a single data breach erode years of trust? The Importance of Secure Payment Methods goes beyond protecting financial details, it’s about safeguarding the trust that fuels customer loyalty. Insecure payment systems expose businesses to fraud, reputational damage, and financial losses. This article uncovers why secure payment methods are essential, the risks of outdated systems, and how OxaPay’s crypto solutions provide a secure, transparent path forward.

Why Secure Payment Methods Are Crucial for Customer Trust

Secure payment methods form the backbone of a trustworthy business. When customers share sensitive information like credit card details, they expect it to be handled responsibly. Unfortunately, traditional payment systems are vulnerable to fraud, data breaches, and misuse of customer information. A single security incident can irreparably damage trust.

The High Cost of Trust Breaches

- Data Breaches and Fraud:

In 2023, global fraud losses across online payment platforms reached an estimated $48 billion, with many incidents tied to insecure systems(FINTECH FUTURES). - Customer Perceptions:

A survey by PwC revealed that 85% of customers will stop doing business with a company after a data breach, showcasing how trust directly affects retention(PWC AUSTRALIA). - Notable Incidents:

- Target Breach (2013): Over 40 million credit card numbers were stolen, resulting in millions in damages and a significant loss of customer trust(CNN MONEY).

- Equifax Breach (2017): The exposure of 145 million customer records led to lawsuits, fines, and a tarnished reputation(FEDERAL TRADE COMMISSION).

The Target Data Breach: A Cautionary Tale

One of the most infamous incidents in the history of traditional payment systems was the Target data breach of 2013, which exposed the vulnerabilities of centralized payment methods and shattered customer trust.

What Happened?

During the holiday shopping season, hackers infiltrated Target’s payment system through a third-party vendor’s credentials. Over the course of weeks, the attackers gained access to the retailer’s point-of-sale (POS) systems, compromising the credit and debit card information of 40 million customers. In addition, personal details such as names, addresses, and phone numbers of 70 million customers were leaked.

The Fallout

The breach had devastating consequences for Target and its customers:

- Financial Loss: Target faced $18.5 million in settlements and incurred significant costs for security upgrades and legal fees.

- Reputation Damage: Customers lost confidence in the retailer, leading to a 46% drop in quarterly profits following the breach.

- Customer Trust Erosion: Many customers chose alternative retailers, and the brand struggled to regain its reputation for years.

Lessons Learned

This incident highlights the critical need for secure payment systems. The centralized nature of traditional payment methods, combined with weak security practices, allowed hackers to exploit vulnerabilities. Customers expect businesses to protect their financial and personal information, and a failure to do so can result in long-lasting damage to trust and loyalty.

How Secure Payment Methods Prevent Trust Breaches

By adopting secure payment methods, businesses can:

- Protect Customer Data: Encryption and advanced security protocols prevent unauthorized access.

- Ensure Transaction Integrity: Payments are processed accurately without risk of tampering.

- Foster Customer Loyalty: When customers feel secure, they are more likely to return.

In short, secure payment systems aren’t just about compliance, they’re about safeguarding the trust that fuels long-term business success.

How Crypto Payments Enhance Security and Trust

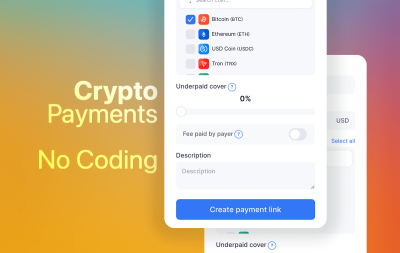

Cryptocurrency payments are revolutionizing how businesses approach payment security. Powered by blockchain technology, they offer unparalleled levels of protection and transparency. Here’s how OxaPay crypto payment solutions can transform your business:

1. Unmatched Security

Traditional payment methods rely on centralized systems, which are prime targets for cyberattacks. In contrast, crypto payments through blockchain technology, ensuring:

- Decentralized processing to eliminate single points of failure.

- Encryption that makes transactions tamper-proof.

- No storage or sharing of sensitive customer data, reducing fraud risks.

This advanced security reassures customers that their payments are protected from cyber threats.

2. Transparency for Greater Accountability

Blockchain’s transparent nature records every transaction on a public ledger. This traceability fosters accountability:

- Customers can verify the status of their payments in real-time.

- Businesses can ensure accurate records for audits and dispute resolution.

By removing opacity from the payment process, OxaPay builds confidence in every transaction.

3. Privacy-First Payment Options

Unlike traditional systems that require personal data, crypto payments only need wallet addresses. This protects customers’ identities and financial details, offering:

- Enhanced privacy for security-conscious users.

- Peace of mind for customers wary of sharing sensitive information online.

OxaPay even supports privacy-focused cryptocurrencies like Monero (XMR), catering to customers who value anonymity.

4. Irreversible Transactions to Reduce Chargebacks

Chargebacks are a significant challenge for businesses, often leading to financial losses and strained customer relationships. With crypto payments:

- Transactions are final and irreversible once confirmed on the blockchain.

- Fraudulent chargebacks become a thing of the past, creating a fairer environment for businesses and customers alike.

Building Trust Beyond Customers: Strengthening Business Relationships

Secure payment methods also enhance trust in business-to-business (B2B) relationships. Whether paying suppliers, vendors, or partners, crypto payments through OxaPay ensure:

- Faster settlements with no delays.

- Transparent records to avoid disputes.

- Automation of payouts for streamlined operations.

Trust, built on the foundation of secure payments, strengthens partnerships and drives business growth.

Future-Proofing Your Business with OxaPay’s Secure Payment Solutions

As digital transactions evolve, customer expectations are shifting. Businesses that fail to adopt modern, secure payment methods risk falling behind. OxaPay crypto payment gateway offer a future-ready approach, providing:

- Support for multiple cryptocurrencies to cater to diverse customers.

- User-friendly integration options for seamless adoption.

- Tools like real-time tracking to enhance transparency and trust.

By embracing OxaPay’s secure payment systems, businesses can stay ahead of the curve, ensuring they meet the growing demand for safety, privacy, and transparency in payments.

Conclusion

The importance of secure payment methods cannot be overstated in the digital era. They are the cornerstone of customer trust and business success. By adopting crypto payments through OxaPay crypto gateway, businesses gain access to secure, transparent, and privacy-focused payment solutions that build lasting customer loyalty.

Secure payment systems are no longer optional, they are essential for building trust and ensuring a sustainable future for your business.