Have you ever wondered why some businesses grow fast with crypto payments while others struggle to make it work? Is it the coins they accept, the fees they pay, or the technology running in the background? Choosing the best crypto payment gateway isn’t about hype, it’s about solving these exact questions.

In this article, we break down the strengths and weaknesses of leading providers, showing how they differ in real-world use. By the end, you’ll know which gateway matches your business goals and which ones may slow you down.

1. OxaPay: Infrastructure-First, Business-Focused

Overview:

OxaPay is a next-generation crypto payment gateway designed for businesses that need a fast, global, and flexible way to accept cryptocurrency payments. With support for more than 20 coins across major networks, it helps merchants streamline payments without lengthy onboarding or complex compliance.

🔧 Core Technical & Advanced Features

OxaPay runs on a microservice-based architecture that ensures high uptime and scalability. It offers developer-first tools including a full API suite, sandbox environment, and webhook integrations. Advanced features such as static wallets, scheduled withdrawals, mixed and underpaid payment handling, and built-in swap functionality give merchants control and automation over their payment flows.

📊 Basic Comparison Highlights

- Supported Assets & Networks: 20+ assets, multi-network (ERC20, TRC20, Polygon, TON, BEP20).

- KYC/KYB Requirements: No KYC required for crypto usage.

- Fee Structure: From 0.4%, with volume-based discounts.

- Settlement & Custody Model: Hosted balance, crypto withdrawals only (instant/scheduled).

- Automation Features: Auto-withdrawal, mixed/underpaid handling, crypto swaps.

- Integration & Developer Tools: WooCommerce, WHMCS, Blesta, API + sandbox.

- Payment services Variety: Invoices, Payment Links, POS system, Donations, White-label, Static Address.

- Security & Access Control: 2FA, IP allowlisting, webhook signing, project roles.

- Scalability & Performance: Microservice architecture, modular scaling, high uptime.

- White-Label & Branding Options: Full customization supported.

✅ Pros

- Onboarding is quick and frictionless since no KYC is needed for crypto-only usage.

- Automation tools (auto-withdrawals, swaps, mixed/underpaid handling) reduce manual work.

- Static wallets and real-time settlements support recurring and subscription-based payments.

- Full white-label customization gives resellers and platforms complete brand control.

- Developer-friendly with APIs, sandbox, and webhook tools.

❌ Cons

- No fiat withdrawals available.

- ERP integration limited to CSV/JSON exports.

- Lesser-known brand compared to long-standing players like BitPay.

✅ Why It Matters:

For a growing online store or global platform, the ability to start accepting crypto payments without waiting weeks for approvals can be decisive. OxaPay reduces entry barriers while offering advanced automation, giving businesses more control over cash flow and user experience.

2. BitPay: Enterprise Reputation, Rigid Limitations

Overview:

BitPay is one of the longest-standing crypto payment gateway providers, trusted by large enterprises for its brand reputation and fiat payout options. Its strength lies in compliance and stability, though this comes at the cost of flexibility for smaller or fast-moving businesses.

🔧 Core Technical & Advanced Features

BitPay operates on a centralized infrastructure geared toward enterprise clients. It supports fiat and crypto settlements, scheduled withdrawals, and integrations with accounting platforms like QuickBooks. Security tools include IP filtering, webhook encryption, and multi-user account controls. However, merchants cannot use static wallets or accept mixed/partial payments, and KYC is mandatory even for testing.

📊 Basic Comparison Highlights

- Supported Assets & Networks: ~13 coins (BTC, ETH, USDC, DOGE, etc.).

- KYC/KYB Requirements: Full KYC required for all usage.

- Fee Structure: 1% per transaction, with possible surcharges.

- Settlement & Custody Model: Hosted balance, payouts in fiat or crypto.

- Automation Features: Scheduled withdrawals and auto-convert to fiat.

- Integration & Developer Tools: WooCommerce plugin, QuickBooks integration, API support.

- Payment Tools Variety: POS, invoices, QR code payments.

- Security & Access Control: IP filtering, webhook encryption, team permissions.

- Scalability & Performance: Stable enterprise-grade infrastructure.

- White-Label & Branding Options: Limited customization only.

✅ Pros

- Established brand with proven stability and institutional reputation.

- Fiat payout options make it suitable for enterprises tied to traditional banking.

- Provides scheduled withdrawals and auto-convert features.

- Integrates with popular business tools like WooCommerce and QuickBooks.

❌ Cons

- Full KYC required, even for initial testing.

- Limited coin and network variety compared to newer gateways.

- No support for static wallets or mixed payments.

- White-label customization options are minimal.

✅ Why It Matters:

A startup or global team that needs quick onboarding and diverse network coverage may find BitPay’s compliance-heavy structure restrictive. OxaPay offers a more agile path for businesses that want to scale crypto payments without waiting through long approval processes.

3. CoinPayments: Broad Support, Custodial Friction

Overview:

CoinPayments is a widely used crypto payment gateway recognized for supporting a large number of cryptocurrencies, making it appealing to merchants who want to accept not just popular coins but also niche assets. However, its custodial model and additional wallet fees can create limitations for businesses that prioritize control and automation.

🔧 Core Technical & Advanced Features

CoinPayments supports 2000+ cryptocurrencies with hosted wallets, Auto-Sweep, and Auto-Convert tools. It offers WooCommerce plugins, APIs, and sandbox testing, plus static wallets and white-label options. Security includes 2FA, webhook signing, and fraud detection, though infrastructure fits small to mid-size merchants better than enterprises.

📊 Basic Comparison Highlights

- Supported Assets & Networks: 2000+ cryptocurrencies (BTC, ETH, LTC, XRP, etc.).

- KYC/KYB Requirements: Partial; required for advanced features.

- Fee Structure: 0.5% per transaction, flat rate.

- Settlement & Custody Model: Custodial with hosted balances; withdrawals available in crypto.

- Automation Features: Auto-Sweep, Auto-Convert, scheduled withdrawals.

- Integration & Developer Tools: Plugins for WooCommerce and others, API access, sandbox.

- Payment Tools Variety: Invoices, payment links, plugins, white-label options.

- Security & Access Control: 2FA, webhook signing, fraud protection.

- Scalability & Performance: Centralized infrastructure, moderate performance.

- White-Label & Branding Options: Supported for merchants needing branding control.

✅ Pros

- Wide coin coverage beyond major assets.

- Predictable 0.5% flat fee structure.

- Auto-Sweep and Auto-Convert provide basic automation.

- Plugins available for WooCommerce and multiple platforms.

❌ Cons

- Custodial model means merchants don’t have direct control of funds.

- ERP integration limited to CSV exports.

- Auto-conversion restricted to selected pairs.

- Infrastructure less robust for enterprise-level scaling.

✅ Why It Matters:

For most businesses, accepting dozens of coins is less valuable than having reliable control over cash flow. OxaPay provides real-time access and automation, while CoinPayments may suit merchants focused mainly on niche asset coverage.

4. Coinbase Commerce: Polished but Restrictive

Overview:

Coinbase Commerce is a well-known crypto payment gateway that benefits from the strong reputation of Coinbase and offers a straightforward way for merchants to accept major cryptocurrencies. Its polished dashboard and integrations make it appealing to regulated businesses, but strict KYC requirements and narrow asset support limit its global flexibility.

🔧 Core Technical & Advanced Features

The platform provides hosted balances with options for fiat conversion and scheduled withdrawals. Merchants can create invoices, payment links, and POS requests, but static wallets and mixed payment handling are not supported. Security includes IP filtering, webhook encryption, and fraud detection. Developer APIs and a sandbox are available, though all usage requires full KYC/KYB.

📊 Basic Comparison Highlights

- Supported Assets & Networks: ~10 coins (BTC, ETH, LTC, USDC, DAI, etc.).

- KYC/KYB Requirements: Mandatory for all merchants.

- Fee Structure: 1% per transaction.

- Settlement & Custody Model: Hosted balance, fiat or crypto payouts via Coinbase.

- Automation Features: Auto-convert to fiat, scheduled withdrawals.

- Integration & Developer Tools: WooCommerce plugin, APIs, sandbox.

- Payment Tools Variety: Invoices, payment links, POS.

- Security & Access Control: IP filtering, webhook signing, fraud detection.

- Scalability & Performance: Enterprise-grade but tied to Coinbase ecosystem.

- White-Label & Branding Options: Very limited customization.

✅ Pros

- Strong brand reputation with regulatory compliance.

- Supports fiat settlements and auto-conversion.

- Advanced dashboard and reporting tools.

- Sandbox and API support for developers.

❌ Cons

- Strict KYC required from the start.

- Limited coin and network support.

- No static wallet or mixed payment support.

- White-label options minimal.

✅ Why It Matters:

Merchants outside Coinbase’s core regions or those seeking more flexible branding may find the platform restrictive. OxaPay delivers a wider toolkit with fewer entry barriers, helping businesses expand faster and on their own terms.

5. CoinGate: Mid-Tier Versatility

Overview:

CoinGate is a versatile crypto payment gateway that positions itself as a bridge between crypto and fiat, offering merchants the ability to accept payments in 70+ cryptocurrencies and settle in local currency. It’s flexible for small to medium businesses but lacks the depth and advanced customization larger enterprises may need.

🔧 Core Technical & Advanced Features

CoinGate supports crypto and fiat settlements via hosted balances, with POS apps, invoices, and plugins for major platforms. It allows mixed payments and auto-conversion to fiat or BTC. Security includes 2FA, webhook encryption, and fraud monitoring. ERP integration is CSV-only, but the system remains user-friendly.

📊 Basic Comparison Highlights

- Supported Assets & Networks: 70+ coins across major networks.

- KYC/KYB Requirements: Optional for crypto; required for fiat payouts.

- Fee Structure: 1% flat fee.

- Settlement & Custody Model: Hosted balance, payouts in crypto or fiat.

- Automation Features: Auto-conversion, scheduled withdrawals.

- Integration & Developer Tools: WooCommerce plugin, mobile apps, API.

- Payment Tools Variety: Invoices, POS, mobile checkout.

- Security & Access Control: 2FA, webhook encryption, fraud detection.

- Scalability & Performance: Centralized infrastructure, suitable for SMEs.

- White-Label & Branding Options: Available, but limited compared to advanced providers.

✅ Pros

- Supports both crypto and fiat settlements.

- Broad coin coverage with 70+ assets.

- Mixed payments accepted, flexible for customers.

- Easy integration with WooCommerce and other platforms.

❌ Cons

- ERP integration limited to manual exports.

- White-label branding less advanced.

- Static wallets not supported.

- No volume-based discount structure disclosed.

✅ Why It Matters:

Small merchants may find CoinGate a practical entry point into crypto payments. However, businesses planning for automation, scalability, or brand control will likely outgrow it, areas where OxaPay provides more comprehensive solutions.

6. NOWPayments: Feature-Rich, But Custodial

Overview:

NOWPayments is a feature-rich crypto payment gateway that attracts merchants with its wide asset coverage and ease of integration. Supporting hundreds of coins and offering multiple plugins, it’s designed for accessibility. However, its centralized model and limits in white-label depth or automation make it less suitable for enterprises with complex demands.

🔧 Core Technical & Advanced Features

The platform provides hosted balances with configurable auto-withdrawals and crypto-to-crypto conversions. Merchants can access invoices, payment links, widgets, and plugins for WooCommerce and other platforms. Static wallets and mixed payments are supported, and developer tools include APIs and sandbox testing. ERP integration is limited to CSV exports, and scalability is more constrained than microservice-based providers.

📊 Basic Comparison Highlights

- Supported Assets & Networks: 300+ coins with multi-network support.

- KYC/KYB Requirements: No KYC for crypto-only merchants; required for fiat payouts.

- Fee Structure: 0.5–1%, with possible volume discounts.

- Settlement & Custody Model: Hosted balance, crypto withdrawals, auto-convert supported.

- Automation Features: Auto-withdrawals, mixed payments, crypto swaps.

- Integration & Developer Tools: Plugins (WooCommerce, etc.), APIs, sandbox.

- Payment Tools Variety: Invoices, links, widgets, plugins.

- Security & Access Control: 2FA, webhook signing.

- Scalability & Performance: Centralized architecture, less robust than microservices.

- White-Label & Branding Options: Basic white-label supported.

✅ Pros

- Supports more than 300 coins, including major networks.

- Static wallets and mixed payments available.

- Plugins for popular platforms simplify onboarding.

- Sandbox and documentation make integration developer-friendly.

❌ Cons

- ERP integrations limited to exports.

- Not microservice-based, so scaling may be constrained.

- Fiat withdrawals require KYC.

- White-label options less advanced than some competitors.

✅ Why It Matters:

Coin variety alone doesn’t guarantee better operations. Businesses need payment systems that automate processes and scale with demand, areas where OxaPay provides a stronger foundation.

7. ALFAcoins: Basic and Outdated

Overview:

ALFAcoins is a straightforward crypto payment gateway designed for small to mid-size businesses that want a simple setup. While it covers the basics of accepting and settling crypto, it lacks the advanced automation, developer tools, and branding flexibility that modern businesses often require.

🔧 Core Technical & Advanced Features

The platform provides hosted balances with real-time settlement in either crypto or fiat. Merchants can generate payment links, invoices, and basic checkout options. Auto-withdrawals are supported, and static wallets are available, but integration depth is limited. Security includes 2FA and simple fraud protection, with no advanced ERP or API ecosystem.

📊 Basic Comparison Highlights

- Supported Assets & Networks: ~6–10 major coins (BTC, ETH, LTC, XRP, etc.).

- KYC/KYB Requirements: No KYC for crypto; required for fiat payouts.

- Fee Structure: 0.99% flat per transaction.

- Settlement & Custody Model: Hosted balance, crypto or fiat payouts.

- Automation Features: Auto-withdrawal supported.

- Integration & Developer Tools: Limited plugins, basic API.

- Payment Tools Variety: Invoices, payment links, simple checkout.

- Security & Access Control: 2FA, basic fraud prevention.

- Scalability & Performance: Centralized model, suitable only for low-volume use.

- White-Label & Branding Options: Very limited customization.

✅ Pros

- Simple setup makes onboarding easy for smaller merchants.

- No KYC required for crypto-only transactions.

- Auto-withdrawals supported with no extra fees.

- Transparent pricing with a flat 0.99% fee.

❌ Cons

- Very limited coin support compared to other gateways.

- No advanced developer or ERP integrations.

- Branding and customization minimal.

- Infrastructure less suited for scaling businesses.

✅ Why It Matters:

For occasional or low-volume crypto acceptance, ALFAcoins may suffice. But businesses aiming for growth, automation, and international reach will quickly outgrow its limited features, making OxaPay a more sustainable choice.

8. GoURL: Legacy but Developer-Oriented

Overview:

GoURL is an open-source, self-hosted crypto payment gateway that appeals mainly to developers who want full control over their payment infrastructure. It’s privacy-friendly and requires no KYC, but its limited features and manual setup make it less practical for mainstream businesses.

🔧 Core Technical & Advanced Features

GoURL runs on a non-custodial model, sending payments directly to merchants’ wallets without holding balances. It offers WordPress and WooCommerce plugins for integration but lacks automation, auto-conversion, or advanced ERP tools. Security and usability are highly dependent on the merchant’s technical expertise, as hosting and maintenance are manual.

📊 Basic Comparison Highlights

- Supported Assets & Networks: ~10 coins (BTC, Speedcoin, etc.), limited network variety.

- KYC/KYB Requirements: None; privacy-focused.

- Fee Structure: 1.5–3.5%, higher than modern gateways.

- Settlement & Custody Model: Non-custodial, direct wallet settlement.

- Automation Features: Minimal; no auto-convert or advanced automation.

- Integration & Developer Tools: WordPress/WooCommerce plugins, open-source code.

- Payment Tools Variety: Basic checkout plugins only.

- Security & Access Control: Dependent on merchant’s hosting setup.

- Scalability & Performance: Limited; requires manual server management.

- White-Label & Branding Options: Customizable via open-source code.

✅ Pros

- Fully KYC-free, privacy-focused solution.

- Open-source and customizable for developers.

- Direct, non-custodial settlements to merchant wallets.

- Works well with WordPress-based sites.

❌ Cons

- Very limited coin support.

- Higher fees compared to modern gateways.

- No automation tools like auto-withdrawals or swaps.

- Scalability limited due to self-hosted requirements.

✅ Why It Matters:

Self-hosted systems may suit developers with time and technical resources, but for most merchants, they create friction and limit scalability. A managed gateway like OxaPay allows businesses to focus on growth instead of infrastructure management.

9. Crypto.com Pay: App-Centric Convenience

Overview:

Crypto.com Pay is tightly integrated with the broader Crypto.com ecosystem, making it convenient for merchants already using the app and wallet. It offers competitive fees and fiat conversion, but mandatory KYC and reliance on the ecosystem limit independence for businesses seeking flexibility.

🔧 Core Technical & Advanced Features

Crypto.com Pay offers hosted balances with real-time settlement, auto-withdrawals, and crypto-to-fiat conversion. Merchants can create invoices, payment links, or use POS tools, with fiat payouts on a T+1 basis. It supports WooCommerce and APIs, but static wallets depend on the app and branding options are minimal.

📊 Basic Comparison Highlights

- Supported Assets & Networks: ~20 coins (BTC, ETH, CRO, USDT, etc.).

- KYC/KYB Requirements: Mandatory for all merchants.

- Fee Structure: 0% transaction fee + 0.5% settlement fee.

- Settlement & Custody Model: Hosted balance, crypto or fiat payouts (fiat typically T+1).

- Automation Features: Auto-withdrawals, auto-convert to fiat.

- Integration & Developer Tools: WooCommerce plugin, APIs, app-based integration.

- Payment Tools Variety: POS, invoices, payment links.

- Security & Access Control: Webhook signing, fraud prevention.

- Scalability & Performance: Stable infrastructure but tied to Crypto.com ecosystem.

- White-Label & Branding Options: Very limited customization.

✅ Pros

- Competitive fees with fiat conversion and T+1 payouts.

- Auto-withdrawal and auto-conversion features built-in.

- Easy integration with WooCommerce and Crypto.com wallet ecosystem.

- Provides POS and invoice tools for merchants.

❌ Cons

- Full KYC required for all merchants.

- Strong reliance on the Crypto.com ecosystem reduces flexibility.

- Static wallets tied to the app, limiting independence.

- Minimal branding and white-label options.

✅ Why It Matters:

Relying too heavily on a single ecosystem like Crypto.com can limit flexibility and long-term brand control. For merchants comparing the best crypto payment gateway, OxaPay delivers a more modular and independent infrastructure, allowing businesses to expand globally without being locked into one platform.

10. CoinsPaid: Enterprise Focus, High Commitment

Overview:

CoinsPaid uses a microservice architecture, enabling real-time settlements, auto-withdrawals, and fiat payouts. It supports mixed payments, invoicing, and POS tools, with security features like IP allowlisting, webhook encryption, and role-based access. ERP integration is via APIs/CSV, though native plug-ins aren’t confirmed, and onboarding is complex

🔧 Core Technical & Advanced Features

CoinsPaid uses a microservice architecture, enabling real-time settlements, auto-withdrawals, and fiat payouts. It supports mixed payments, invoicing, and POS tools, with security features like IP allowlisting, webhook encryption, and role-based access. ERP integration is via APIs/CSV, though native plug-ins aren’t confirmed, and onboarding is complex.

📊 Basic Comparison Highlights

- Supported Assets & Networks: 30+ major coins (BTC, ETH, USDT, etc.).

- KYC/KYB Requirements: Mandatory for all merchants.

- Fee Structure: Custom fees (disclosed during onboarding), volume-based discounts available.

- Settlement & Custody Model: Hosted balances, payouts in crypto and fiat.

- Automation Features: Auto-withdrawals, mixed payments, scheduled settlements.

- Integration & Developer Tools: WooCommerce plugin, APIs, CSV/JSON exports.

- Payment Tools Variety: POS, invoices, checkout, white-label.

- Security & Access Control: IP allowlisting, webhook signing, role-based permissions.

- Scalability & Performance: Microservice design, enterprise-grade throughput.

- White-Label & Branding Options: Full white-label customization available.

✅ Pros

- Scalable microservice architecture built for high volumes.

- Supports crypto and fiat settlements with automation.

- Advanced features like mixed payments and team-based account management.

- Strong security standards and enterprise-grade reliability.

❌ Cons

- Full KYC/KYB required from the start.

- Pricing not transparent (custom quotes only).

- ERP integrations limited to API/CSV, not native plug-ins.

- Onboarding process is heavier than lightweight gateways.

✅ Why It Matters:

CoinsPaid works well for enterprises that need scale and advanced security, but strict onboarding and unclear pricing can slow down smaller or fast-moving businesses. For many companies evaluating the best crypto payment gateway, OxaPay provides a lighter, more flexible alternative with enterprise-level features and faster accessibility.

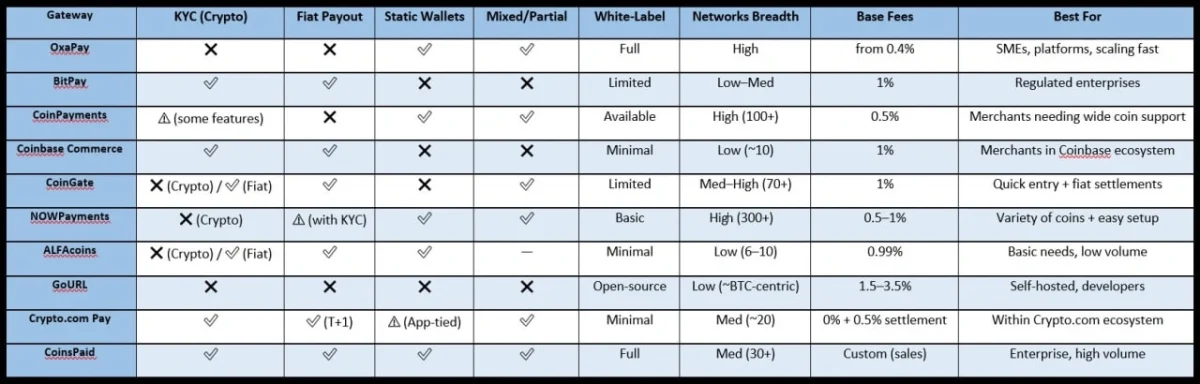

Quick Comparison: Which Is the Best Crypto Payment Gateway for Your Business?

The table below provides a side-by-side comparison of all gateways reviewed, highlighting only the most decisive factors for businesses.

Final Thoughts: Look Beyond the Coin Count

The best crypto payment gateway is the one that matches your business needs, not just on paper, but in real operations. If your priority is compliance and fiat payouts, legacy players may fit. If speed, automation, and flexibility matter more, modern gateways like OxaPay deliver stronger value. What began as questions about fees, settlement speed, and integrations now has clearer answers: choose the gateway that removes friction, supports growth, and gives you control over your payment flow. That is what makes a gateway truly “best” for your business.

Explore OxaPay today and discover the infrastructure that grows with your business.