Integrating cryptocurrency payments for an online store can diversify your payment options, attract a tech-savvy customer base, and potentially reduce transaction fees. If you’re considering crypto payment integration in your online store, here are some key guidelines to help you navigate this transition smoothly:

10 Tips to Successful Crypto Payment Integration in Your Online Store

1. Understand the Basics of Cryptocurrency

Before integrating crypto payments, it’s crucial to have a solid understanding of how cryptocurrencies work. This includes knowing about different cryptocurrencies like Bitcoin, Ethereum, and others, blockchain technology, and the security aspects involved.

2. Choose the Right Cryptocurrencies for Your Online Store

Decide which cryptocurrencies you want to accept for crypto integration in your online store. Popular options like Bitcoin and Ethereum are almost universally recognized, which could make them a safer bet for wider acceptance.

3. Select a Reliable Crypto Payment Gateway for Online Store

Choose a crypto payment processor that integrates seamlessly with your current e-commerce platform. Providers like OxaPay offer features that are essential for crypto integration in online stores, including instant conversion of cryptocurrencies into stable currency to mitigate volatility risks.

4. Understand Legal and Tax Implications of Crypto Integration

Crypto integration in online stores comes with its own set of regulations. Consult with a financial advisor or legal expert to understand your obligations and ensure compliance with your local laws regarding cryptocurrency transactions.

5. Enhance Your Store’s Security for Crypto Payments

Crypto transactions are secure, but it’s crucial to enhance your site’s security to prevent any potential vulnerabilities. Implement strong cybersecurity measures, including SSL certificates, robust encryption methods, and secure wallet storage practices.

6. Educate Your Customers on Crypto Payments

Since crypto is still a new concept for many, providing educational resources about how to make payments with cryptocurrency can be very beneficial. Include FAQs or tutorials on your website to guide your customers through the process.

7. Monitor Volatility and Manage Risks in Crypto Transactions

Using payment gateways that convert cryptocurrencies to stable currency instantly can help protect your revenues from market fluctuations, a critical aspect of crypto integration in online stores.

8. Marketing and Customer Outreach for Crypto Payments

Inform your customers about the new payment option through marketing campaigns. Highlight the benefits of crypto integration in your online store, such as enhanced security and lower transaction fees.

9. Provide Customer Support for Crypto Transactions

Ensure that your customer service team is trained and ready to handle queries about crypto payments in your online store. Quick and effective support can help build trust and encourage more customers to try out this new payment method.

10. Evaluate and Adapt Crypto Payment Processes

After implementing cryptocurrency payments, continuously evaluate their performance and impact on your business. Gather customer feedback and make necessary adjustments to improve the experience.

Integrating crypto payments can set your online store apart and open up new avenues for growth. However, it’s important to proceed with caution, keep abreast of regulatory changes, and always prioritize security and customer satisfaction.

Technical Checklist for Integrating Crypto Payments in Your Online Store

Switching to cryptocurrency payments involves several technical considerations to ensure a smooth and secure integration into your online store. Here is a detailed checklist to guide you through the process:

1. Evaluate E-commerce Platform Compatibility for Crypto Payments:

- Check if your platform supports cryptocurrency integrations directly or through plugins and APIs, which are crucial for seamless crypto payment integration in online stores.

- Identify available plugins or extensions and APIs that facilitate crypto payments. For platforms like Shopify, WooCommerce, or Magento, look for dedicated plugins and crypto payment API integrations that enhance functionality and streamline payment processes.

2. Choose a Crypto Payment Gateway:

- Research and select a payment gateway that supports the cryptocurrencies you want to accept.

- Consider gateways that offer features like instant conversion to stable currencies, wallet management, and direct blockchain integrations.

3. Set Up a Merchant Crypto Wallet:

- Set up a secure wallet to receive cryptocurrency payments, a fundamental component of crypto integration.

- Ensure the wallet is compatible with the payment gateway and the cryptocurrencies you plan to accept.

4. Integrate Payment Gateway with Your Store:

- Follow the specific integration steps provided by the payment gateway. This usually involves installing a plugin or adding a few lines of code to your website.

- Configure the gateway settings in your store’s backend, set up which cryptocurrencies to accept, decide on conversion settings, and define transaction fee preferences.

5. Test the Payment System:

- Conduct thorough testing to ensure the payment gateway works correctly within your store environment. Test with small transactions using various cryptocurrencies.

- Check the transaction flow from checkout to your crypto wallet, and verify that conversions (if applicable) are functioning as expected.

6. Implement Security Measures for Crypto payment Integration:

- Enable HTTPS and consider additional security layers like two-factor authentication for your crypto integration in online stores.

- Regularly update and patch any software related to your e-commerce and payment systems to protect against vulnerabilities.

7. Prepare Backup and Recovery Procedures:

- Establish procedures for backing up your wallet keys and other critical data.

- Create a disaster recovery plan in case of data loss or a security breach involving your crypto transactions.

8. Monitor and Optimize the Integration:

- Once live, continuously monitor transactions for any unusual activity or technical issues.

- Gather feedback from customers regarding their payment experience to identify areas for improvement.

9. Stay Updated on Compliance and Regulations:

- Regularly review updates in cryptocurrency regulations that might affect your payment processing.

- Ensure ongoing compliance with both local and international laws concerning cryptocurrency transactions.

10. Train Your Staff:

- Train your team on how to manage the new payment system, focusing on troubleshooting common issues and enhancing customer support for crypto payments.

By following this checklist, you can effectively manage the technical aspects of integrating cryptocurrency payments into your online store, ensuring a secure and efficient setup that enhances your business operations and customer experience.

Positive Changes from Integrating Crypto Payments in Your Business

Expanded Global Reach

Cryptocurrencies eliminate exchange rates and bank fees, making your store more accessible internationally and potentially boosting sales.

Increased Privacy for Customers

Cryptocurrencies require less personal information, appealing to privacy-conscious shoppers.

Reduced Transaction Costs

Crypto transactions avoid traditional banking and credit card fees, often lowering costs for you and your customers, which can lead to happier customers and more sales.

Quicker Payment Processing

Cryptocurrency transactions are typically faster than bank transfers, improving cash flow and order fulfillment speed.

Market Differentiation

Accepting crypto payments helps your business stand out, attracting tech-savvy buyers and those preferring cryptocurrencies, giving you an edge in the market.

Enhanced Security Features

Blockchain technology reduces fraud and chargeback risks, increasing your store’s trustworthiness and encouraging more transactions.

New Marketing Opportunities

Crypto payments position your brand as modern and innovative, attracting more customers and possibly gaining media attention.

Streamlined Financial Operations

Cryptocurrencies simplify financial management due to their transparency and efficient transaction recording.

Guide to Choosing OxaPay for Crypto Payments

If you’re ready to integrate crypto payments into your online store, OxaPay is a strong option worth exploring. As you look to enhance your e-commerce operations by accepting cryptocurrencies, choosing the right payment gateway becomes crucial. OxaPay provides a comprehensive solution tailored to the needs of online retailers who want to embrace the burgeoning world of cryptocurrencies.

Why Choose OxaPay?

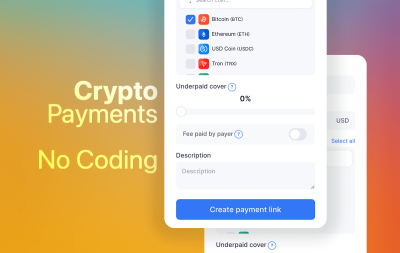

OxaPay streamlines the process of accepting cryptocurrency payments with key features that are advantageous for e-commerce settings:

- Instant Conversion: OxaPay offers instant conversion of cryptocurrencies to stablecoin , safeguarding your revenue against market volatility.

- Wide Cryptocurrency Support: With support for major cryptocurrencies like Bitcoin and Ethereum, OxaPay caters to a diverse customer base.

- Security and Compliance: OxaPay ensures secure transactions and adheres to current regulations, minimizing your business risks.

- Easy Integration: OxaPay’s integration is streamlined for ease, utilizing APIs for seamless incorporation into your e-commerce infrastructure. For standard platform setups, simple plugins are also available, facilitating quick and straightforward integration.

Setting Up OxaPay

To get started with OxaPay, follow these straightforward steps:

- Sign Up: Visit the OxaPay website and register for a merchant account, providing necessary business details and documentation for verification.

- Integration: Choose API integration for a customized setup that fits your unique platform requirements, ensuring a seamless connection with OxaPay’s payment gateway.

- Configuration: In your platform’s settings, select the cryptocurrencies you want to accept and configure conversion settings to manage price volatility.

- Testing: Perform test transactions to ensure the system functions as intended, identifying and rectifying any issues.

- Go Live: With testing complete and the system verified, activate OxaPay to start accepting crypto payments.

Choosing OxaPay enhances your store’s appeal by tapping into the cryptocurrency market, potentially broadening your customer base and reinforcing your market position with advanced payment options.

conclusion

Adding crypto payment integration to your online store is a great way to attract new tech-savvy customers, potentially boost sales, and give your business a modern edge. By following this guide, you can easily set up crypto payments and start reaping the benefits!