Over the past decade, debates on crypto payments have swung between hype and doubt, often centering on fees, UX, or volatility. Yet for those shaping global payment infrastructure, the deeper issue lies in the architecture. The real question is whether blockchain-based systems can deliver what legacy cards structurally cannot. This article examines the core infrastructure differences in crypto payments vs credit cards, focusing on settlement, risk, cost, and programmability, and how these factors influence real-world payment design.

Legacy Card Systems: Strong but Rigid

Credit card networks like Visa and Mastercard have evolved into globally resilient, high-throughput systems. Their architecture rests on three foundational pillars:

- Three- and four-party models: separating issuer and acquirer functions, with clearing and settlement typically routed through centralized schemes and settlement banks.

- Batch-based, deferred settlement: where transaction authorization is real-time, but fund finality typically takes 1–3 business days.

- Centralized trust architecture: network operators administer dispute resolution, manage fraud detection, and oversee governance mechanisms.

Together, these pillars define a payment model optimized for centralized scale: issuers absorb user risk, acquirers manage merchant exposure, and card schemes orchestrate message routing, clearing, and dispute handling through globally standardized protocols.

The system intentionally decouples settlement from transaction flow, enabling reliability and volume but also embedding latency and multi-party reliance as structural trade-offs.

These attributes enable credit cards to scale across billions of transactions annually while maintaining consumer protection and merchant reliability.

Limits of Legacy Design

However, they also introduce architectural limitations:

- High cost-to-settle ratios, especially for cross-border flows, due to currency conversion, multi-party routing, and scheme fees(Source: airwallex).

- Operational dependencies on regional processors, settlement banks, and legal jurisdictions(Source: bis).

- Limited flexibility: card rails are not natively programmable, context-aware, or composable across services(Source: Stripe).

In essence, designers built the card stack for a world of trusted institutional intermediaries, not for programmable value transfer.

Why Legacy Systems Can’t Evolve Easily

And this is where its strength becomes its weakness.

While the system optimizes for control, risk allocation, and standardization, it lacks the architectural fluidity to support models where value moves autonomously, instantly, and by logic, not trust.

Innovations such as programmable settlement, multi-asset routing, or peer-defined conditions remain structurally outside the card paradigm, not because designers consider them undesirable, but because they never built the network to support them.

This gap sets the stage for understanding how blockchain-based payment systems approach settlement differently, a central theme in exploring crypto payments vs credit cards.

Blockchain Payments: A New Settlement Model

Crypto payments are often misunderstood as just another method of transferring value. But in architectural terms, they represent a completely different settlement model, one that departs from institutional delegation and builds trust into the protocol layer itself.

Blockchain-based payment systems introduce three foundational shifts:

- Push-based authorization: Users initiate and sign transactions directly, removing the need for merchant-side pull requests or third-party verification(Source: CoinDesk).

- Protocol-level settlement finality: Once confirmed, transactions are immutable and final, removing counterparty risk associated with deferred settlement cycles(Source: bankofcanada).

- Programmability and composability: Smart contracts enable dynamic, context-aware logic, ranging from escrow and time-locks to conditional disbursement and automated refund logic(Source: Ethereum.org).

These elements don’t merely improve transaction flow; they actively redefine how developers and protocols construct settlement itself.

Shifting from Routing to Logic

In a blockchain-native model, there are no central clearinghouses, no reliance on netting cycles, and no need to reconcile across institutional boundaries. Funds move atomically, with transparency and determinism built into the process. The system doesn’t manage risk through layered control, it minimizes it through structural design. The system assumes that trust is unavailable, and replaces it with code.

This changes the role of the payment processor entirely: from a router of messages to a designer of logic. Developers can re-architect acceptance, settlement, and dispute resolution on programmable rails, modular, portable, and global by default.

Where legacy systems build trust through layers, blockchain collapses those layers into protocols that settle by definition, not negotiation.

Key Infrastructure Comparison

The table below compares crypto payments vs credit cards across critical dimensions, settlement model, latency, cost, and programmability, so readers can see, at a glance, how each rail behaves under real constraints.

| Dimension | Credit Card Networks | Blockchain Payment Systems |

| Settlement Model | Deferred and netted; fund finality in 1–3 business days | On-chain finality; settlement occurs at protocol level per transaction |

| Settlement Finality | Reversible; subject to disputes and chargebacks | Irreversible after confirmation; deterministic based on protocol rules |

| Latency | Authorization is real-time; settlement is delayed | Varies by network; generally seconds to minutes for confirmation |

| Counterparty Risk | Distributed across issuers, acquirers, and schemes | Minimized; trust is replaced by cryptographic finality |

| Risk Allocation Model | Structured across institutions; issuers absorb fraud, acquirers manage onboarding | Flat; users or smart contracts own risk without intermediated guarantees |

| Dispute Resolution | Centralized chargebacks and arbitration | No native reversibility; off-chain or contract-based arbitration mechanisms |

| Interoperability | Network-bound; closed schemes (e.g., Visa, Mastercard) | Cross-chain capable; bridges, swaps, and multi-asset gateways |

| Cost Model | Merchant fees (1.5%–3.5%); layered with issuer/acquirer/scheme margins | Network-based fees (<1% typical); minimal overhead via direct routing |

| Scalability | Scales via centralized processors and bank networks | Modular; scales horizontally via L2s, sharding, and protocol abstraction |

| Programmability | Not programmable; fixed flows and closed logic | Fully programmable via smart contracts; context-aware and composable |

| Data Governance | Closed and opaque; network-owned transaction records | Transparent and user-centric; public ledgers and verifiable logic |

Professionals familiar with real-time payment (RTP) systems will recognize similarities, yet blockchain adds programmability and self-custody, which RTP does not inherently provide.

What Crypto Can Do That Cards Can’t

While credit cards optimize trust within institutions, crypto optimizes away from institutions. This shift unlocks capabilities difficult to retrofit into card networks:

- Smart contracts allow payments tied to external events (oracles), time-based vesting, and conditional fulfillment.

- Merchants aren’t tied to a specific acquiring bank, processor, or region. Payment acceptance becomes permissionless.

- With crypto, value moves without clearinghouses or FX intermediaries.

- Every component of cost is visible, traceable, and auditable, unlike opaque interchange models.

- Developers can compose payment logic across services and layers, such as swaps, rewards, or access control, without needing central approval or facing integration bottlenecks.

- The protocol can dynamically route, split, or transform settlement based on transaction metadata, rules, or network state, executing these actions directly at the protocol level.

For global merchants operating in complex regulatory or cross-border contexts, this transparency and flexibility is not theoretical, it’s operationally transformative.

why cross-border payments are easier with crypto payment gateways?

Limitations or Signs of Change?

Crypto payments have long faced fundamental criticisms, many of them valid. But in the details of each concern, a shift is taking place.

Volatility: Still a Risk for Merchants?

It’s difficult to justify accepting a payment method that may drop 5% in value overnight. For merchants, this isn’t theoretical, it’s existential.

But the reality is changing. Today, the majority of crypto payments are processed via stablecoins like USDT and USDC. Gateways such as OxaPay offer auto-conversion and instant swaps, removing exposure before it begins. The volatility remains, but merchants no longer have to touch it.

No Chargebacks: Trust Gap or Opportunity?

Without reversibility, how can crypto handle disputes, fraud, or consumer protection?

That’s a critical concern, but the ecosystem is responding. Escrow contracts, custodial arbitration, and platform-level refund APIs offer alternative models of resolution, ones that aren’t based on reversals, but on programmable consensus.

Is Crypto Still Too Technical?

Wallets, keys, gas fees, barriers remain. But they’re being abstracted. Modern interfaces now enable network detection, QR checkout, and guided flows indistinguishable from traditional checkouts. Complexity hasn’t disappeared, but it’s been redesigned for the edge of the screen, not the backend.

Crypto’s early flaws aren’t vanishing. They’re being engineered into flexibility, quietly, structurally, and at scale.

The Modular Future of Payments

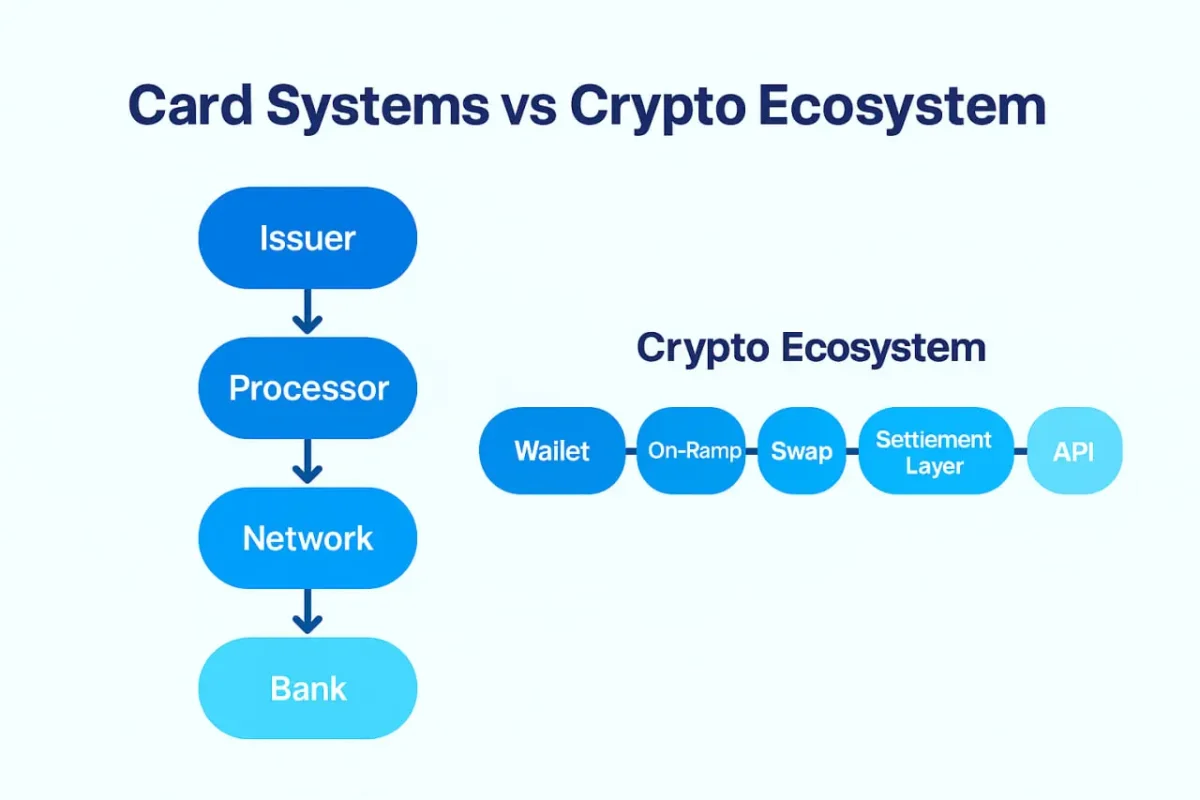

Perhaps the most underappreciated difference is architectural. Card systems are vertically integrated, issuer, processor, network, bank. Crypto is horizontally modular, wallets, on-ramps, swaps, settlement layers, and APIs all decoupled.

For payment professionals building new services, this modularity means:

- Composable design: build your own logic into the flow.

- Minimal vendor lock-in: replace layers without re-architecting everything.

- Multi-channel readiness: accept payments across websites, wallets, web3 platforms, and even Telegram bots, without separate merchant contracts.

This shift is not just technical, it’s strategic. Payments are evolving from “pipes” to “protocols.”

Modularity in Action

What this really means in practice is freedom: teams no longer have to build their payment flow around a rigid network’s rules. They can swap one provider for another without disrupting the whole system. They can build for multiple user channels without duplicating onboarding logic. And they can embed logic directly in the transaction path, rather than relying on post-processing or middleware. In traditional payment infrastructure, this level of flexibility would require multiple vendors, custom contracts, and complex reconciliation workflows. In crypto, it’s available out of the box, by design.

Conclusion

The idea of one payment system replacing another is outdated. While credit cards remain firmly anchored in institutional control, the shift from network-based infrastructure to protocol-driven systems challenges many of their long-held assumptions. In crypto payments vs credit cards, crypto doesn’t attempt to replicate card rails, it delivers capabilities they fundamentally cannot: global fluidity, embedded logic, and programmable settlement.

For those designing tomorrow’s infrastructure, the question isn’t whether crypto will replace cards, it’s which legacy constraints you’re still designing around that no longer need to exist.

Ready to explore this modular future in practice?

OxaPay offers crypto-native infrastructure built for developers, platforms, and merchants looking to extend beyond the constraints of legacy systems. From flexible payment routing to low-latency crypto settlement, you can start integrating the future, without disrupting the present.