Why do customers abandon purchases at the final step, even when they are ready to buy? Why does choosing the right Crypto Invoice Service matter so much for online sales today?

For many online businesses, the problem is not the product or the price. It is the payment experience itself. Failed transactions, limited payment methods, high fees, and cross-border friction remain some of the biggest barriers to completed sales.

This is where a Crypto Invoice Service comes into focus. By combining blockchain-based payments with structured invoicing logic, crypto invoice services give businesses a more reliable way to request and receive payments online. They replace open-ended crypto transfers with clear payment terms, predictable checkout flows, and real-time payment visibility.

This article explains what a crypto invoice service is, how it works in online sales environments, and why it is becoming an important part of modern e-commerce payment strategies.

E-Commerce and the Evolution of Payment Methods

E-commerce thrives on speed, convenience, and global reach. As online stores expand beyond local markets, traditional payment systems increasingly show their limitations. Banking delays, cross-border fees, currency conversions, and chargeback risks create friction for both merchants and customers.

Cryptocurrency payments address many of these structural issues. Built on decentralized networks, they allow value to move directly between payer and merchant without relying on intermediaries. Crypto invoices bring structure to this process, transforming raw blockchain transfers into organized, trackable payment flows suitable for online commerce.

Limitations of Traditional Online Payments

Conventional payment methods are tightly coupled with banking infrastructure. While familiar, they introduce several recurring challenges for online businesses:

- High transaction and processing fees, especially for international payments

- Settlement delays that affect cash flow

- Exposure to chargebacks and payment disputes

- Limited availability in certain regions or markets

These issues do not just impact operations; they directly influence conversion rates and customer trust during checkout. For example, delays in transaction processing can lead to abandoned carts as customers grow impatient, and high fees reduce the profitability of each sale, making it harder for businesses to scale efficiently. As a result, businesses are often forced to choose between customer satisfaction and operational costs.

Why Crypto Invoices Are Different

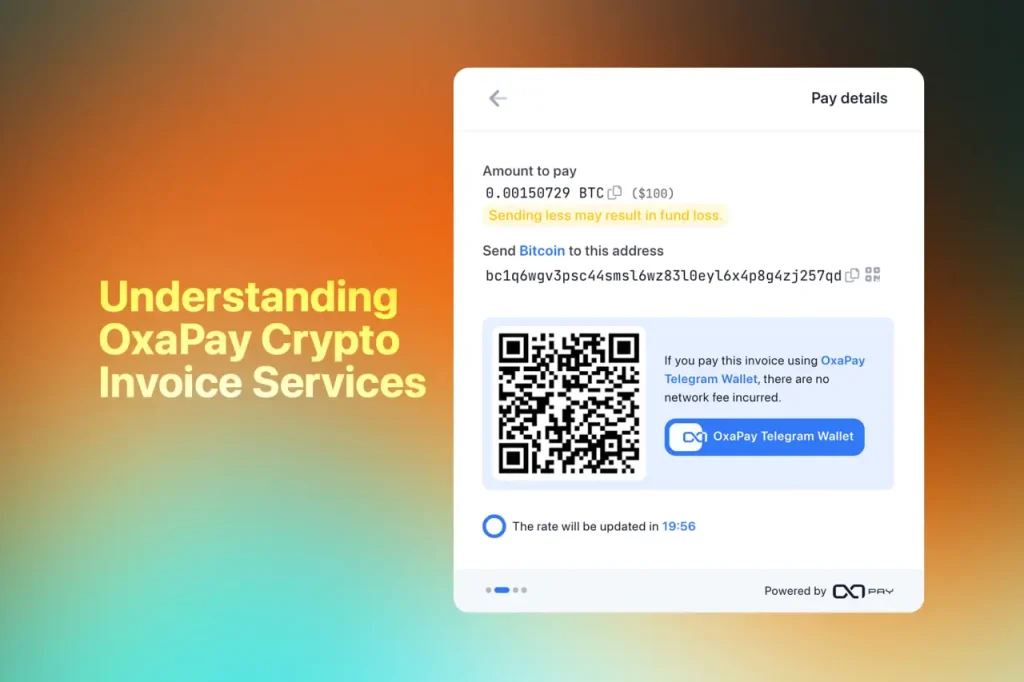

The key difference between crypto invoices and traditional crypto payments lies in how they shape user behavior at checkout. A standard crypto transfer places responsibility on the customer to calculate fees, choose the correct network, and send the exact amount, often without immediate feedback. Crypto invoices replace this uncertainty with a guided payment flow. The amount, currency, and payment window are clearly defined, and the customer receives real-time confirmation as the transaction progresses, reducing hesitation at the final step.

Crypto invoices also change how merchants manage payments at scale. Instead of reacting to late, partial, or mismatched transfers, businesses define settlement rules in advance. Expiration logic, accepted currencies, and payment status tracking are built into the invoice itself. This structure aligns decentralized payments with modern e-commerce expectations, resulting in fewer failed transactions, cleaner reconciliation, and a checkout experience that feels predictable rather than experimental.

What Exactly Are Crypto Invoices?

Crypto invoices are digital payment requests that integrate blockchain-based payments with traditional invoicing systems. Unlike conventional invoices, which typically involve banks or third-party payment processors, crypto invoices use cryptocurrency networks to facilitate direct, peer-to-peer transactions.

A crypto invoice defines clear payment term, such as the amount, currency, expiration time, and settlement rules, allowing customers to pay using their preferred cryptocurrency. This system ensures transparency, security, and a streamlined payment process for both businesses and customers.

In essence, a crypto invoice is a more structured and efficient way to request payments, offering businesses the benefits of decentralized financial systems without sacrificing the organization and clarity found in traditional invoicing.

Understanding Crypto Invoicing in Practice

A crypto invoice is a structured payment request that defines the amount, timeframe, and conditions for payment. When a customer chooses to pay using a crypto invoice, the process is clear and guided rather than open-ended.

The invoice presents exact payment details and a visible time window, so customers know what is expected before sending funds. As the payment is made, the invoice reflects its status in real time, removing uncertainty about whether the transaction was received or is still pending. This clarity reassures customers during the most sensitive stage of checkout and reduces hesitation caused by waiting or second-guessing.

For businesses, this structured flow eliminates guesswork and manual follow-ups. Payments are easier to track, reconciliation becomes straightforward, and crypto transactions feel closer to a familiar online checkout experience rather than a technical transfer.

For developers or businesses that want to see how crypto invoices are generated programmatically, the OxaPay Generate Invoice API documentation provides a detailed technical reference.

Traditional vs. Crypto Invoices

Traditional invoices are built around banking infrastructure and intermediaries. Payments often pass through multiple layers, including card networks, acquiring banks, and settlement processors. While this model is familiar, it introduces delays, higher fees, and exposure to chargebacks. For online businesses operating internationally, these frictions become more visible at checkout, where declined cards, currency restrictions, and processing delays can interrupt the payment flow and reduce completion rates.

Crypto invoices follow a fundamentally different path. Payments settle directly on blockchain networks without relying on banks or card rails. This removes many of the structural bottlenecks that slow down traditional invoices. Transactions are verifiable, settlement is faster, and disputes tied to chargebacks largely disappear. For merchants, this means clearer payment states and faster access to funds. For customers, it results in a checkout experience that feels more reliable, especially in cross-border and digital-first sales environments.

Improving Business Operations with Crypto Invoice Services

Modern crypto invoice services allow businesses to kripto faturaları oluşturun on demand, define payment parameters in advance, and track each transaction from creation to settlement. This level of control simplifies daily operations and reduces manual payment handling as transaction volume grows.

Key operational improvements include:

- Real-time payment visibility and status tracking

- Support for multiple cryptocurrencies and stablecoins

- Automated handling of partial or delayed payments

- Centralized reporting and transaction records

Services like OxaPay crypto invoice solution illustrate how these capabilities can be packaged into a unified system that supports daily business operations without requiring deep blockchain expertise.

Fiat Pricing with Crypto Settlement

One of the major barriers to crypto adoption in commerce is price volatility. Crypto invoice systems address this by allowing businesses to define invoice values in fiat currencies while still accepting crypto payments.

In this model:

- The invoice amount is fixed in fiat

- The crypto equivalent is calculated dynamically at payment time

- Settlement remains predictable for accounting purposes

This hybrid approach preserves pricing stability while offering customers flexible payment options.

Managing Payment Variations and Exceptions

Real-world payments are rarely perfect. Network fees, wallet behavior, and user errors can result in small payment discrepancies.

Advanced crypto invoice services handle these scenarios by:

- Allowing acceptable underpayment thresholds

- Supporting completion of remaining balances with another currency

- Clearly recording payment states for reconciliation

These mechanisms reduce failed payments and minimize the need for manual intervention.

Security and Trust in Crypto Invoicing

Security is crucial in crypto invoicing platforms. They rely on:

- Cryptographic verification for transaction authenticity

- Blockchain transparency for payment traceability

- Secure communication channels Ve encrypted data handling

- Secure API communication Ve clear separation between payment logic and settlement confirmation

These measures help build trust with merchants and customers, ensuring reliable payments and boosting conversion rates in online environments.

Enhancing Customer Experience at Checkout

From the customer’s perspective, payment should feel simple and predictable. Crypto invoices improve the checkout experience by:

- Reducing failed or delayed payments

- Supporting familiar wallets and currencies

- Providing clear payment instructions and confirmations

A smoother payment experience leads to higher completion rates and stronger customer confidence, ultimately driving higher conversion rates. As customers face fewer hurdles during checkout, they are more likely to complete their purchases, increasing overall sales and customer retention.

Supporting Business Growth and Scalability

As businesses scale, payment systems must handle increasing volume without introducing complexity. Crypto invoicing supports scalability by design, enabling automated processing, standardized payment states, and consolidated reporting.

Platforms such as OxaPay demonstrate how crypto invoice services can support businesses at different stages, from small online shops to high-volume global operations.

Çözüm

Crypto invoicing represents a shift in how online payments are structured and managed. By combining blockchain settlement with invoice logic, businesses gain faster payments, clearer tracking, and greater operational control.

Rather than replacing existing systems overnight, crypto invoices complement modern e-commerce by solving specific payment pain points. As adoption grows, they are becoming an essential component of efficient, global online sales infrastructure.

SSS

One practical example of a production-ready crypto invoice system is OxaPay Merchant Invoice, which combines fiat pricing, real-time payment status, and clean reconciliation for online businesses.