APIs have transformed how businesses operate by enabling different systems to connect smoothly, automate financial transactions, and enhance security. At the core of these interactions is the API Key, a unique credential that controls access to critical services. In the world of cryptocurrency payments, strong API Key Security is essential to prevent unauthorized access and financial risks. This guide explains how the OxaPay payment gateway helps businesses through secure APIs, highlights the role of API Keys in safe transactions, and outlines best practices for strong API Key Security.

What is an API?

An API (Application Programming Interface) is a set of rules and protocols that allow different software applications to communicate with each other. APIs act as intermediaries, enabling developers to integrate external functionalities into their systems without building them from scratch.

The Role of APIs in System Communication

APIs facilitate seamless data exchange and automation, playing a crucial role in:

- Automating Business Operations: APIs reduce manual effort by enabling systems to perform transactions and data transfers in real time.

- Enhancing Interoperability: Different applications, even those developed with distinct technologies, can communicate via APIs.

- Providing Security and Control: APIs help regulate data access and ensure secure transactions by implementing authentication mechanisms like API Keys.

APIs in Payment Services

Payment APIs play a crucial role in facilitating secure and seamless financial transactions between merchants, customers, and financial institutions. These APIs act as intermediaries, enabling businesses to accept payments via credit cards, bank transfers, and cryptocurrencies without the need to develop their own processing systems. By integrating with various platforms, they ensure efficient, accurate, and secure payment processing, while also reducing development costs and enhancing transaction security.

The Role of Payment APIs

Payment APIs provide essential functions, including:

- Transaction Processing: Securely transferring funds between payers and recipients.

- Security & Authentication: Protecting transactions with encryption and API Keys.

- Multi-Currency Support: Accepting fiat and cryptocurrencies to expand customer reach.

- Automated Payment Handling: Streamlining invoicing, recurring payments, and refunds.

- Real-Time Verification: Instantly validating transactions for accuracy and reliability.

Payment APIs in Cryptocurrency Transactions

Crypto payment APIs enable businesses to accept digital assets, convert them to fiat, and track payments efficiently while ensuring compliance with blockchain security standards. They are essential for invoice generation, payment processing, and integrating third-party gateways, making them a key component of modern digital transactions.

What is an API Key and Why Is API Key Security Important?

An API Key is a unique alphanumeric credential used for authentication and authorization between applications and APIs. It ensures secure access by verifying the sender’s identity and controlling permissions. In payment services, API Keys help authenticate transactions, prevent unauthorized access, and enable seamless invoice creation, transaction confirmation, and payout management. Effective API Key Security is essential for preventing fraud, protecting sensitive financial data, and ensuring smooth integration of payment gateways into online platforms.

Why is an API Key Important for Authentication and Security?

API Keys are essential for securing API communication, ensuring that only authorized applications can access sensitive functionalities. These unique credentials authenticate API requests and restrict unauthorized access, preventing data breaches, fraud, and system disruptions. Without proper security, exposed API Keys can allow attackers to manipulate transactions, steal funds, or access confidential information.

In payment services, API Keys play an even more crucial role as they control access to financial operations, including processing transactions, retrieving payment statuses, and managing payouts. If a payment API Key is compromised, businesses may face:

- Unauthorized Transactions & Withdrawals: Attackers can initiate payments, refund requests, or alter transaction details.

- Financial Data Exposure: Hackers could access and misuse customer payment details, leading to fraud.

- Tampered Invoices & Payment Confirmations: Malicious actors can manipulate invoice data or delay transaction approvals.

- Service Downtime Due to API Abuse: Excessive API requests can overload systems, disrupting payment processing.

- Compliance Risks: Unauthorized transactions may violate financial security regulations, leading to legal penalties.

To prevent these threats, businesses must implement strong security measures, including IP allowlisting, encryption, rate limiting, and frequent key rotations. Secure API management ensures fraud prevention, data protection, and the safe execution of payment transactions.

OxaPay Payment APIs

OxaPay provides a robust set of APIs designed to facilitate seamless cryptocurrency transactions for businesses. The Merchant Service and Payout Service APIs enable merchants to automate payment processing, manage payouts, and integrate crypto payments into their platforms with ease. These APIs ensure secure and efficient handling of transactions while offering flexibility for different business models. All services rely on strong API Key Security to safeguard access and maintain the integrity of payment operations.

Key OxaPay APIs

OxaPay offers a comprehensive set of APIs that cover various aspects of cryptocurrency payments, withdrawals, and transaction management. While the platform provides numerous API functionalities, some of the most essential ones include:

- Invoice API – Creates and manages invoices for cryptocurrency payments.

- White-Label API – Enables businesses to integrate OxaPay’s payment processing under their own branding.

- Static Wallet API – Assigns unique cryptocurrency addresses to users for recurring transactions.

- Payout API – Automates bulk cryptocurrency withdrawals and mass payments.

- Webhook API – Sends real-time notifications about transaction statuses and updates.

These APIs represent some of the key functionalities within OxaPay’s extensive ecosystem, providing businesses with seamless payment processing, enhanced security, and efficient transaction management.

How to Generate a Merchant API Key and Payout API Key

To use OxaPay’s API services, businesses need to generate API keys for authentication and security.

Generating a Merchant API Key:

- Log in to your OxaPay account.

- Navigate to the Merchants section in your dashboard.

- Click on Generate Merchant API Key.

- Provide the necessary details, including:

- Merchant name (3-30 characters).

- Logo URL (PNG or SVG format with a transparent background).

- Accepted cryptocurrencies (select specific coins or enable all).

- Underpaid cover percentage (0-60%).

- Fee settings (choose whether the payer covers transaction fees).

- Click Generate and copy the provided API key.

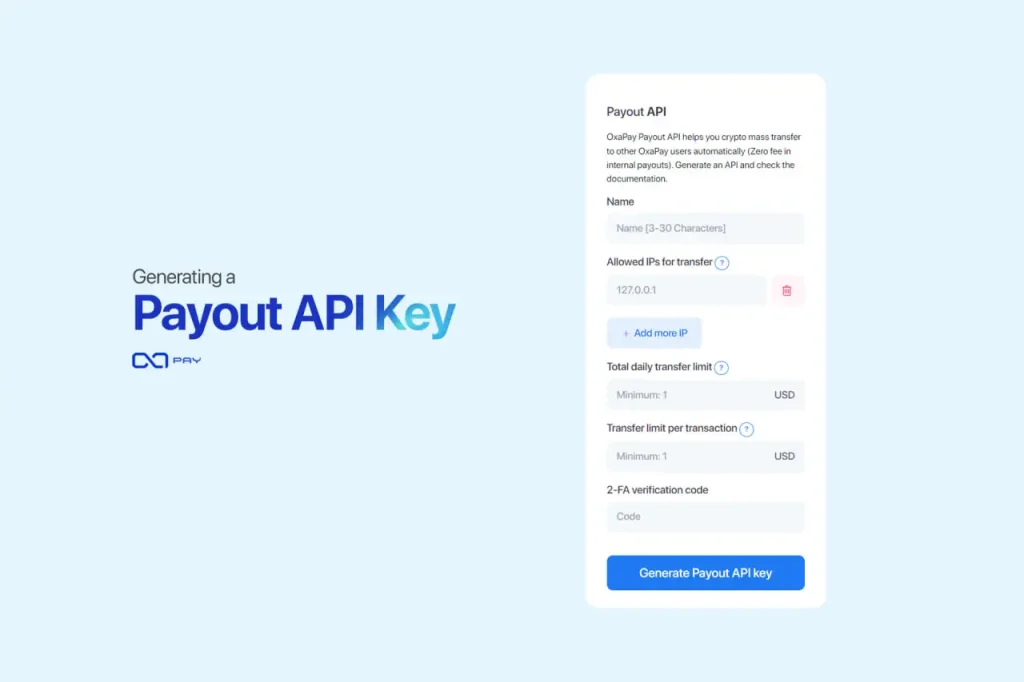

Generating a Payout API Key:

- Enable Two-Factor Authentication (2FA) in your OxaPay account.

- Go to the Payout API section in the dashboard.

- Click Generate Payout API Key and configure the following:

- API key name (3-30 characters).

- Allowed IP addresses for secure transactions.

- Daily transfer limits and per-transaction limits.

- 2FA verification code for added security.

- Click Generate and securely store your API key.

Use Cases of Merchant API Key and Payout API Key

Merchant API Key

The Merchant API Key is essential for businesses using OxaPay’s payment services, enabling seamless integration with various platforms. It grants access to multiple features, such as invoice generation, automated payment confirmations, and customized payment solutions like white-label services. Merchants can also integrate it with plugins to facilitate cryptocurrency payments (e.g., WooCommerce, PrestaShop, WHMCS). This key ensures secure, real-time transaction management and a streamlined payment experience.

Payout API Key

The Payout API Key automates cryptocurrency withdrawals and mass payments, making it ideal for handling transactions like payroll, vendor settlements, and affiliate payouts. It enhances security through IP allowlisting and transaction limits while reducing manual effort and operational errors.

Managing API Key Security in OxaPay: Usage and Risk Prevention

OxaPay’s Merchant API Key and Payout API Key are essential credentials that grant businesses access to payment processing, invoice generation, payouts, and transaction management. Since these keys control critical financial operations, keeping them secure is vital to prevent unauthorized access, fraudulent transactions, and data breaches.

Best Practices for Securing OxaPay API Keys

- Use IP allowlisting: OxaPay allows businesses to restrict API access to specific IP addresses, ensuring only trusted servers can make requests.

- Generate Separate API Keys for Different Services: Merchants should create separate API Keys for payment processing and payouts, reducing risk in case of a security breach.

- Store API Keys Securely: API Keys should never be exposed in frontend code, emails, or public repositories. Instead, they should be stored securely using encrypted vaults or environment variables.

- Rotate API Keys Regularly: Businesses should periodically generate new API Keys and revoke old ones to minimize risks associated with compromised keys.

- Restrict Permissions: OxaPay enables businesses to configure API permissions, ensuring each key has the minimum required access to perform necessary functions.

Ensuring Safe Usage of OxaPay API Keys

- Always Use HTTPS: OxaPay requires all API communications to be encrypted using HTTPS, preventing data interception.

- Monitor API Usage in the OxaPay Dashboard: Businesses should regularly check API activity logs to detect unauthorized access attempts or unusual transaction patterns.

- Enable Two-Factor Authentication (2FA): Activating 2FA for the OxaPay account adds an extra layer of protection, ensuring that only authorized users can generate or manage API Keys.

- Set Transaction Limits for Payout API Keys: OxaPay allows users to define daily transfer limits and per-transaction limits to prevent excessive withdrawals in case of unauthorized access.

- Use Webhooks Instead of Polling: Instead of making frequent API calls to check payment statuses, merchants can utilize OxaPay’s Webhook API to receive real-time transaction updates securely.

By following these security practices, businesses can safeguard their OxaPay API Keys, prevent unauthorized access, and maintain a secure and efficient cryptocurrency payment environment.

Conclusion

API Keys are at the core of secure payment processing, especially in systems handling cryptocurrency transactions. While Payment APIs streamline operations, automate workflows, and improve efficiency, ensuring strong API Key Security is essential to protect against unauthorized access, fraud, and data breaches.

OxaPay payment gateway provides a reliable and secure API infrastructure that empowers businesses to manage crypto payments and payouts with confidence. By following best practices, such as IP allowlisting, key rotation, encrypted storage, and permission restrictions, businesses can maintain robust API Key Security and ensure safe, seamless financial operations.