¿Qué sucede cuando un cliente paga de menos una factura de criptomonedas? ¿Se pierde la venta? ¿Tiene que empezar de cero? O peor aún, ¿se da por vencido? ¿Qué pasaría si una opción de Pago Mixto pudiera recuperar esa factura al instante, sin fricciones, sin complicaciones y sin necesidad de asistencia?

Las facturas incobrables son uno de los problemas más comunes en las transacciones de criptomonedas. Ya sea por comisiones de la billetera, errores del usuario o retrasos inesperados en la red, interrumpen el proceso de pago y perjudican su negocio. Para solucionar esto, OxaPay Incluye una función integrada llamada Cobertura de Pago Insuficiente que ayuda a los clientes a recuperarse de pequeños errores completando el pago con la misma moneda. Pero ¿qué pasa si quieres darles aún más flexibilidad?

Precisamente por eso OxaPay introdujo el Pago Mixto: una forma más inteligente de permitir a los usuarios completar facturas incompletas con otra criptomoneda aceptada. En lugar de reiniciar todo el proceso, pueden pagar el resto con las monedas disponibles.

Veamos con más detalle cómo funcionan estas características y por qué el Pago Mixto podría ser una de las actualizaciones más importantes para su experiencia de pago con criptomonedas.

Cobertura insuficientemente pagada: la base de los pagos flexibles

OxaPay incluye una función predeterminada llamada Cobertura de Pago Insuficiente, que detecta cuando un cliente paga menos del total de la factura. Notifica al usuario al instante, muestra el saldo restante y le permite completar el pago con la misma criptomoneda, todo sin intervención manual.

¿Pero qué pasa si el cliente ya no tiene esa moneda? ¿O si las comisiones de la red o los problemas con la billetera dificultan el uso de la misma criptomoneda?

Aquí es donde entra en juego el Pago Mixto, ofreciendo una forma más inteligente de completar la transacción.

Gestione los criptopagos: Gestione los pagos insuficientes y las comisiones con OxaPay

¿Qué es el pago mixto?

El Pago Mixto es una solución flexible para completar pagos insuficientes. facturas criptográficas utilizando una moneda aceptada diferente.

Cuando un cliente paga menos del importe de la factura, normalmente se le pide que la complete con la misma criptomoneda. Pero en muchos casos, como cuando ya no tiene esa criptomoneda o prefiere una diferente, esto puede convertirse en un problema.

Pago Mixto soluciona esto ofreciendo una opción sencilla:

“Puedes pagar el importe restante con otra moneda que ya tengas”.”

Una vez activado por el comerciante, Pago Mixto aparece automáticamente cuando se detecta un pago parcial.

El cliente elige entre cualquiera de las monedas aceptadas y completa la factura, de forma rápida y sencilla.

No es necesario convertir moneda ni empezar de nuevo.

Es una solución práctica y real para problemas de pago del mundo real.

Por qué es importante el pago mixto

Los usuarios de criptomonedas a menudo enfrentan pequeños problemas durante las transacciones:

- Ellos subestiman Tarifas de gas, dejando menos del importe total de la factura.

- Envían fondos desde billeteras con límites fijos, como los exchanges.

- Reciben interrupciones y pagan en dos sesiones separadas.

- Prefieren usar diferentes monedas, dependiendo del saldo de la billetera o la carga de la red.

El Pago Mixto simplifica estos problemas de pago y los soluciona. Protege la venta, reduce la necesidad de atención al cliente y ayuda a las empresas a recuperar pagos que, de otro modo, no se concretarían.

Y lo que es más importante, ofrece a los usuarios una experiencia más fluida. No se sienten penalizados por errores involuntarios y es más probable que completen el pago.

Tasas de gas Ethereum: Cómo afecta a los pagos de comerciantes

¿Cómo funciona el pago mixto?

El Pago Mixto se activa solo cuando el cliente ya ha pagado parte de la factura. No se trata de elegir múltiples monedas desde el principio, se trata de rescatar la transacción si no sale según lo planeado.

Esto es lo que pasa:

- Un cliente envía parte del importe de la factura, intencional o accidentalmente.

- El sistema OxaPay detecta el faltante y etiqueta la factura como pagada en exceso.

- El usuario ve el saldo restante exacto que debe pagar.

- Si el Pago Mixto está habilitado, se les ofrece una lista de monedas alternativas que pueden usar para completar el pago.

- Eligen una moneda, confirman y envían el resto.

- El sistema confirma ambos pagos y completa automáticamente la factura.

Todo esto sucede en la misma página de factura, sin necesidad de contactar al comerciante ni generar una nueva factura.

¿Qué pasa si la factura ha expirado?

Gran pregunta y una de las partes más inteligentes de esta función.

Si la factura vence antes de que el cliente complete el pago restante, el comerciante puede reactivarla desde su panel de control. OxaPay registra el importe ya pagado.

Una vez reactivado:

- El usuario verá la factura original,

- El sistema mostrará el saldo pendiente,

- Y aún pueden completar el pago utilizando otra moneda.

Esto es especialmente útil para clientes en diferentes zonas horarias o que enfrentan confirmaciones lentas en ciertas cadenas de bloques.

¿Quién puede utilizar el pago mixto?

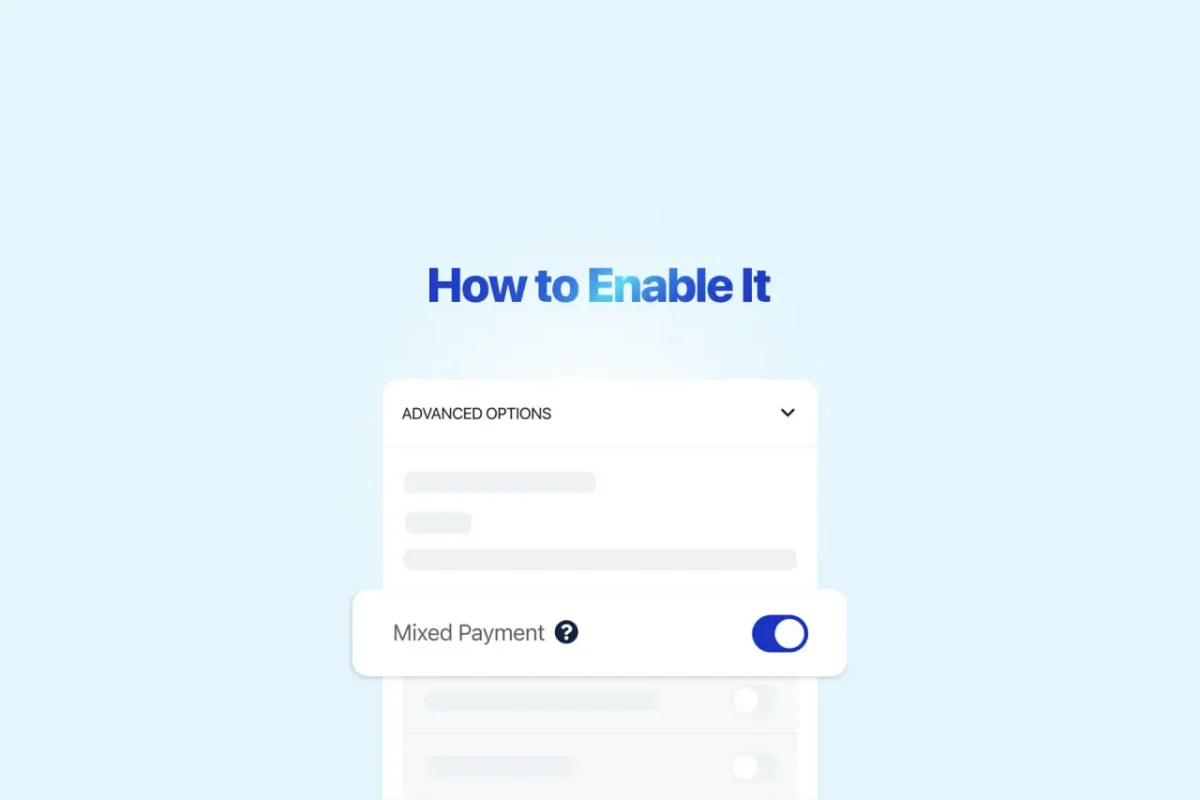

El pago mixto lo controla el comerciante. No está activo por defecto. Para usarlo, el comerciante debe habilitar la función en la configuración de su servicio.

Una vez encendido:

- Se aplica a todas las facturas creadas a través de la cuenta de ese comerciante.

- Admite cualquiera de las monedas seleccionadas como aceptadas en la configuración del comerciante.

- Los clientes verán automáticamente la opción de Pago Mixto si pagan de menos.

No es necesario realizar ningún cambio de código ni configuraciones complicadas, simplemente activar la función y listo.

Escenarios de la vida real

Un cliente paga $40 de una factura de $70 con Ethereum, pero posteriormente se da cuenta de que el pago estaba incompleto. Al regresar, la factura muestra claramente: "Ha pagado $40. Quedan $30". Como ya no tiene ETH, opta por completar el pago con USDT, de forma rápida y sin problemas. Incluso si la factura hubiera vencido, el comerciante podría haberla reactivado con un solo clic. El cliente seguiría viendo su pago anterior y finalizaría el resto con cualquier moneda aceptada. Con el Pago Mixto, el proceso se mantiene fluido, flexible y fiable para ambas partes.

Por qué el pago mixto es bueno para los negocios

Más allá de la comodidad, el Pago Mixto genera un valor comercial real. Aquí te explicamos cómo:

1. Mayor tasa de finalización de pagos

Los pagos parciales ya no son la solución. El Pago Mixto rescata transacciones que, de otro modo, fracasarían.

2. Menor carga de atención al cliente

Menos usuarios se acercan para preguntar qué hacer. El sistema les muestra el camino de forma clara y automática.

3. Una experiencia más compatible con las criptomonedas

Los clientes se sienten cómodos sabiendo que tienen opciones. Es una buena experiencia de usuario y eso genera lealtad.

4. Valor de marketing

El Pago Mixto no es solo una comodidad para el backend, sino una ventaja para el cliente. Al destacar esta función en su sitio web, páginas de pago o contenido promocional, envía un mensaje contundente:

“Aceptamos pagos de criptomonedas flexibles, incluso si los divides entre monedas”.”

Esto tranquiliza a los compradores indecisos, especialmente a aquellos con saldos limitados en una sola billetera. Además, distingue a su negocio en un mercado competitivo, demostrando que comprende y apoya el comportamiento real de las criptomonedas, lo que aumenta la probabilidad de que los clientes lo elijan frente a alternativas menos flexibles.

Cómo habilitarlo

Habilitar el pago mixto en OxaPay es sencillo:

- Vaya a su panel de control.

- Navegue hasta el servicio donde desea habilitar el Pago Mixto, Servicios para comerciantes o Enlace de pago.

- Busque la opción Pago Mixto y actívela.

- Guardar configuración. ¡Listo!

No necesitas configurar nada especial. Las monedas que aceptes estarán disponibles automáticamente para pagos mixtos.

Reflexiones finales

El Pago Mixto no es solo una función, es una respuesta inteligente a cómo se comportan realmente los usuarios de criptomonedas. Con Pasarela de criptopago OxaPay, Puede recuperar fácilmente pagos atrasados, reducir la fricción y guiar a sus clientes para que completen sus transacciones sin reiniciar el proceso. Al habilitar el Pago Mixto, su negocio se adapta a desafíos reales como pagos insuficientes, errores de billetera o retrasos en la red, a la vez que mejora las tasas de finalización y ofrece una experiencia al cliente más fluida. Una simple configuración en OxaPay puede convertir posibles pérdidas en pagos exitosos. Actívelo hoy mismo y haga que sus pagos con criptomonedas sean más flexibles y confiables.