In the fast-moving world of freelancing and gig work, the need for financial fluidity and convenience takes center stage. Freelancers, independent contractors, and gig workers in the gig economy prioritize flexibility in both their working hours and payment methods. Traditional payment systems often struggle to meet these specific requirements. Cryptocurrency offers a novel solution: Crypto Payments for Freelancers. This approach reinvents how freelancers in the gig economy handle and receive payments, aligning perfectly with their needs for quick, flexible, and globally accessible financial transactions.

Gig Economy and the Financial Needs of Freelancers

Understanding the Gig Economy

The gig economy represents a contemporary shift in the workforce, characterized by a dominance of short-term contracts or freelance work rather than permanent jobs. This sector thrives on the desire for flexibility, autonomy, and personal control over work-life balance.

The Unique Financial Needs of Freelancers in the Gig Economy

Freelancers in the gig economy face unique financial challenges and needs, differentiating them from traditional employees:

- They often deal with irregular income streams. Unlike traditional jobs with steady paychecks, the income of freelancers fluctuates based on the number and type of gigs they complete.

- They access global opportunities and payments. The digital nature of many gig economy jobs allows freelancers to work for clients worldwide, which requires a payment system capable of handling international transactions smoothly.

- They need quick and flexible payment solutions. The project-based nature of their work demands payment solutions that are fast and can adapt to varying payment schedules.

- They seek lower transaction costs. High transaction fees can significantly eat into the earnings of freelancers, especially for smaller gigs. Hence, they prefer cost-effective payment methods.

- They must manage their finances and ensure security. Freelancers often handle multiple gigs simultaneously, which complicates financial management. They need secure and efficient ways to manage their earnings.

Why Cryptocurrency for Freelancers?

Crypto uniquely addresses the needs of freelancers in the gig economy, offering financial autonomy and a global reach. Its borderless nature eliminates the complexities and fees of international banking and currency conversion, a boon for freelancers with a diverse, international clientele. Additionally, the lower crypto payments costs beneficial for freelancers handling smaller projects, where traditional banking fees can significantly impact earnings.

Beyond cost benefits, the speed and security of cryptocurrency transactions are well-aligned with the dynamic nature of freelance work. Rapid, sometimes instant, processing ensures quick access to funds, essential for maintaining a consistent cash flow. Enhanced security and privacy safeguard against financial data breaches, an increasing concern in the digital era. For freelancers in areas with limited banking services, cryptocurrencies offer an inclusive financial alternative. The ease of tracking and recording transactions on blockchain technology streamlines accounting and tax preparation.

Introducing the Payment Link Solution for Freelancers

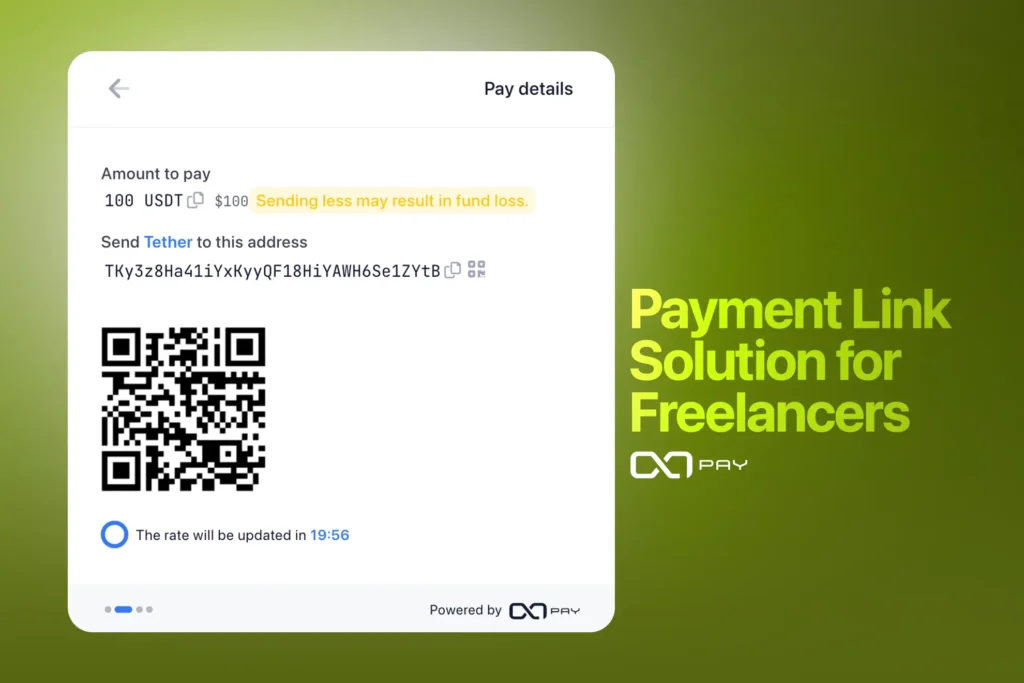

The Payment Link solution revolutionizes the way freelancers in the gig economy receive payments. This service simplifies and accelerates the process of getting paid, particularly when dealing with a variety of international clients. Payment Link operates as a straightforward, user-friendly mechanism: Freelancers generate a unique payment link for each project or client. This link can then be shared via email, messaging apps, or even embedded in invoices. Upon clicking the link, clients are directed to a secure payment gateway where they can complete the transaction using their preferred cryptocurrency.

What sets the Payment Link apart is its convenience and speed. Freelancers no longer need to navigate the complexities of international banking or wait for prolonged processing times. Instead, they receive their payments swiftly and directly into their cryptocurrency wallets. This method also bypasses traditional banking fees, making it a cost-effective option. Moreover, the Payment Link offers enhanced security features, ensuring both the freelancer and the client are protected throughout the transaction.

OxaPay : Secure Payment Link Generator

OxaPay emerges as a standout player in the realm of Payment Link generators, specifically catering to the needs of freelancers who wish to accept crypto payments. This crypto payment gateway provides an intuitive platform that streamlines the creation and management of payment links. With a focus on the gig economy, OxaPay understands the importance of quick, reliable, and secure transactions.

The OxaPay platform is designed to be user-friendly, even for those new to cryptocurrency. It supports a wide range of cryptocurrencies, offering freelancers the flexibility to choose which ones they want to accept. Additionally, OxaPay incorporates real-time conversion rates, ensuring both freelancers and their clients know exactly how much is being transacted. Their system also provides detailed transaction histories, aiding in financial tracking and reporting.

Step-by-Step Guide to Getting Started with OxaPay

Creating and using a payment link with OxaPay is a simple and efficient process, especially for freelancers who want to simplify their payment methods and use crypto for their payments. Here is a detailed guide:

1. Create an OxaPay Account:

- Visit the OxaPay website.

- Sign up for a free account using your email address. The registration process is quick, typically taking less than a minute.

- Once registered, log in to your OxaPay account.

2. Generate a Payment Link:

- Navigate to the “Payment Links” tab within your OxaPay account dashboard.

- Click on the option to generate a new payment link. This is where you’ll create a unique link for each payment you need to receive.

3. Customize Your Payment Link:

- Personalize each payment link according to the specific requirements of the transaction.

- Add a description for clarity – this could be the name of the project, service, or any identifier that makes the transaction recognizable.

- Set a due date if there is a specific deadline by which you need to receive the payment.

- Specify the payment amount. This ensures transparency and agreement on the transaction value.

4. Share Your Payment Link:

- Once your payment link is customized, you can share it directly with your clients.

- Use convenient methods like email, SMS, chat applications, or social media to send the link.

- This flexibility allows you to choose the communication channel that best suits your and your client’s preferences.

5. Accept Payments:

- When your client clicks on the payment link, they will be directed to a secure checkout page.

- On this page, they can review the payment details and enter their payment information to complete the transaction.

- You will receive a notification once the payment is processed, and the funds will be transferred to your account.

By following these steps, freelancers can utilize OxaPay’s Payment Link feature to receive payments quickly and securely, making financial transactions a seamless part of their business operations.

Conclusion

Integrating cryptocurrency and freelancing via solution Payment Link is more than a convenience; it’s a significant step towards financial empowerment for freelancers.With its ability to streamline payments, lower costs, and enhance security, the use of crypto via OxaPay’s Payment Link is not just a convenience, it’s a vital tool that empowers freelancers to take control of their financial transactions and thrive in a global marketplace.

Join OxaPay now and transform your payment process!