In the rapidly evolving landscape of cryptocurrencies, Bitcoin and Ethereum have emerged as the leading players, each with its unique features and capabilities. As the world explores the potential of digital assets in the payment system, it becomes crucial to understand the similarities, differences, and the pros and cons of using Bitcoin and Ethereum. This comprehensive article aims to provide a detailed comparison of Bitcoin and Ethereum in the context of the crypto payment system, enabling readers to make informed decisions regarding their usage.

Understanding Bitcoin

Bitcoin, introduced in 2009, was the first decentralized cryptocurrency, designed as a peer-to-peer digital currency without intermediaries. It has gained widespread recognition and acceptance, cementing its position as the leading cryptocurrency in the global payment system.

Borderless Transactions

Bitcoin’s decentralized nature enables seamless cross-border transactions, eliminating the need for intermediaries and traditional banking systems. This feature empowers individuals and businesses to conduct transactions across borders with greater speed and lower fees compared to traditional methods.

Store of Value

Bitcoin’s limited supply of 21 million coins and its decentralized nature have positioned it as a potential hedge against inflation and a store of value. It has gained popularity as a digital asset for preserving wealth and diversifying investment portfolios.

Security and Reliability

Bitcoin’s blockchain, powered by robust cryptographic algorithms, provides a high level of security and immutability. Its decentralized nature ensures that transactions are recorded transparently and cannot be easily altered, offering confidence in the integrity of the payment system.

Understanding Ethereum

Ethereum, launched in 2015, introduced a new paradigm by offering a programmable blockchain platform. It not only serves as a cryptocurrency (Eth) but also enables the creation of decentralized applications (dApps) and the execution of smart contracts.

Proof of Stake

Proof of Stake (PoS) is a significant development in Ethereum’s blockchain technology, replacing the energy-intensive mining process with a more efficient and secure consensus mechanism. In PoS, validators hold and “stake” a certain amount of Ether as collateral to secure the network and are selected to create new blocks and validate transactions based on their staked amount.

PoS brings several benefits to the Ethereum network . These benefits include:

- Scalability: PoS improves the network’s capacity to handle a larger number of transactions quickly and efficiently, addressing scalability challenges faced by both Bitcoin and previous Ethereum’s Proof of Work (PoW) mechanism during high demand periods.

- Energy Efficiency: Unlike PoW, PoS consumes far less energy, making Ethereum a more sustainable choice for users and aligning with the goal of promoting eco-friendly solutions in the crypto payment system.

- Security: PoS enhances network security by incentivizing validators to act honestly. Validators risk losing their staked funds if they behave maliciously or attempt to manipulate the system, promoting network integrity and reducing the likelihood of attacks.

Smart Contracts

Ethereum’s smart contracts automate the execution of agreements, enabling secure, transparent, and self-executing transactions without intermediaries. This feature opens up a wide range of possibilities for automating payment processes, streamlining supply chains, and facilitating complex financial agreements.

Decentralized Finance (DeFi)

Ethereum’s programmability and the transition to proof of stake have paved the way for the rise of decentralized finance. DeFi applications built on the Ethereum blockchain offer services such as lending, borrowing, trading, and yield farming, providing individuals with direct access to financial services without relying on traditional institutions.

Interoperability

Ethereum’s open architecture and compatibility with other blockchains have positioned it as a hub for interoperability. It can facilitate transactions and value transfers between different cryptocurrencies and blockchain networks, fostering greater connectivity and liquidity within the global payment system.

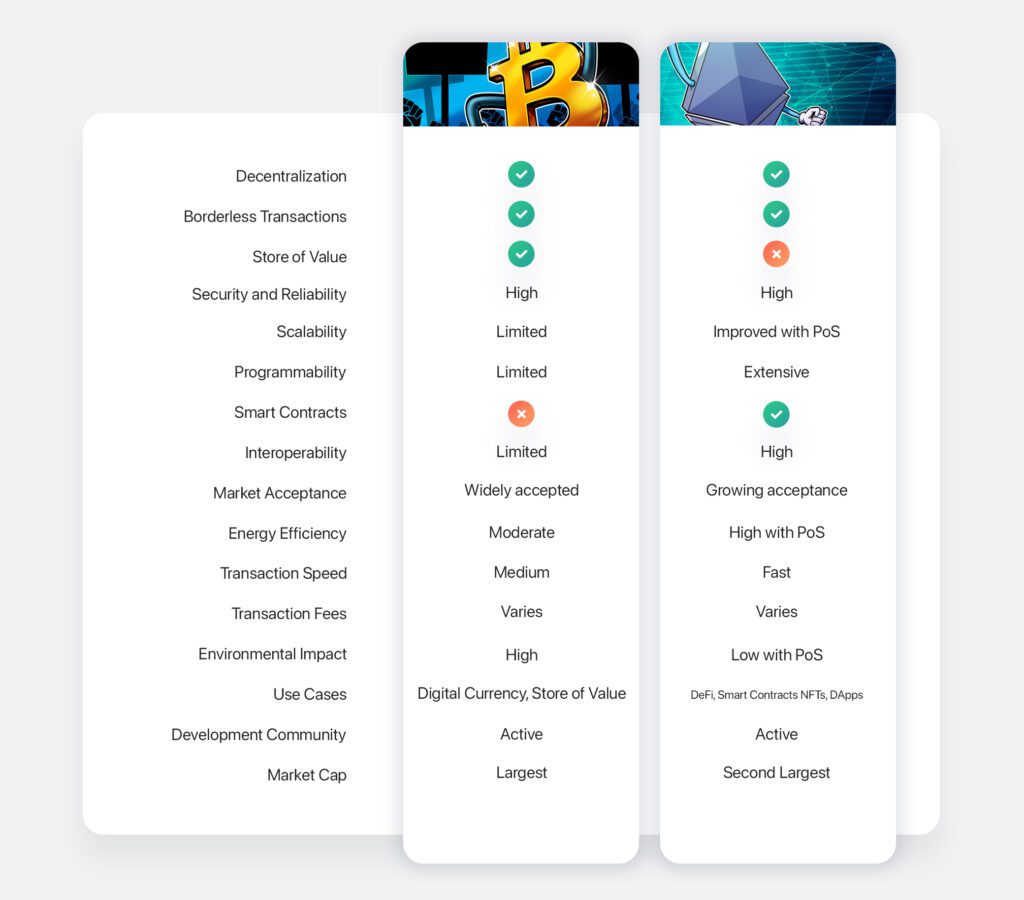

Comparison of Bitcoin and Ethereum in the Crypto Payment System

When comparing Bitcoin and Ethereum in the crypto payment system, several key factors come into play.

Speed and Scalability

Bitcoin’s original design limits its transaction processing capacity, leading to scalability challenges. Ethereum also faced similar challenges during periods of high demand, but its transition to Proof of Stake is expected to address these issues and improve scalability.

Programmability

While Bitcoin primarily focuses on being a digital currency, Ethereum’s programmability allows for the creation of sophisticated payment systems and decentralized applications. This makes Ethereum more versatile in terms of building customized payment solutions.

Use Cases

Bitcoin’s primary use case is as a decentralized digital currency and a store of value. Ethereum, on the other hand, offers broader use cases with its programmability, including decentralized finance, non-fungible tokens (NFTs), and decentralized applications.

Market Acceptance

Bitcoin has a significant advantage in terms of market acceptance and recognition as a form of payment. It is more widely accepted by merchants and service providers compared to Ethereum. However, Ethereum’s ecosystem is rapidly growing, and more businesses are starting to accept Ethereum as a form of payment.

Pros and Cons of Using Bitcoin and Ethereum in a Payment System

When considering the use of Bitcoin and Ethereum in a payment system, it’s important to evaluate their respective pros and cons.

Bitcoin Pros

- Established and widely accepted as a digital currency: Bitcoin’s pioneering status as the first decentralized cryptocurrency has led to its widespread acceptance and recognition as a legitimate form of digital currency.

- Security and reliability of the blockchain: Bitcoin’s blockchain, supported by robust cryptographic algorithms, ensures a high level of security and immutability, providing users with confidence in the integrity of transactions.

- Potential as a store of value and hedging against inflation: Bitcoin’s limited supply and decentralized nature position it as a potential hedge against inflation and a store of value, making it attractive for long-term investment strategies.

Bitcoin Cons

- Scalability challenges and potential for high transaction fees: Bitcoin’s original design imposes limitations on its transaction processing capacity, leading to scalability challenges and occasional spikes in transaction fees during periods of high demand.

- Limited programmability compared to Ethereum: While Bitcoin’s primary focus is on being a digital currency, its programmability is limited compared to Ethereum, which restricts the development of more complex payment systems and applications.

Ethereum Pros

- Smart contract functionality enables automated and complex transactions: Ethereum’s smart contracts allow for the automation and execution of agreements without intermediaries, providing a secure and transparent platform for complex transactions and business processes.

- Interoperability and compatibility with other blockchains: Ethereum’s open architecture and compatibility with other blockchains enable seamless interoperability, fostering connectivity and liquidity within the broader cryptocurrency ecosystem.

- Growing ecosystem with a vibrant developer community: Ethereum’s ecosystem has experienced rapid growth, attracting a vibrant community of developers who continuously contribute to its expansion and innovation.

Ethereum Cons

- Scalability challenges during periods of high demand: Similar to Bitcoin, Ethereum faces scalability challenges during periods of increased network activity, leading to potential delays and higher transaction fees.

- Price volatility and potential impact on payment stability: Ethereum’s price volatility introduces an element of risk for payment stability, as its value can fluctuate significantly over short periods of time.

The Benefits and Considerations of Crypto Payment System

Crypto payments offer several benefits and considerations that distinguish them from traditional payment methods.

Speed and Efficiency

Cryptocurrencies provide faster and more efficient transaction settlements compared to traditional payment methods. The decentralized nature of cryptocurrencies eliminates the need for intermediaries, streamlining the payment process and reducing processing times.

Reduced Costs

Cryptocurrencies eliminate or minimize intermediary fees typically associated with traditional payment methods. This reduction in fees makes cross-border payments more affordable and accessible to a broader range of users.

Financial Inclusion

One of the significant advantages of crypto payments is their potential to increase financial inclusion. By leveraging cryptocurrencies, individuals can access financial services without relying on traditional banking infrastructure. This opens up new possibilities for individuals who are underserved by the traditional banking system.

Innovation and Disruption The rise of cryptocurrencies has sparked innovation in the financial sector. It has led to the development of new payment solutions and decentralized applications that offer enhanced functionality and accessibility. The ability to automate processes through smart contracts and the emergence of decentralized finance (DeFi) have the potential to revolutionize traditional financial systems.

FAQ

How does the scalability of Bitcoin and Ethereum compare, and how are they addressing scalability challenges?

Bitcoin's original design limits its transaction processing capacity, leading to scalability challenges. Ethereum also faced similar challenges during periods of high demand. However, Ethereum's transition to Proof of Stake (PoS) is expected to address these issues and improve scalability by increasing the network's capacity to handle a larger number of transactions quickly and efficiently.

How does the energy consumption of Bitcoin and Ethereum differ?

Bitcoin's mining process, based on Proof of Work (PoW), consumes a significant amount of energy. In contrast, Ethereum's transition to Proof of Stake (PoS) significantly reduces energy consumption, making it a more sustainable choice for users and aligning with the goal of promoting eco-friendly solutions in the crypto payment system.

How does Ethereum's interoperability with other blockchains benefit a business using a crypto payment system?

Ethereum's open architecture and compatibility with other blockchains position it as a hub for interoperability. It enables seamless transactions and value transfers between different cryptocurrencies and blockchain networks, fostering greater connectivity and liquidity within the global payment system. This can enhance a business's ability to transact with various cryptocurrencies and tap into broader markets.

What are the pros and cons of using Bitcoin and Ethereum as payment methods?

- Bitcoin pros: Established and widely accepted as a digital currency, security and reliability of the blockchain, potential as a store of value and hedging against inflation

- Bitcoin cons: Scalability challenges and potential for high transaction fees, limited programmability compared to Ethereum.

- Ethereum pros: Smart contract functionality, interoperability and compatibility with other blockchains, growing ecosystem with a vibrant developer community.

- Ethereum cons: Scalability challenges during periods of high demand, price volatility and potential impact on payment stability.

Conclusion

In conclusion, For users looking for a straightforward and widely accepted payment method, Bitcoin’s recognition as a digital currency and its proven security make it a solid choice. Its limited supply and decentralized nature also position it as a potential hedge against inflation and a store of value, appealing to those seeking long-term investment opportunities.

On the other hand, Ethereum’s programmability opens up a world of possibilities for customized payment solutions. With smart contracts automating transactions and facilitating complex financial agreements, Ethereum provides a platform for secure and transparent payments. Additionally, its compatibility with other blockchains and growing ecosystem make it an attractive option for users seeking interoperability and connectivity within the broader cryptocurrency landscape.

When deciding between Bitcoin and Ethereum as a payment method, it’s crucial to consider factors such as speed, scalability, use cases, market acceptance, and the specific requirements of your business or personal needs. The choice ultimately depends on your priorities and the unique features offered by each cryptocurrency.

If you’re looking for a secure crypto payment gateway, OxaPay provides a reliable and user-friendly platform for processing cryptocurrency transactions. Whether you choose Bitcoin or Ethereum With its emphasis on security, transparency, and efficiency, OxaPay ensures that your crypto payments are processed seamlessly and with confidence.

Enter the OxaPay payment gateway and experience the convenience and security of crypto payments firsthand. With OxaPay, you can embrace the future of digital finance and unlock new possibilities in the global payment landscapend crypto payment system.