Every merchant accepting crypto payments has the same core concerns: Is the payment secure? How fast will it settle? In traditional finance, security depends on banks and central authorities, while speed depends on their systems and intermediaries. In blockchain, both are governed by one invisible engine: consensus mechanisms.

This article explains how consensus works, why it matters for merchants, and how it directly impacts the speed, security, and trustworthiness of crypto payments.

What Is Consensus in Blockchain?

Blockchain consensus is the process by which thousands of independent computers, known as nodes, agree on the validity of transactions without relying on any central authority. This shared agreement is what makes blockchains decentralized, secure, and reliable for crypto payments.

In simple terms, consensus ensures that all participants in the network see and accept the same version of the ledger , confirming who owns what and which transactions have occurred. Each node verifies new data, and only when a majority agrees that the transaction is valid does it become permanently recorded on the blockchain.

Without consensus:

- Anyone could fake or duplicate payments.

- Double spending (sending the same coins twice) would be possible.

- The system could not be trusted to handle real financial value.

With consensus:

- Transactions are validated independently across the network.

- Every participant shares a single, verified source of truth.

- Once confirmed, data becomes immutable and tamper-proof.

👉 For merchants, this means that every confirmed transaction is validated by a global network of validators, not by a single company or server , ensuring both transparency and security in every payment.

How Consensus Powers Security

The most important job of blockchain consensus is to protect the network against fraud, double spending, and manipulation. By requiring thousands of independent validators to agree before a transaction is approved, consensus ensures that no single party can alter or falsify payment data. This decentralized agreement makes blockchain one of the most secure foundations for crypto payments.

Different consensus mechanisms achieve this protection in their own way:

Proof of Work (PoW)

In simple terms, Proof of Work means using computer power to prove that real effort was made to validate transactions. The more energy used, the harder it is to cheat.

- Used by البيتكوين و Litecoin.

- Miners solve complex cryptographic puzzles to add new blocks.

- Security comes from the massive computing power required to rewrite transaction history.

Proof of Stake (PoS)

Proof of Stake replaces energy consumption with financial commitment. Validators lock up their own coins to prove honesty and earn rewards for maintaining the network.

- Used by الإيثيريوم, مضلع, و Solana.

- Validators stake coins as collateral and are penalized for misconduct.

- Security relies on economic incentives, making attacks extremely costly.

Delegated Proof of Stake (DPoS)

DPoS works like a democratic system where users vote for a few trusted representatives who create blocks and secure the network on behalf of everyone.

- Used by TRON و EOS.

- Token holders elect a small number of validators.

- Security depends on community governance and fast replacement of dishonest nodes.

PoA relies on the identity and reputation of trusted validators instead of computing power or staked coins, making it fast but less decentralized.

- Common in private and enterprise blockchains.

- Validators are pre-approved authorities known to the network.

- Provides high speed and reliability but depends on trusted entities.

Each of these mechanisms ensures that once a payment is confirmed, altering or reversing it becomes nearly impossible. Attackers would need enormous computational power, majority control of staked coins, or access to validator permissions , all highly impractical.

Byzantine Fault Tolerance (BFT)

BFT ensures that even if some nodes act maliciously or fail, honest nodes can still agree on valid transactions.

- Used by Cosmos و Hyperledger.

- Security comes from validator voting and instant block finality.

Hybrid (PoW + PoS)

Combines the strengths of PoW for network security with PoS for efficiency and lower energy use.

- Used by DigiByte and similar blockchains.

- Balanced protection and performance, offering layered security.

Why This Matters for Merchants

- Irreversible Payments: Once a transaction is confirmed through consensus, it cannot be altered or rolled back, eliminating chargebacks and fraud.

- Network Integrity: Attackers would need enormous computing power (in PoW) or massive staked assets (in PoS) to compromise a network , a nearly impossible task.

- Customer Trust: Consensus-backed confirmations guarantee transparency and reliability, reassuring both merchants and customers that every payment is genuine.

- Global Security Standard: Unlike traditional systems where security depends on one provider, blockchain security is maintained collectively by thousands of independent participants.

👉 In short, blockchain consensus transforms digital payments into a tamper-proof, transparent, and self-verifying process that merchants can fully rely on.

How Consensus Impacts Payment Speed

While security is vital, merchants also care about how quickly they can access funds.

In Traditional Systems

- Settlement often takes 1–3 business days.

- Cross-border payments can stretch to 5–7 days.

- Each intermediary adds time and fees.

In Blockchain Systems

Blockchain consensus defines how fast transactions become final. Different mechanisms reach agreement in different ways, leading to noticeable differences in settlement speed:

Proof of Work (PoW)

- Bitcoin: ~10 minutes per block, 3–6 confirmations (~30–60 minutes).

- Litecoin: ~2.5 minutes per block, 2–4 confirmations.

Proof of Stake (PoS)

- Ethereum: ~15 seconds per block, ~3 minutes for full confirmation.

- Polygon: 2–3 seconds per block.

- Solana: Near-instant confirmations.

Delegated Proof of Stake (DPoS)

- TRON: Finality under 3 seconds.

- EOS: 0.5–1 second per block.

- Block times <1 second with instant finality.

Byzantine Fault Tolerance (BFT)

- Typical block times: 1–2 seconds.

- Offers strong security and fast confirmations for smaller networks.

Hybrid (PoW + PoS)

- Block times: ~15–30 seconds.

- Provides stable confirmations with lower energy use.

Takeaway for Merchants

The type of blockchain consensus directly determines payment speed and user experience. Proof of Work offers the highest security but slower confirmations, while Proof of Stake and Delegated Proof of Stake provide faster, low-cost settlements with reliable decentralization. Proof of Authority delivers near-instant results in trusted private systems. For merchants, choosing faster consensus networks like Polygon or TRON enables smoother checkouts and near-instant crypto payments without compromising trust or reliability.

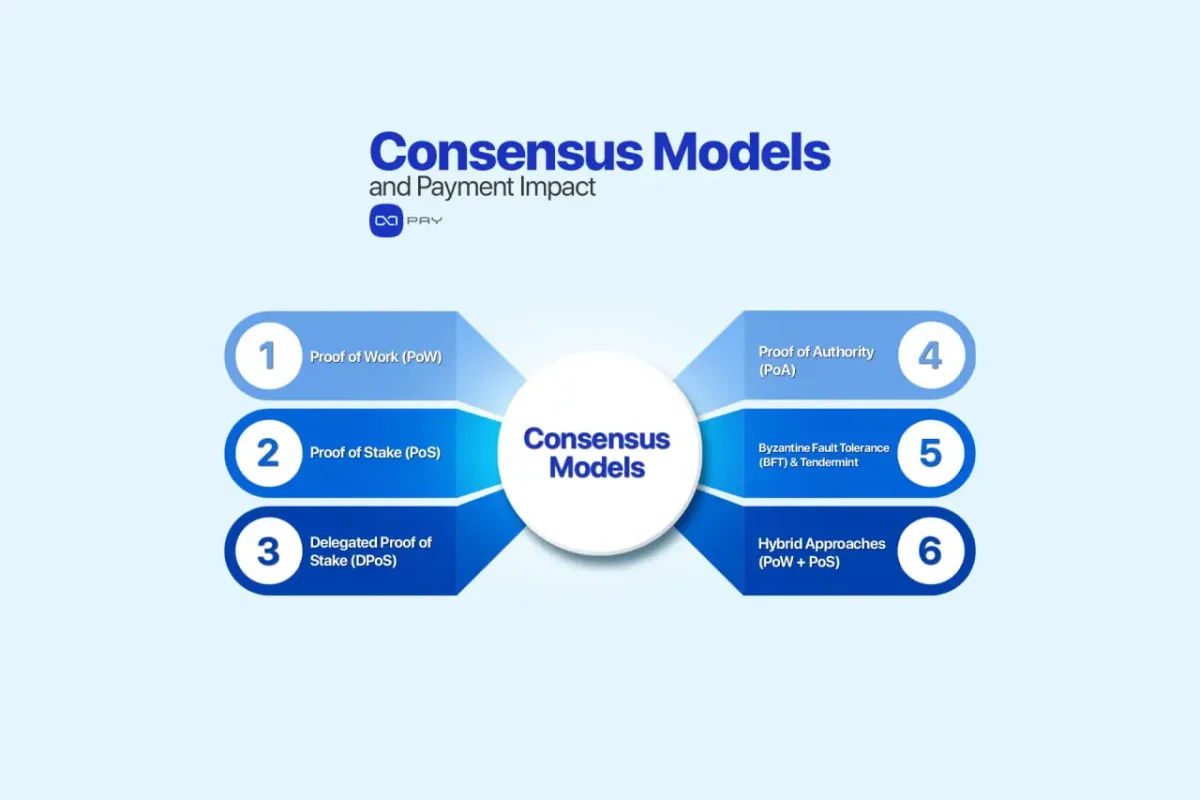

Major Consensus Mechanisms and Their Impact on Payments

Not all blockchains use the same consensus mechanism. Each model reaches agreement differently, affecting how payments perform in terms of speed, cost, and reliability. For merchants, understanding these differences helps in choosing the right network for their business needs.

Proof of Work (PoW)

Best suited for high-value or cross-border payments where maximum security is essential. PoW transactions may take longer to confirm, but their immutability makes them ideal for large settlements or financial operations that demand the highest trust level.

Proof of Stake (PoS)

Combines efficiency and security, offering faster confirmations and lower fees. PoS networks like Ethereum and Polygon make it easier for merchants to process payments within seconds, making them practical for both e-commerce and service-based transactions.

Delegated Proof of Stake (DPoS)

Designed for performance and scalability, DPoS networks like TRON and EOS can handle large transaction volumes with near-instant confirmations. This makes them perfect for high-frequency payments such as online retail, gaming, and microtransactions.

Used in private or consortium systems, PoA provides instant and predictable confirmations since trusted authorities validate every transaction. It’s ideal for enterprise or internal blockchain environments where control and speed are priorities over decentralization.

Byzantine Fault Tolerance (BFT)

Ensures consensus even if some validators fail or act maliciously. With instant finality and high reliability, BFT-based systems like Cosmos or Hyperledger are well-suited for private networks and fast, closed-loop payment infrastructures.

Hybrid (PoW + PoS)

Combines the resilience of PoW with the efficiency of PoS. Hybrid systems, such as DigiByte, deliver balanced performance , providing both security for large payments and flexibility for faster retail transactions.

👉 For merchants, the type of blockchain consensus explains why Bitcoin is preferred for secure, large-scale settlements, while TRON or Polygon offer faster, cost-efficient solutions for daily crypto payments. Choosing the right mechanism helps align payment performance with business goals , balancing speed, cost, and security for an optimal customer experience.

Consensus and Finality: When Is a Payment Truly Yours?

Another key concept in blockchain consensus is finality , the point at which a payment cannot be reversed.

- في PoW systems, finality is probabilistic. Each new block reduces the chance of reversal but doesn’t eliminate it until many confirmations.

- في PoS systems like Ethereum, finality can be deterministic. Once a checkpoint is finalized, it cannot be reverted without massive penalties.

- في DPoS systems such as TRON or EOS, finality is nearly instant, with confirmations usually under three seconds.

- في PoA networks, finality is immediate since trusted authorities validate each block directly.

- في BFT systems like Cosmos, finality is absolute , once validators agree, transactions are final.

- في Hybrid (PoW + PoS) systems, finality combines both approaches for balanced speed and reliability.

👉 For merchants, this means:

- A small café can safely deliver coffee after 1 confirmation on TRON.

- A luxury watch store might wait for 6 confirmations on Bitcoin.

Blockchain consensus gives merchants the confidence to decide how quickly they can treat payments as final, balancing speed with security.

Decentralization: Trust Without Intermediaries

In traditional payments, merchants rely on banks, card networks, and payment processors to authorize and settle transactions. Each adds cost, delay, and sometimes risk. Blockchain consensus eliminates this dependency:

Consensus eliminates this dependency:

- No bank is needed to say “yes” or “no.”

- No central system can freeze or reverse a transaction.

- The network itself validates and secures every payment.

👉 For merchants, this decentralization means greater independence, especially for cross-border transactions where banks typically add friction.

Real-World Impact for Merchants

Blockchain consensus directly shapes how merchants experience crypto payments by defining their speed, security, and reliability. It enables near-instant confirmations, allowing businesses to complete sales within seconds instead of days. At the same time, consensus ensures that once payments are confirmed, they become irreversible and resistant to fraud, removing chargebacks and disputes common in traditional systems. This decentralized structure also expands global access, letting merchants accept crypto from anywhere without relying on banks or intermediaries.

Practical Example:

In traditional finance, an e-commerce store selling $5,000 worth of products may wait 2–3 days to receive funds, losing about 3% to card fees. In contrast, with blockchain consensus, the same transaction settles in under 3 minutes with fees below 1% , giving merchants faster liquidity, lower costs, and a smoother customer experience.

الخاتمة

Blockchain consensus has become the foundation of trust in modern digital payments. It removes the need for centralized approval by enabling transactions to be validated collectively across independent nodes. For merchants, this means faster settlements, transparent verification, and complete protection against fraud , all achieved through decentralized agreement rather than traditional intermediaries.

👉With OxaPay Crypto Gateway, merchants can benefit from these advantages without managing blockchain complexity. OxaPay is integrated with multiple major blockchains, allowing businesses to accept crypto payments securely and efficiently across various networks. It delivers the perfect balance of speed, reliability, and simplicity , so merchants can focus on growth while OxaPay ensures every transaction is verified and trusted.