Have you ever wondered how to simplify payment processes while elevating security and user satisfaction? Businesses today demand fast, reliable, and secure transactions without unnecessary complexity. Advanced payment APIs bridge this gap, enabling developers to integrate customized, efficient payment solutions into applications. In this article, we’ll uncover the transformative power of these APIs, explore their technical capabilities, and highlight OxaPay’s Invoice Service as a standout example of innovation in payment management.

What Are Advanced Payment APIs?

At their core, payment APIs (Application Programming Interfaces) are software intermediaries that allow applications to communicate with payment processing systems. They enable developers to seamlessly incorporate payment functionalities such as:

- Real-time transaction processing.

- Multi-currency acceptance.

- Recurring billing and subscription management.

- Fraud prevention and risk management.

- Financial reporting and analytics.

Advanced payment APIs go beyond basic functionality by offering tailored features, enhanced performance, and integration capabilities that address the complexities of modern payment ecosystems. These APIs simplify operations for businesses and empower developers to create customized payment experiences.

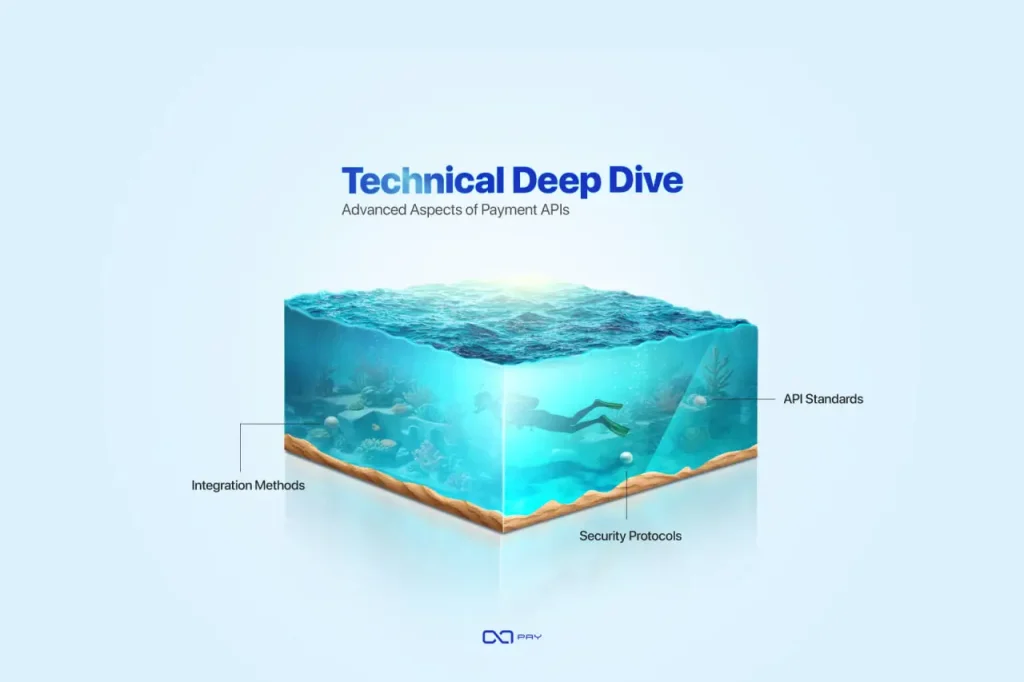

Technical Deep Dive: Advanced Aspects of Payment APIs

API Standards

Advanced payment APIs are designed to comply with global standards like RESTful APIs, which use HTTP methods and JSON or XML formats for efficient communication. OAuth 2.0 is widely implemented for secure authentication and authorization, ensuring data integrity and user trust. By adhering to these standards, developers can integrate payment solutions seamlessly across platforms.

Integration Methods

Advanced APIs offer flexible integration options, including SDKs for different programming languages, pre-built plugins for popular platforms, and direct API calls for custom workflows. Sandbox environments facilitate testing, allowing developers to validate functionality without affecting live operations. Integration guides and technical support ensure smooth adoption regardless of the complexity of the business model.

Security Protocols

Security is paramount in payment APIs. They employ multi-layered protection mechanisms, including:

- Tokenization: Replacing sensitive payment data with secure tokens.

- Encryption: Securing data in transit using advanced cryptographic protocols.

- Fraud Detection: Leveraging machine learning and behavioral analytics to identify anomalies in real-time.

- Compliance: Meeting industry standards like PCI DSS, GDPR, and local regulations ensures user data is always protected.

Business Impact: Advanced APIs as a Competitive Advantage

Having explored the technical and security aspects of advanced payment APIs, it’s time to understand how they translate into tangible business advantages. In this section, we’ll delve into innovative use cases and practical impacts, highlighting how these APIs empower businesses to stay ahead in a competitive marketplace.

Innovative Use Cases

- Dynamic Pricing Adjustments: Advanced APIs integrate with AI tools to dynamically adjust prices based on demand, user location, or market trends, increasing profitability.

- Personalized Payment Flows: APIs can leverage customer data to offer tailored payment options, such as suggesting preferred payment methods or discounts, improving customer satisfaction and loyalty.

Decision-Making with Data

Real-time analytics provided by advanced APIs offer actionable insights. Businesses can use these tools to optimize payment processes, detect bottlenecks, and enhance customer engagement. For example, transaction heatmaps and conversion analysis can guide improvements in checkout design.

Fraud Prevention and Revenue Protection

AI-driven fraud detection systems built into advanced APIs adapt to new attack vectors, reducing unauthorized transactions and chargebacks. This proactive approach secures both revenue streams and customer trust, ensuring businesses maintain a competitive edge.

Advanced Use Cases of Payment APIs

Building on the business advantages of advanced payment APIs, let’s explore their practical applications. This section highlights real-world use cases, showcasing how these APIs streamline operations and open new opportunities across industries.

Subscription Management

Payment APIs enable businesses to manage recurring payments, offering features like automatic billing, retry logic for failed payments, and customizable subscription plans. These tools simplify handling memberships and SaaS products, improving customer retention and reducing churn rates.

Cryptocurrency Payments

With the rise of blockchain technology, advanced APIs now facilitate cryptocurrency payments. These APIs handle wallet integration, automatic exchange rate conversion, and multi-network support, opening businesses to new customer demographics. For example, an online retailer accepting Bitcoin and Ethereum can attract tech-savvy customers looking for modern payment options.

Cross-Border Transactions

Multi-currency support and localized payment methods make advanced APIs ideal for international businesses. They simplify regulatory compliance, reduce currency conversion costs, and optimize transaction workflows for cross-border operations.

Case Study: E-commerce Business

An international e-commerce platform using an advanced API reduced cart abandonment rates by 30% through the introduction of localized payment options and one-click checkout. Real-time fraud detection also cut chargebacks by 50%, saving the company significant costs and improving customer trust.

OxaPay’s Invoice Service: Redefining Efficiency

Comprehensive Features

OxaPay’s Invoice Service offers:

- Customizable Payment Links: Generate and share unique payment links tailored to individual transactions.

- Cryptocurrency Support: Accept payments in leading cryptocurrencies like Bitcoin, Ethereum, and Tether, with options for automatic stablecoin conversion.

- Fee Transparency: Options like “Fee Paid by Payer” ensure cost predictability for businesses.

- Webhook Notifications: Real-time updates on payment statuses streamline transaction management.

- Analytics and Reporting: Detailed dashboards provide insights into transaction trends, enabling data-driven strategies.

Target Audience

OxaPay’s Invoice Service is designed for:

- E-commerce Businesses: Simplify online checkout processes with secure and flexible payment options.

- Freelancers and Small Businesses: Generate professional invoices and accept global payments seamlessly.

- Enterprises: Manage high transaction volumes with advanced analytics and multi-currency support.

Use Cases

- E-commerce Platforms: Streamline checkout with customizable payment links and multi-currency support.

- Subscription Services: Automate billing cycles and handle global payments with ease.

- Service-Based Businesses: Simplify invoicing for international clients with real-time payment tracking.

Competitive Differentiators

OxaPay sets itself apart with:

- Cryptocurrency Integration: Seamlessly bridges traditional and decentralized payment systems.

- Ease of Use: Intuitive interfaces and developer-friendly tools reduce implementation times.

- Global Reach: Supports multiple currencies and compliance across regions, ensuring accessibility.

- Cost Efficiency: Transparent pricing and minimal fees ensure affordability for businesses of all sizes.

Value Proposition

OxaPay’s Invoice Service addresses key pain points for businesses by:

- Simplifying complex payment workflows.

- Enhancing financial visibility with robust reporting tools.

- Increasing global reach through multi-currency and cryptocurrency support.

Conclusion

Advanced payment APIs have become a cornerstone of modern payment ecosystems, offering scalability, security, and adaptability. They not only simplify payment management but also drive innovation, enabling businesses to meet evolving customer expectations. OxaPay’s Invoice Service exemplifies how advanced APIs can provide unparalleled value, solving specific business challenges and enhancing operational efficiency. By embracing these technologies, businesses can unlock new opportunities, enhance customer experiences, and stay ahead in an increasingly competitive marketplace.

Streamline Payments with OxaPay

Simplify payment management with secure, customizable solutions:

- Accept Crypto Payments: Bitcoin, Ethereum, and more.

- Real-Time Tracking: Stay updated instantly.

- Flexible Payment Links: Tailored for every transaction.

✨ Start Now with OxaPay | Learn More | Contact Us

Smart payments, simplified with OxaPay!