加密货币已成为现代金融的核心组成部分,但并非所有数字资产都具有相同的性质。尽管“币”(coin)和“代币”(Token)这两个术语指的是功能和创建方式截然不同的加密资产类型,但人们常常误解它们之间的区别。.

无论您是投资者、开发商还是企业主,了解两者的区别都至关重要,因为您希望 接受加密货币支付.本文将对此进行简单明了的阐述。

什么是硬币?

币是一种加密货币,在自己的本地区块链上运行。它是一种独立的数字货币,是区块链网络的一部分,可作为交换媒介、价值存储或网络运行的动力。

硬币是通过采矿等过程产生的。 工作证明系统 如比特币)或赌注(在 赌注证明系统 如合并后的以太坊)。这些过程涉及验证交易和确保区块链安全,以换取新铸币作为奖励。

与其他数字资产(尤其是代币)相比,加密货币最大的区别在于它拥有自己专属的区块链。例如:

- 比特币 (BTC) 在比特币区块链上运行。

- 莱特币(LTC) 拥有独立于比特币的区块链。

- 以太坊 (ETH)尽管它承载了许多代币,但它本身也是一种代币,因为它直接为以太坊区块链提供动力。

硬币的主要特征

- 建立在独立的区块链(如比特币、以太坊、莱特币)上。

- 主要用于点对点交易。

- 通常用于支付汽油费和交易成本。

- 可根据区块链的共识机制进行挖矿或定点。

简而言之,所有币都是其区块链的原生币,它们构成了各自网络的核心经济和技术层。

什么是代币?

代币是建立在现有区块链之上的加密货币,而不是拥有自己的区块链。代币使用 智能合约 运行,并完全依赖于主机区块链的基础设施来运行。

代币是通过代币生成智能合约创建的,最常用的标准是以太坊上的 ERC-20、Tron 上的 TRC-20 或 Binance 智能链上的 BEP-20。这些标准规定了代币的行为方式以及与钱包和应用程序的交互方式。

代币与加密货币的区别在于依赖性:代币本身并不运行网络,它们依赖于宿主链的安全性和共识机制。此外,代币通常扮演着更为专业化的角色,服务于特定的平台、应用或生态系统。.

例如

- USDT (ERC-20) 是一种在以太坊上运行的代币。

- SHIB 也是一种基于以太坊的代币。

- UNI 在 Uniswap 协议中赋予治理权,但仍依赖以太坊区块链。

代币的主要特点

- 使用另一个区块链(通常是以太坊或 Tron)上的智能合约构建。

- 通常代表资产、公用事业或权利(如治理或使用权)。

- 可用于 DeFi 应用程序、游戏、NFT、DAO 等。

- 使用 ERC-20、TRC-20 或 BEP-20 等标准轻松创建。

虽然一个区块链上可以存在多种代币,每种代币都有不同的用途,但只有一种代币是该区块链的原生代币(如以太坊上的 ETH)。

硬币与代币:技术差异解释

| 特点 | 硬币 | 代币 |

| 区块链 | 拥有自己的 | 建立在现有的基础上 |

| 创造 | 原产于链条 | 通过智能合约创建 |

| 目的 | 货币和价值转移 | 公用事业、治理、资产 |

| 实例 | BTC, ETH, LTC | 联合国训练研究所、联合国大学、社会科学及人文科学处 |

| 已缴费用 | 硬币本身 | 主机区块链的硬币(如 ETH) |

对于企业来说,硬币与代币的区别决定了系统的构建方式。代币更易于管理,而代币具有灵活性,但需要额外的步骤,如处理智能合约和费用依赖性。

硬币和代币在交易中的主要区别

如果您 使用加密货币支付, 因此,了解加密货币和代币之间的区别非常重要,尤其是在交易过程中它们的行为方式以及费用处理方式方面。.

硬币

当您发送比特币或莱特币等币种时,网络费用将使用相同的币种支付。例如,如果您发送 1 BTC,费用也会从您的 BTC 余额中扣除。一切都只用一种货币来处理。

代币

代币则不同。由于它们在另一个区块链上运行,因此需要区块链的主币来支付交易费用。

- 如果您要发送 USDT (ERC-20)您需要 ETH 在你的钱包里支付汽油费。

- 如果您要发送 USDT (TRC-20)您需要 TRX 钱包里的钱来支付这笔费用。

即使你拥有足够的代币,但如果没有足够的代币,交易也会失败。.

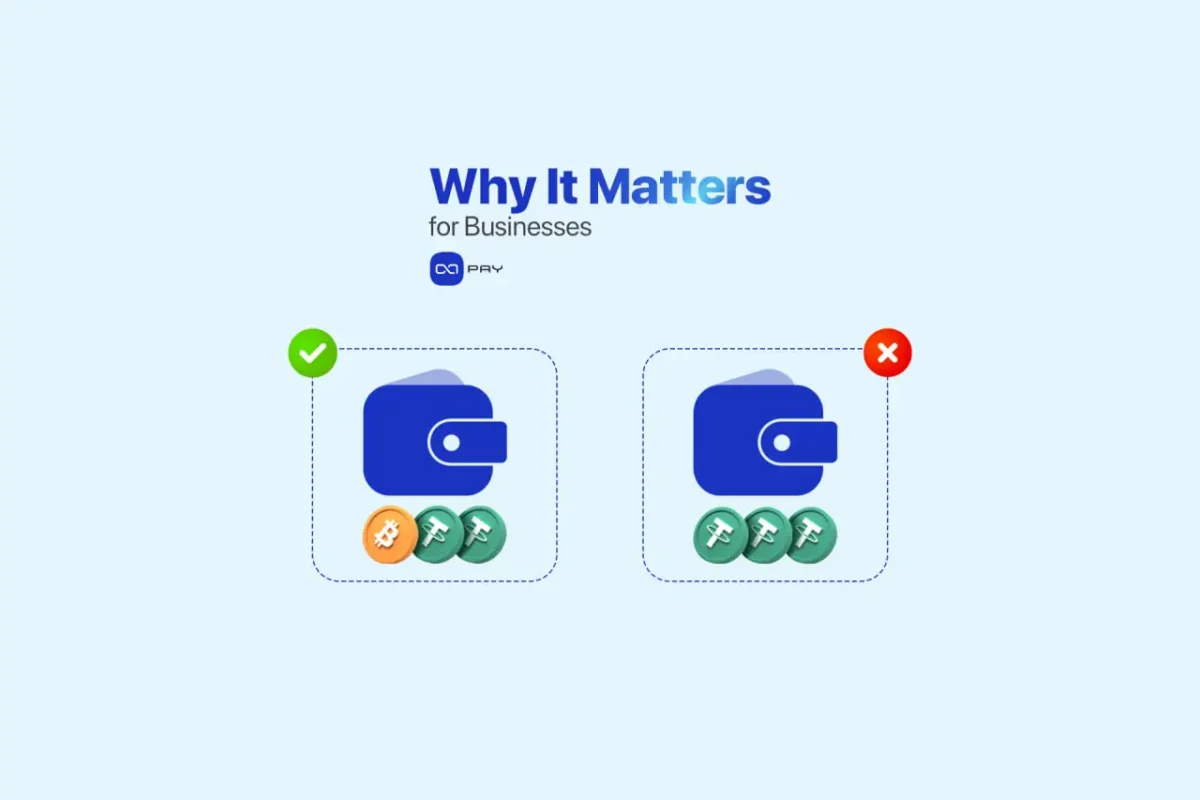

为何对企业至关重要

企业 接受代币付款 或发送象征性付款:

- 您需要在每个持有代币的钱包中保留少量基础币(如 ETH 或 TRX)。

- 没有它,付款可能无法通过,从而导致订单延误或失败。

因此,管理代币交易意味着跟踪两个余额:代币本身和用于收费的硬币。

真实世界使用案例

实践中的硬币

- 用于支付交易费用,并为自身区块链(如 ETH、BNB)的运行提供动力。

- 作为投资资产或价值储存而持有,尤其是比特币。

- 奖励保护网络安全的矿工或验证者。

- 用作交易对和 DeFi 平台的基础资产。

代币实践

- 在分散式应用中提供管理权限。

- 在平台、游戏或服务中提供实用性。

- 通过标记化来代表现实世界或数字资产。

- 通过 USDT 或 USDC 等稳定币实现低波动性转账。

- 在数字环境中代表 NFT 或游戏内资产的所有权。

为什么这种差异对用户和企业至关重要?

了解加密货币与代币的区别不仅仅是技术性的,它直接影响你在实践中如何构建、使用和管理加密货币。.

针对用户

这有助于他们了解 交易费如何收取, 了解哪些钱包兼容,以及导致交易失败的原因,例如尝试发送代币但没有足够的本地代币来支付 gas 费用。这种了解可以减少困惑并建立信任。.

企业

这种区别会影响基础设施和客户体验。硬币通常更容易整合,而代币则需要处理智能合约和额外的资产费用,这增加了运营的复杂性。

- 这种差异还影响到 钱包 设置、支付自动化、会计和安全。代币可能提供访问控制或所有权等功能,但它们依赖于其主区块链的可靠性。而货币通常提供更高的稳定性和更广泛的实用性。.

简而言之,了解差异有助于避免错误,并在用户体验和系统设计方面做出更明智的选择。.

OxaPay 同时支持硬币和代币

作为 支付 网关, OxaPay 支持主要区块链上的各种硬币和代币,包括:

- 硬币:比特币(BTC)、以太坊(ETH)、莱特币(LTC)、波场币(TRX)、Solana(SOL)

- 代币:USDT(ERC-20、TRC-20、BEP-20)、DAI、USDC、SHIB 等

这种灵活性使商家能够接受与其客户最相关的数字资产付款,无论客户喜欢稳定代币还是基础层代币。.

您还可以启用 硬币和代币之间的零费用交换 直接使用 OxaPay 的掉期 工具,让您更轻松地管理和转换收到的付款。.

结论

加密生态系统建立在两个基本要素之上:货币和代币。虽然两者都是数字资产,但它们的角色、结构和用途却截然不同。货币与代币的区别在于,货币能够驱动其自身的区块链,并充当类似货币的工具;而代币则建立在现有区块链之上,涵盖从稳定币到 DeFi 工具的各种功能。.

对于用户和企业来说,理解这种区别是做出有关支付、投资和区块链应用的明智选择的关键。.

准备好接受硬币和代币了吗?

无论你想接受比特币、USDT 等稳定币,还是与你所在行业相关的独特代币,, OxaPay 让一切变得简单. 没有 KYC 加密网关 以及强大且易于集成的平台。.

👉 立即开始接受加密货币

📘 探索完整 文件