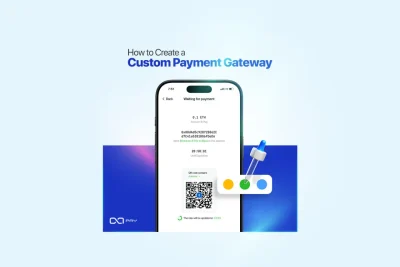

Generating a crypto invoice is not just about creating a payment request.

For a real business, this means setting a clear price, avoiding payment confusion, handling fees correctly, tracking payment status in real time, and matching every payment to a specific order or customer.

Many businesses start by sharing a wallet address. That works once or twice. But as soon as invoices, deadlines, partial payments, or accounting enter the picture, things break down quickly.

A crypto invoice solves this by turning a blockchain payment into a structured, trackable transaction.

In this guide, you will see exactly how to generate a crypto invoice using OxaPay merchant invoices, step by step.

No theory, no marketing claims. Just the practical process, from setting the amount to tracking payment status, so you can start accepting crypto payments with clarity and control.

Before You Generate the Invoice

Before generating a crypto invoice, it is important to understand that each setting directly affects how the payment behaves. The amount, expiration time, and fee handling all shape the final payment experience for both you and your customer.

The following steps walk through this process in order, starting with the most fundamental decision: setting the invoice amount.

If you are looking for a more technical implementation, including API parameters and request structure, you can refer to the Generate Invoice documentation. It covers how to create invoices programmatically and integrate invoice generation into your backend or payment flow.

This guide focuses on the practical steps of generating crypto invoices through the OxaPay dashboard. If you are looking for a more technical implementation, including API parameters and request structure, you can refer to the Generate Invoice documentation to create invoices programmatically and integrate them into your backend or payment flow.

Step 1: Set the Invoice Amount

Start by defining the payment amount.

You can set the amount in USD or another supported fiat currency. OxaPay automatically calculates the equivalent crypto value at the time of payment.

This approach keeps pricing clear for your business while allowing customers to pay in crypto.

Step 2: Choose the Invoice Expiration Time

Each invoice has a defined lifetime.

When you generate crypto invoices, you set how long each payment link remains valid. You can choose short checkout windows for immediate payments or longer periods for delayed settlement scenarios.

After the invoice reaches its expiration time, the system no longer accepts payments. This prevents late or accidental transactions and keeps your payment flow predictable, controlled, and easy to reconcile.

Step 3: Decide Who Pays the Fees

OxaPay allows you to choose who pays the transaction fee:

- The merchant

- Or the customer

This setting ensures the final received amount matches your expectations and avoids accounting confusion.

Step 4: Handle Partial and Mixed Payments

Customers sometimes send slightly less than the requested amount due to wallet behavior or network fees.

OxaPay lets you:

- Allow a small underpayment tolerance

- Enable mixed payments so customers can complete the remaining amount with another cryptocurrency

These options reduce failed payments and improve completion rates.

Step 5: Generate the Invoice and Payment Link

After you set the invoice details, generate the crypto invoice.

OxaPay creates a unique payment link that you can:

- Share with customers

- Embed in your checkout page

- Send via email or messaging apps

Customers open the link, choose their wallet, and complete the payment.

Step 6: Track Payment Status in Real Time

After you send the invoice, you can track its status from your dashboard:

- Pending

- Paid

- Partially paid

- Expired

Payment updates happen automatically, removing the need for manual checks.

Step 7: Test Before Going Live (Optional)

OxaPay supports sandbox mode for testing.

You can generate test invoices to verify payment flow and callbacks before accepting real funds.

Use this step if you plan to automate invoice handling.

Technical Checklist Before Sending a Crypto Invoice

Before sharing an invoice with your customer, confirm the following settings:

- Invoice amount and currency are defined correctly (

amount,currency) - Invoice lifetime is set according to the payment scenario (

lifetime) - Fee responsibility is configured as intended (

fee_paid_by_payer) - Underpayment tolerance is reviewed if partial payments are expected (

under_paid_coverage) - Mixed payment option is enabled only if required (

mixed_payment) - Callback URL is reachable and ready to receive payment status updates (

callback_url) - Return URL redirects users correctly after successful payment (

return_url) - Order reference is mapped to your internal system (

order_id) - Auto withdrawal behavior matches your settlement flow (

auto_withdrawal) - Sandbox mode is disabled for live payments (

sandbox: false)

Final Summary

Generating crypto invoices is about more than sending a payment link. It is about turning an unpredictable blockchain transaction into a controlled, business-ready payment flow.

By defining clear pricing, setting expiration rules, handling fees correctly, and supporting partial or mixed payments, a crypto invoice removes the uncertainty that usually comes with wallet-based payments. Every invoice becomes traceable, time-bound, and easy to reconcile.

OxaPay brings these elements together in a single invoice flow. The result is a payment process that works not just for receiving funds, but for accounting, automation, and real-world business operations.

Once this structure is in place, accepting crypto payments becomes a repeatable and reliable process rather than a manual workaround.

FAQ

Start Accepting Crypto Payments

Generate a crypto invoice using OxaPay merchant invoices, share the payment link with your customer, and accept crypto payments with clarity and control. Start collecting payments without manual wallet management, payment confusion, or complex setup.