Introduction

In the ever-changing realm of cryptocurrencies, Bitcoin continues to attract the attention of investors and enthusiasts alike. As we approach the highly anticipated Bitcoin halving event in 2024, along with ongoing discussions about Bitcoin exchange-traded funds (ETFs), inflation concerns, Ripple’s court victory, and other market factors, the direction of Bitcoin’s price remains a subject of significant interest and speculation. This article delves into the world of Bitcoin price prediction for 2024, exploring the factors that can potentially impact its value. By analyzing historical patterns, institutional adoption, regulatory developments, and the evolving cryptocurrency landscape, we aim to provide valuable insights for investors navigating the dynamic realm of Bitcoin.

Bitcoin Halving: A Catalyst for Price Increase and Bitcoin Price Prediction

The Bitcoin halving event attracts investors and cryptocurrency enthusiasts worldwide. Set to occur in 2024, this event could drive Bitcoin’s price upwards. Analyzing historical data and current market conditions provides insights into the potential effects of the upcoming halving.

Historical Trends and Price Surge

Past halvings reveal a clear pattern: Bitcoin’s price surges significantly. In 2012, it soared from $13 to $1,242 after the first halving. The second halving in 2016 saw a surge from $663 to $19,880. The third halving in 2020 resulted in an extraordinary increase from $9,100 to $68,350. These trends establish a correlation between halvings and bullish movements in Bitcoin’s price.

Factors Driving Price Surge

The halving reduces the block reward for miners by 50%, creating scarcity and increasing the perceived value of Bitcoin. Its fixed supply schedule further enhances this effect, making it a highly sought-after asset. The event also garners media coverage, raising awareness and attracting investors, ultimately driving up demand and price.

Considerations and Potential Risks

While historical data and market conditions suggest a positive outlook for the 2024 halving, Bitcoin’s price is influenced by various factors. Market sentiment, global economic conditions, and geopolitical events can shape its trajectory. It’s crucial to remain mindful of potential risks, including volatility and regulatory challenges, which can temporarily disrupt price movements.

Anticipated Price Increase

Experts cautiously anticipate a significant price increase following the 2024 halving. While specific predictions are uncertain, professionals speculate that Bitcoin could surpass its previous all-time high and exceed $100,000. However, it’s important to approach these predictions with caution due to the volatile nature of the cryptocurrency market and its susceptibility to external influences.

Bitcoin ETFs: Opening the Doors to Institutional Investment

Interest in Bitcoin exchange-traded funds (ETFs) has surged in recent months, attracting attention in the investment landscape. Leading investment companies, including BlackRock, Fidelity, VanEck, Invesco, and Bitwise Asset Management, have filed proposals with the U.S. Securities and Exchange Commission (SEC) to launch ETFs that would track the spot bitcoin market. These companies hold influential positions in the financial industry, with BlackRock being the world’s largest asset manager and Fidelity managing trillions of dollars in assets. Their participation reflects the increasing acceptance and recognition of cryptocurrencies as a legitimate investment class.

Awaiting Approval: Market Anticipation

While the ETF proposals are still pending approval, their potential acceptance has generated anticipation within the cryptocurrency community. The prospect of major financial institutions offering regulated investment products tied to Bitcoin fosters optimism and indicates a growing mainstream acceptance of cryptocurrencies. If approved, these Bitcoin ETFs could attract significant institutional capital into the cryptocurrency market, driving up demand and potentially increasing the price of Bitcoin.

Monitoring the SEC’s Decision

Market participants and cryptocurrency enthusiasts closely watch the SEC’s decision on these ETF proposals. Approval of the Bitcoin ETFs would establish a regulatory framework and enhance investor confidence, bringing cryptocurrencies closer to traditional investment avenues. However, it is important to recognize that the SEC has expressed concerns about market manipulation, custody practices, and investor protection in relation to cryptocurrency-related products. The outcome of the SEC’s considerations will significantly impact the trajectory of Bitcoin’s price in 2023.

ETF Approvals and Bitcoin’s Price

The filings made by prominent investment companies such as BlackRock, Fidelity, VanEck, Invesco, and Bitwise Asset Management for Bitcoin ETFs indicate the increasing interest in and recognition of cryptocurrencies within the traditional financial sector. Approval of these ETFs by the SEC would represent a significant milestone towards mainstream adoption and could have a positive impact on the price of Bitcoin. However, the final decision lies with the regulatory authorities, who will carefully evaluate the proposals, considering factors such as market integrity, investor protection, and custodial arrangements. Investors should closely monitor the developments surrounding these ETF approvals as they have the potential to shape the future of Bitcoin’s price and its integration into traditional investment portfolios.

Inflation and Its Impact on Bitcoin: Navigating the Financial Landscape

Inflation’s influence on Bitcoin’s price has sparked significant interest and discussions in finance. Inflation refers to the gradual increase in prices over time, reducing the purchasing power of money. In 2022, the global economy faced high inflation rates, leading central banks to raise interest rates. This affected various financial assets, including Bitcoin, which encountered challenges in the inflationary environment.

Bitcoin as an Inflation Hedge

Bitcoin has been seen as an alternative store of value during inflationary periods. Its decentralized nature and limited supply contribute to its perception as an inflation hedge. However, the impact of inflation on Bitcoin’s price in 2022 was nuanced.

Inflation’s Impact in 2022

The United States experienced high inflation rates in 2022 due to factors like the COVID-19 pandemic, supply chain disruptions, and geopolitical tensions. The Federal Reserve raised interest rates to control inflation.

Effect on Bitcoin Price

Higher interest rates made risky assets like Bitcoin less attractive, resulting in decreased demand and a significant price drop of around 50% in 2022. However, as inflation subsided, Bitcoin’s price showed some growth, influenced by other factors.

Uncertainty in Future Impact

The future impact of inflation on Bitcoin remains uncertain. Several scenarios could unfold in 2024:

- If inflation continues to rise, Bitcoin’s price may decline similarly to 2022.

- If inflation persists and rises, Bitcoin’s price may increase as investors see it as an inflation hedge.

- If inflation is controlled, Bitcoin’s price may still rise as more investors consider it.

Complex Relationship and Factors

The relationship between inflation and Bitcoin’s price is complex, influenced by market dynamics, investor sentiment, and macroeconomic conditions. Monitoring these factors and staying informed are crucial for informed investment decisions.

Looking ahead, the impact of inflation on Bitcoin’s price in 2024 remains uncertain, necessitating vigilance and analysis to navigate Bitcoin’s future.

Ripple’s Early Court Victory: Impact on Bitcoin Price

Ripple‘s recent court victory against the SEC carries significant implications for the cryptocurrency market and potentially affects Bitcoin’s price. The ruling dismissed some claims against Ripple Labs, providing legal clarity and challenging the SEC’s classification of XRP as a security. While the case is ongoing, this outcome has the potential to generate positive sentiment and enhance investor confidence in cryptocurrencies as a whole.

Positive Sentiment and Market Impact

If Ripple successfully argues that XRP is a currency rather than a security, it may attract more participants and stimulate market interest. This could benefit Bitcoin’s price by creating a favorable environment and expanding the cryptocurrency market. Conversely, if the court rules against Ripple, confirming XRP as a security, it may introduce caution and regulatory scrutiny, resulting in short-term market volatility that could impact Bitcoin’s price.

Monitoring Ripple’s Case and Regulatory Landscape

The outcome of the Ripple case and its implications for the regulatory landscape will be closely watched. Market participants, investors, and enthusiasts will remain attentive to further developments as they have the potential to shape the future of cryptocurrencies and potentially influence Bitcoin’s price.

Institutional Adoption and Market Credibility

The increasing adoption of Bitcoin by institutional investors is reshaping the cryptocurrency market and driving substantial price growth. Institutions, including hedge funds and investment banks, bring significant resources and expertise, establishing themselves as influential participants.

Impact of Institutional Adoption

Institutional involvement generates increased demand for Bitcoin, leading to price appreciation and enhancing market stability. Their participation adds credibility to Bitcoin as a recognized asset class, promoting wider acceptance and fostering long-term growth. Institutional investors’ focus on longer-term strategies helps mitigate market volatility.

Implications for Bitcoin’s Future

The institutional adoption of Bitcoin holds significant implications for its future trajectory. It strengthens Bitcoin’s position as a reliable store of value and a medium of exchange, solidifying its role in the global financial landscape.

Factors Fueling Bitcoin’s Price Growth in 2024

The year 2024 shows promising signs for Bitcoin’s price growth, driven by three key factors: increasing Bitcoin hash rate, surging transaction numbers, and evolving Bitcoin holder landscape.

Growing Bitcoin Hash Rate

The rising Bitcoin hash rate reflects growing popularity and investor confidence. A higher hash rate indicates a more secure network, boosting trust in Bitcoin as an asset. While it doesn’t solely determine price, historical data suggests a potential for upward price momentum.

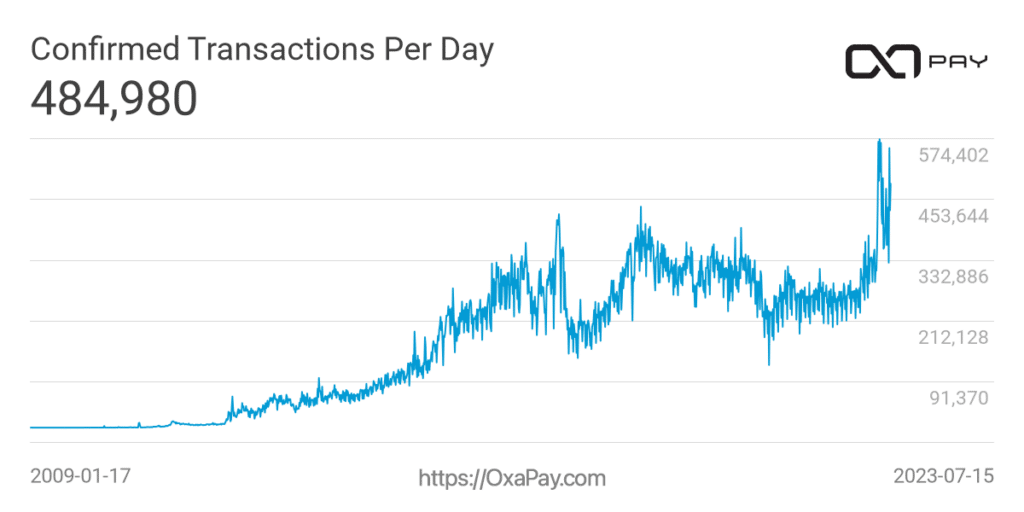

Surge in Bitcoin Transactions

Increasing transaction numbers highlight growing interest in Bitcoin as a digital currency. Factors like new blockchain features ,institutional adoption contribute and the growing accepting as a global crypto payment solution to this surge. More transactions reflect higher demand, potentially driving up Bitcoin’s price. Improved liquidity can attract further participation and stimulate demand.

Changing Bitcoin Holder Landscape

Changes in Bitcoin holder demographics impact market dynamics and price. The rise of long-term holders reduces the influence of short-term traders and speculative investors, increasing market stability. Institutional confidence in Bitcoin further contributes to a positive price trajectory.

Consideration of Multiple Factors

Bitcoin’s price is influenced by a complex interplay of factors such as market sentiment, regulatory developments, and technological advancements. A comprehensive analysis that considers these elements is necessary for understanding Bitcoin’s future performance.

In conclusion, the increasing hash rate, surging transactions, and evolving holder landscape contribute to the positive outlook for Bitcoin’s price in 2024. However, it’s important to conduct a comprehensive analysis considering multiple factors when assessing Bitcoin’s future price trajectory.

FAQ

What is the outlook for Bitcoin's price in 2024?

The outlook for Bitcoin's price in 2024 is cautiously optimistic, with experts anticipating a potential significant price increase following the halving event. Historical patterns have shown that previous halvings have been associated with substantial price surges for Bitcoin. The halving reduces the rate at which new Bitcoins are generated, creating scarcity and driving up demand, which could positively impact its price.

However, specific price predictions for Bitcoin in 2024 vary widely due to the highly volatile and ever-changing nature of the cryptocurrency market. External factors, such as global economic conditions, regulatory developments, and market sentiment, will also play a crucial role in determining Bitcoin's price trajectory.

While the article points towards a positive outlook, it's essential to exercise caution and recognize that unforeseen events and market dynamics could still influence Bitcoin's price in unpredictable ways. Investors should approach predictions with careful consideration, conduct thorough research, and assess multiple factors to make informed decisions in the ever-evolving cryptocurrency market.

How can the possible approval of Bitcoin ETF affect the price of Bitcoin in 2024?

The possible approval of Bitcoin ETFs in 2024 could have a significant impact on Bitcoin's price. If approved, it may attract more institutional and retail investors, leading to increased demand and potential price appreciation. ETFs can also enhance market liquidity and validate Bitcoin as an investable asset. However, ETF approval is uncertain, and its impact will depend on other market factors. Investors should be cautious and research carefully before considering the potential impact of Bitcoin ETFs on its price.

How Ripple's decisive victory in court can affect the crypto market and the price of Bitcoin in 2024?

Ripple's decisive victory in court can significantly affect the crypto market and Bitcoin's price in 2024. A favorable outcome for Ripple would boost market sentiment, validate cryptocurrencies as legitimate assets, and attract more investors, including institutions. Clarity on regulations could create a favorable investment environment, leading to increased demand for Bitcoin and other cryptocurrencies. Moreover, broader adoption of digital assets could strengthen Bitcoin's value. However, investors should stay cautious and consider other market factors when evaluating Bitcoin's price in 2024.

What advice should Bitcoin investors and holders consider to navigate the cryptocurrency market successfully?

Investing in and holding Bitcoin can be a rewarding but volatile journey. Here are some essential pieces of advice for Bitcoin investors and holders to navigate the cryptocurrency market successfully:

- Educate themselves about Bitcoin and market factors.

- Diversify their investment portfolio to reduce risk.

- Invest only what they can afford to lose.

- Stay updated on market trends and news.

- Use secure wallets for long-term holding.

- Avoid making emotional decisions based on fear or hype.

- Have a clear exit strategy and stick to it.

- Be prepared for market volatility.

- Protect personal information and be cautious online.

- Consider seeking professional advice when needed.

Following these tips can help investors make informed decisions and manage risks in the dynamic cryptocurrency market.

Conclusion

The prediction and opinions regarding Bitcoin price in 2024 vary widely among experts and industry professionals, highlighting the overall bullish sentiment surrounding Bitcoin’s potential for growth. However, caution is necessary when considering these forecasts due to the volatile nature of the cryptocurrency market and the multitude of factors that can influence Bitcoin’s price trajectory.

External events, such as regulatory developments, global economic conditions, and market sentiment, can significantly impact Bitcoin’s price. Unforeseen circumstances and unexpected events can introduce uncertainty and disrupt market dynamics. Past performance does not guarantee future results, and thorough research, risk assessment, and professional advice are essential for making informed investment decisions.

While historical data and patterns suggest a positive correlation between Bitcoin halvings, institutional adoption, and price increases, it’s important to recognize that the cryptocurrency market is complex and influenced by multiple factors. Monitoring market dynamics, regulatory developments, institutional adoption, and global economic conditions will be crucial for navigating the evolving landscape of Bitcoin and making well-informed investment decisions.

In conclusion, the outlook for Bitcoin’s price in 2024 is optimistic, but caution should be exercised. Understanding the interplay of various factors and staying informed will be key to successfully navigating the cryptocurrency market and capitalizing on its potential for growth.

For more insights into the cryptocurrency market and expert advice on Bitcoin investment strategies, visit OxaPayblog .

Stay informed and stay ahead in the dynamic world of cryptocurrencies with our comprehensive articles and analysis. Happy investing!